Why we must not retreat into a nationalist bunker

Globalisation helped us prosper before the crisis – it will help us get out of it too

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Over the last week, even as tentative signs emerged that the first wave of the virus may have peaked, the economic backlash seems to have only just started.

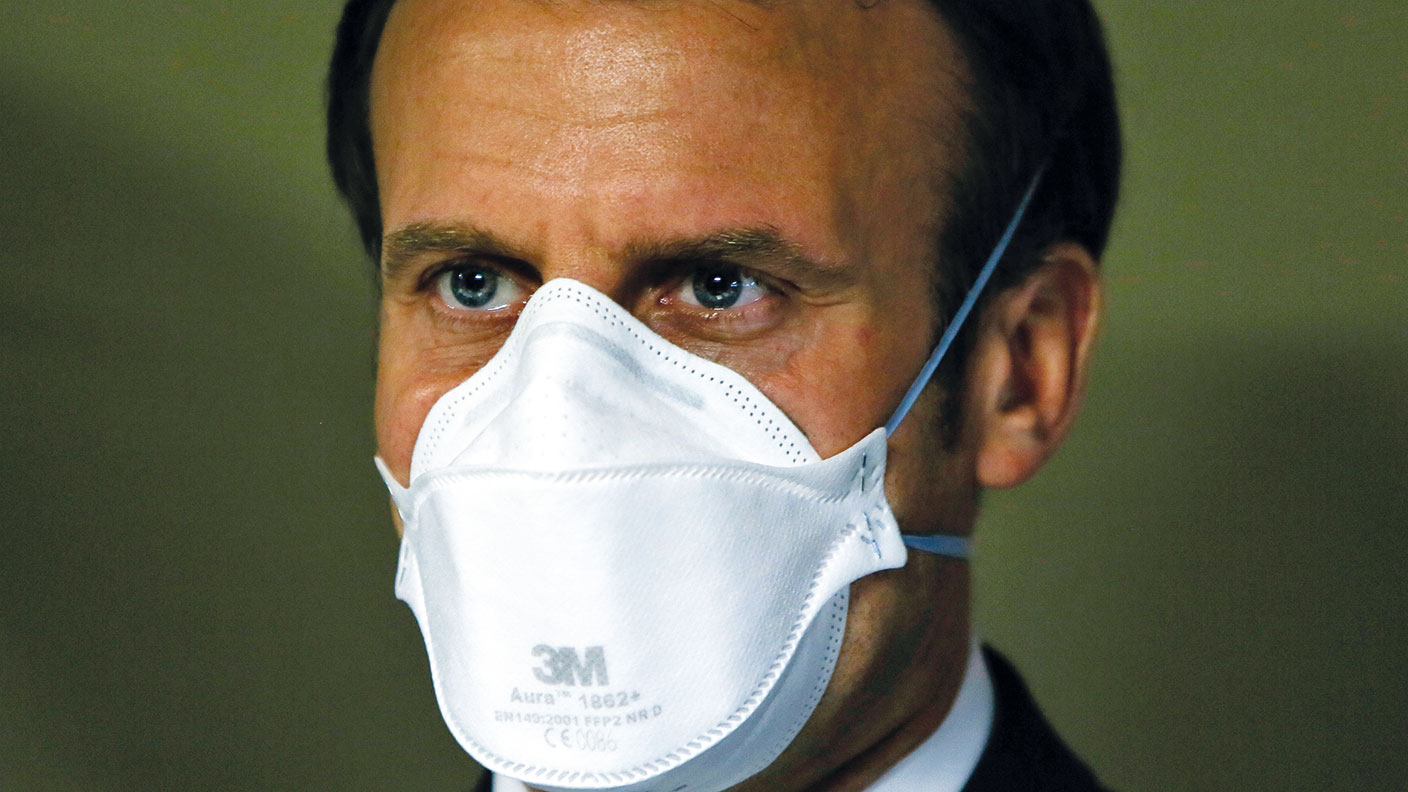

The Italian government has said it is planning new powers to stop foreign takeovers, including potentially from other companies within the EU. France’s President Macron (pictured) has announced plans to make sure medical equipment such as masks and ventilators are produced in his own country, with food quickly added to the list as well.

Spain’s prime minister, Pedro Sánchez, has promised measures “to block foreign companies from taking control of strategic Spanish companies by taking advantage of the share price collapse”. Germany’s economy minister, Peter Altmaier, has demanded that vital industries be protected even as the economy starts to collapse.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Understandable, but wrong

It would be no surprise to see similar demands from the US. There are already reports of the US muscling in on supplies of masks, and trying to buy up potential vaccines. President Trump was fighting trade wars before anyone had ever heard of Covid-19 and it is only likely to encourage him. As Britain leaves its transitional deal with the EU at the end of the year – assuming the timetable isn’t derailed – it will be hard to resist the calls for tariffs and quotas as we take back control of trade policy. Across the world, the coronavirus crisis is leading to an upsurge in economic nationalism and protectionism.

This is understandable. There is a sudden shortage of medical equipment and governments want to ensure supply. And there may be a lurking suspicion that a highly integrated, globalised economy accelerated transmission of the virus from country to country. With a few more barriers, maybe Covid-19 would have stayed in Wuhan at least until we had better treatments available. But a retreat into protectionism would still be a huge mistake. Here’s why.

First, it doesn’t matter where stuff is made. It is unlikely anyone being rushed into A&E will worry about where their ventilator comes from. We need adequate sources of supply that can be ramped up when needed, but where it comes from is irrelevant. It might as well be made wherever the lowest-cost, most-efficient manufacturer is located, and in most cases that is going to be in China, southeast Asia or eastern Europe. That way we can preserve resources for more important things such as more doctors and nurses, or emergency hospitals, all of which are far more important.

We’ll need foreign capital

Next, we will need capital to rebuild once the epidemic has been brought under control. It is going to take a huge effort to restore shattered economies. Lots of companies are going to be effectively bankrupted and are going to have to raise fresh capital to survive.

Unemployment is going to soar. Lots of jobs have been preserved by government support, but once that gets withdrawn employers are inevitably going to lay people off. Start-ups will have to be relaunched, and businesses will need to reinvent themselves as they come out of hibernation. All that is going to involve a lot of risk capital, and that will mean allowing money to move across borders and protecting the rights of investors. Countries putting up barriers to foreign money will quickly find it hard to raise any at all.

Finally, we will need global co-operation to defeat pandemics. With any luck we won’t see a virus as deadly, or as easily spread, as Covid-19 for another century. But we can hardly count on that. Just as the crash of 2008 taught us to be more nervous of banks, so this crisis will teach us to prepare better for epidemics. That will mean scientists and drugs companies will need to work together to create treatments and vaccines ahead of time and work on finding solutions that can be put in place far more quickly. Putting barriers between businesses and countries won’t help that.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.