Quiz of the week 30 May – 5 June

Test your recollection of the last seven days with MoneyWeek's quiz of the week.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

1. Which country is facing its first recession in nearly 30 years after the pandemic caused its economy to contract during the first quarter of the year?

a. Australia

b. New Zealand

c. Japan

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

d. Philippines

2. The European Central Bank said this week it would expand its bond buying programme by €600bn and extend it until 2021. What effect did this have on the euro?

a. It dropped

b. It stayed the same

c. It rose

3. How long has America's Congressional Budget Office estimated it will take the US economy to recover from the pandemic?

a. One year

b. Five years

c. Eight years

d. Ten years

4. The Democratic Republic of Congo is facing a new outbreak of which disease?

a. Covid-19

b. Measles

c. Ebola

d. Tuberculosis

5. Why are protesters taking to the streets for the tenth night in a row in the United States?

a. They don’t want to wear masks and want shops to reopen

b. They are protesting against unemployment figures

c. They are protesting against racism and police brutality

d. They want to impeach Trump because of his poor coronavirus response

6. Which east African country is looking to restructure $11bn in external debt?

a. Zambia

b. Malawi

c. Mozambique

d. Zimbabwe

7. Brazil saw record outflows of how much in the four months from February to May as investors continue to withdraw from Latin America’s largest economy?

a. $12.8bn

b. $10.8bn

c. $11.8bn

d. $9.8bn

8. Which country is struggling to raise its birth rate as it fell for the fourth year in a row?

a. Taiwan

b. Hong Kong

c. Singapore

d. Japan

9. Which country is seeking a $10bn loan from the International Monetary Fund?

a. Lebanon

b. Jordan

c. Syria

d. Turkey

10. When has airline Virgin Atlantic said it plans to resume scheduled passenger flights from the UK?

a. 15 June

b. 30 June

c. 15 July

d. 20 July

Answers

1. a) Australia. Australia’s GDP fell by 0.3% in the three months to march.

2. c) It rose. The euro surged after this bigger-than-expected boost to its stimulus package to combat the economic fallout from the coronavirus crisis was announced.

3. d) Ten years.

4. c) Ebola. A second Ebola outbreak has been reported in the DRC, which is struggling to contain alongside Covid-19 and the world’s largest measles epidemic.

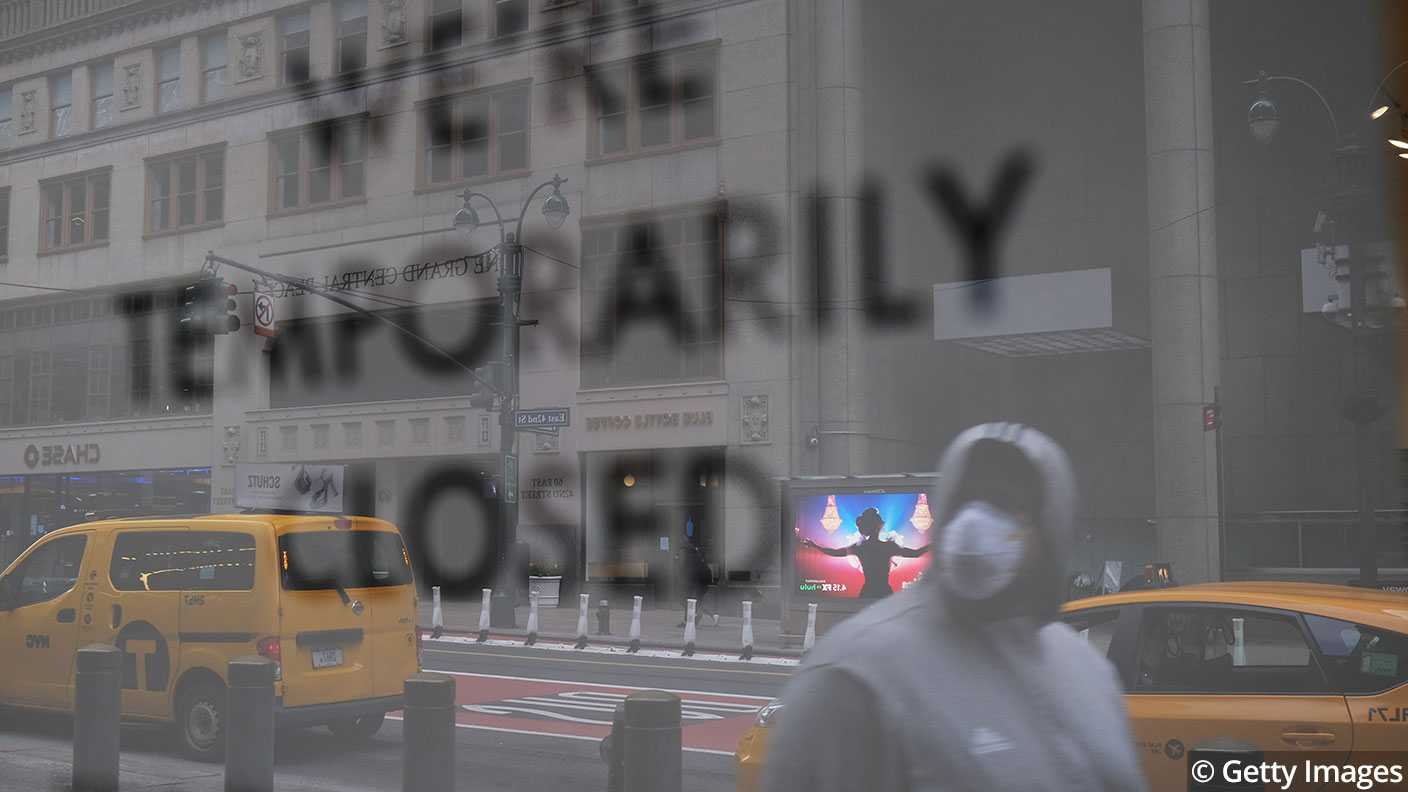

5. c) They are protesting against racism and police brutality. The latest wave of protests in the US was sparked by the murder of George Floyd, a 46-year-old black man who died after white police officer Derek Chauvin knelt on his neck for almost nine minutes while Floyd was handcuffed face down in the street. Protesters are calling for an end to police brutality and reform of the police system.

6. a) Zambia “After Argentina defaulted last month in the middle of negotiations with its bondholders, Zambia’s ability to fix what Bwalya Ng’andu, the finance minister, has called the country’s “over-ambition in terms of borrowing” is seen as the next big test of a sovereign borrower’s response to the pandemic,” says Joseph Cotterill in the Financial Times.

7. c) $11.8bn.

8. d) Japan. Japan, one of the world’s oldest nations, saw births fall by over 50,000 in 2019 to 865,234, a post-World War II low.

9. a) Lebanon. Lebanon’s economy was ailing before the coronavirus outbreak, and government-imposed shutdowns have forced even more Lebanese into poverty. The World Bank estimates that more than half of the country’s population now live below the poverty line.

10. d) 20 July. Virgin Atlantic will restart operations with flights from London Heathrow to New York, Los Angeles, Orlando, Hong Kong and Shanghai.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Nic studied for a BA in journalism at Cardiff University, and has an MA in magazine journalism from City University. She has previously worked for MoneyWeek.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.