The charts that matter: fear takes over

As the US cut interest rates and the markets tanked further, John Stepek looks at how the week's events have affected the charts that matter the most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome back.

What a week! The Federal Reserve slashed interest rates in its first emergency cut since 2008. For some reason, markets didn’t find that reassuring, and as a result, it was a pretty grim week for most assets apart from bonds and gold.

Here are the links for this week’s editions of Money Morning in case you missed any.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

- Monday: Coronavirus: buying opportunity or end of the road?

- Tuesday:Phew! The G7 rides to the markets’ rescue

- Wednesday: The Federal Reserve may have made a huge mistake

- Thursday: Coronavirus is the ideal excuse for governments to blow the budget

- Friday: Coronavirus could be the pin to pop the corporate debt bubble

- Subscribe: Get your first 12 issues of MoneyWeek for £12

Also, don’t miss Merryn’s Blog – this week she wrote about why buying the dip is no longer a good idea in the coronavirus era; but beyond the pandemic, she also covered an employment decision that could have a serious impact on housebuilders; and talked about the impact of potential scrapping entrepreneur’s relief in next week’s Budget.

There’ll be more news on our event on 22 May with next Friday’s issue of MoneyWeek magazine. Don’t miss it – and subscribe here if you haven’t already.

The charts that matter

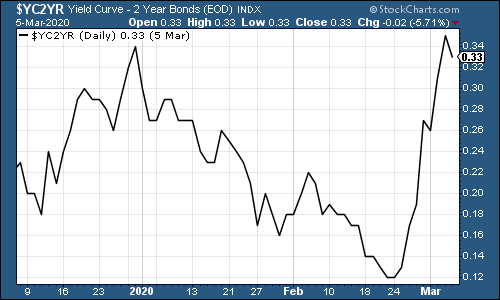

The US yield curve – as measured by the gap between the yield on the ten-year US Treasury (government bond) and the two-year – steepened rapidly this week.

Normally you’d see that as a good thing. When the yield curve flattens or worse still inverts (whereby the two year yields more than the ten year), as it did in the middle of last year, that’s a reliable recession signal. In normal times, the curve should be steeper.

In this instance, however, the yield curve steepened simply because the yield on the two-year fell much faster than the yield on the 10-year, even although both collapsed this week as the Federal Reserve cut interest rates.

(The gap between the yield on the ten-year US Treasury and that on the two-year: three months)

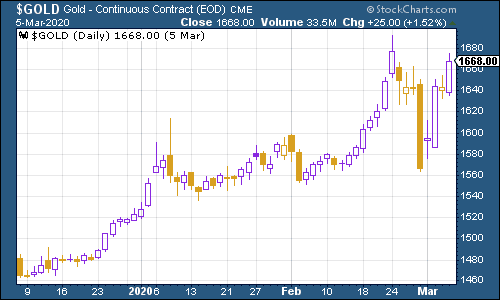

Gold (measured in dollar terms) had a volatile week but ended up having a pretty good one all the same. Financial market havoc, potentially long-term inflationary monetary policy, general panic – it’s all good news as far as gold goes. Which is why you own it, so that at least one thing in your portfolio doesn’t look utterly depressing.

(Gold: three months)

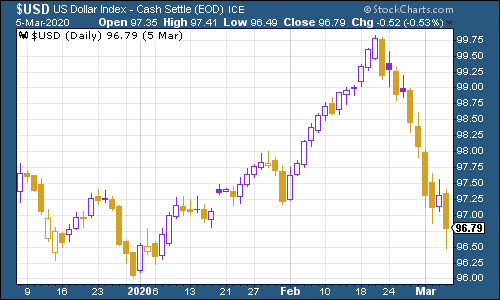

The US dollar index – a measure of the strength of the dollar against a basket of the currencies of its major trading partners – slid hard, as the Federal Reserve slashed interest rates by half a percentage point in an emergency move. There are all sorts of theories for the move but the simplest way to think about it is that investors now expect the Fed to slash faster and harder than any other central bank, and that means reversing a lot of the bets that they’ve been making about relative interest rates (ie borrowing money in euros to invest in dollar assets).

(DXY: three months)

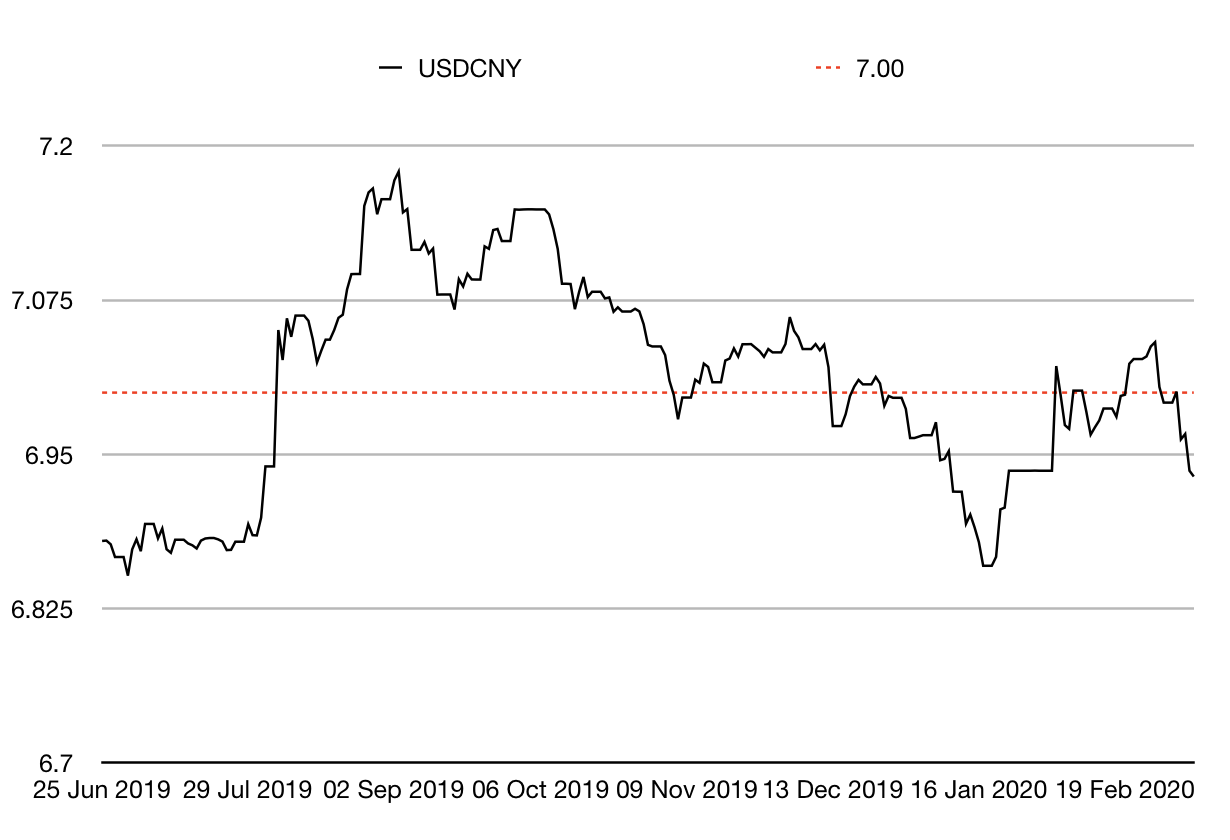

The weak US dollar kept some pressure off the Chinese yuan (or renminbi), which remained strong enough to stay below the $1/¥7 mark that gets markets worried (how long that lasts we’ll just have to see).

(Chinese yuan to the US dollar: since 25 Jun 2019)

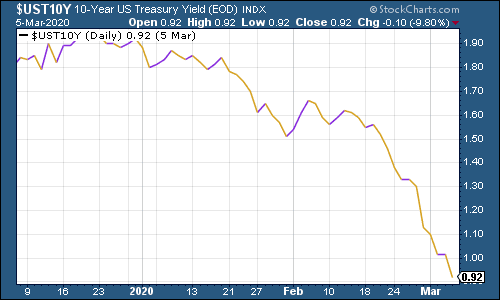

The yield on the ten-year US government bond slid hard as investors quickly decided that they wanted a “safe haven” and that the Federal Reserve was bound to cut interest rates much, much further.

(Ten-year US Treasury yield: three months)

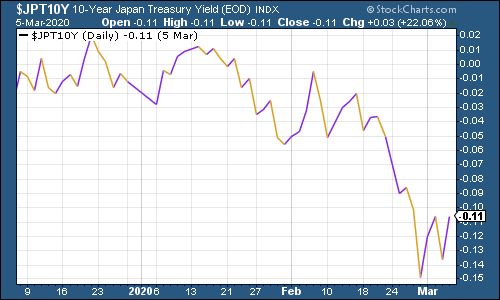

The yield on the Japanese ten-year fell too, but nowhere near as dramatically.

(Ten-year Japanese government bond yield: three months)

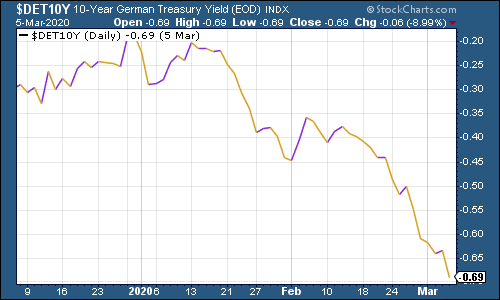

And the yield on the ten-year German bund just tanked.

(Ten-year Bund yield: three months)

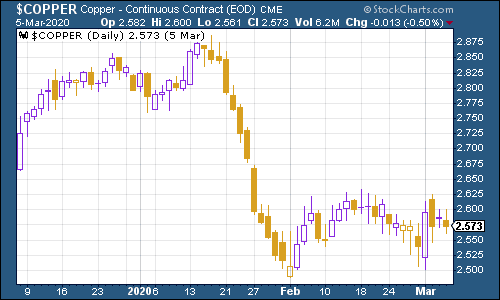

Copper was still frail looking but it hasn’t collapsed as such. Signs that China is returning to work may be helping on that front, but if coronavirus causes disruption to the rest of the world, this might just be a pause before a bigger fall. We’ll keep an eye on it in case.

(Copper: six months)

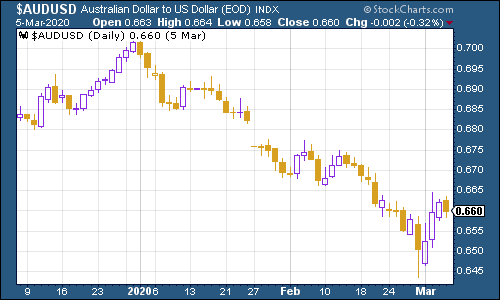

The Aussie dollar clawed back ground against the US dollar despite the fear over the coronavirus, and despite the Australian central bank cutting interest rates.

(Aussie dollar vs US dollar exchange rate: three months)

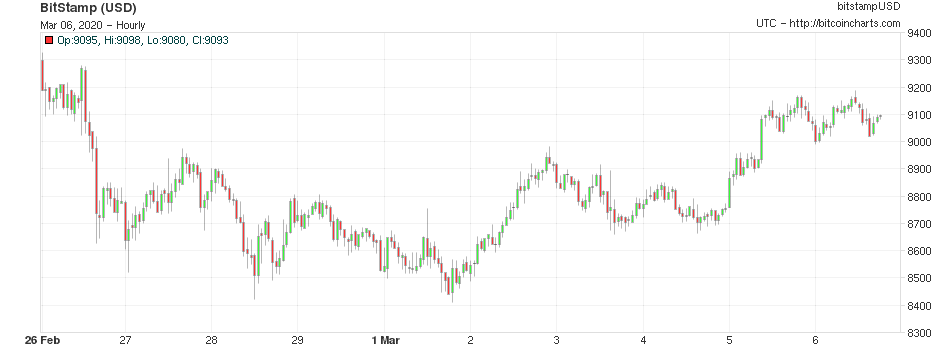

Ironically, cryptocurrency bitcoin may have been the asset class that had the least exciting week. It appears to be neither safe haven nor risk asset these days.

(Bitcoin: ten days)

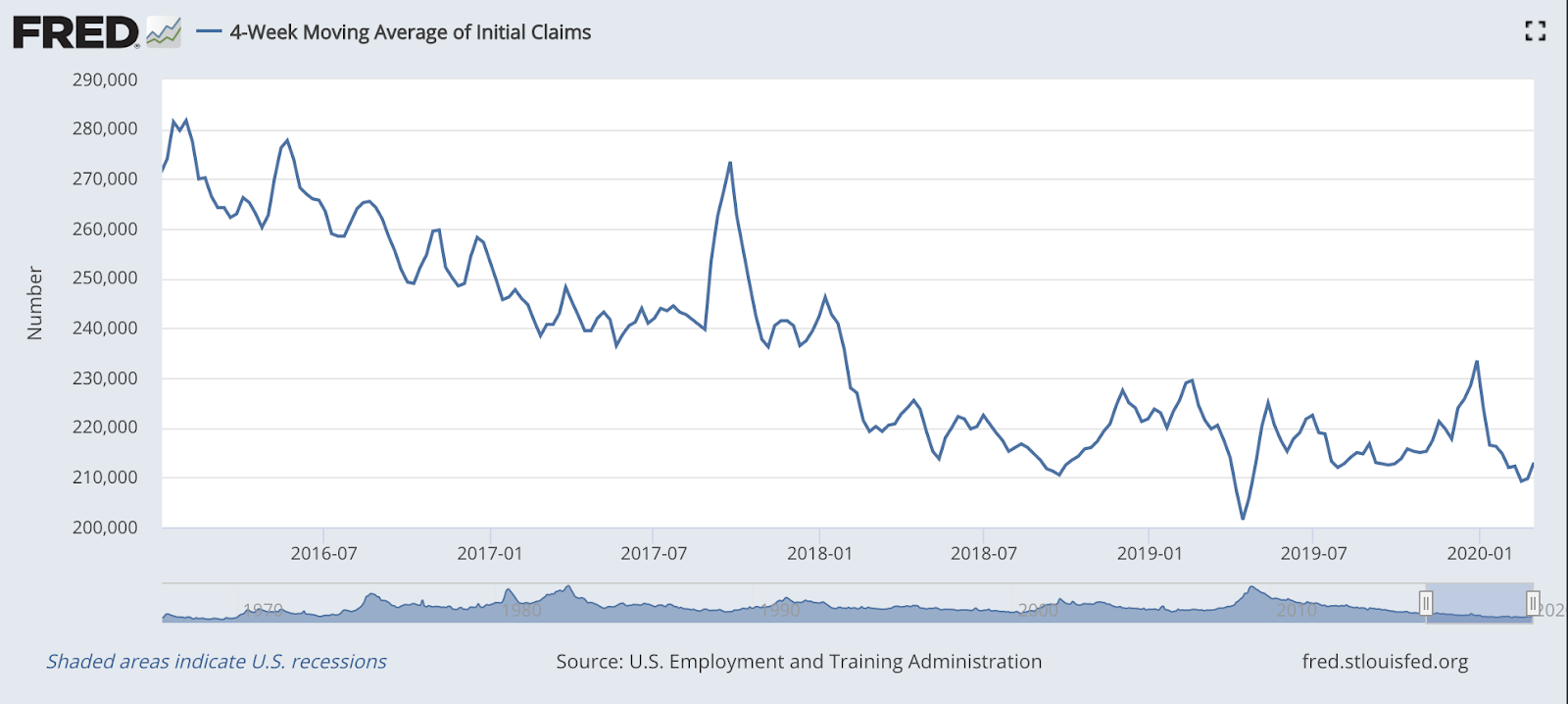

US employment data seems barely worth writing about given that it’s not really picking up the coronavirus disruption yet. Which is a pity, because it’s been pretty decent.

The latest nonfarm payrolls data blew expectations out of the water. In February, American employers hired 273,000 people compared to expectations for closer to 175,000, while January’s turnout was revised significantly higher as well.

Normally that would have had a decent market effect – but no one cares, because everyone is dreading the forthcoming slowdown.

US weekly jobless claims fell to 216,000 (from 219,000 last week, which was unrevised). The four-week moving average now sits at 213,000. When the four-week moving average troughs, the market often hits a top soon after. So far we have no signs at all of any layoffs because of coronavirus but I wouldn’t have expected that yet. I would, however, expect it to be coming around the corner.

(US jobless claims, four-week moving average: since January 2016)

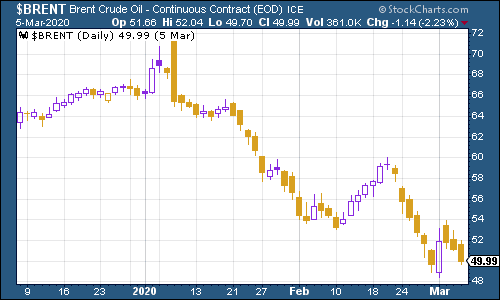

The oil price (as measured by Brent crude, the international/European benchmark) had an absolute shocker of a week. It fell hard, particularly as the so-called Opec-plus cartel (that is, Opec members plus the Russians, basically) failed to reach any sort of agreement on cutting production.

(Brent crude oil: three months)

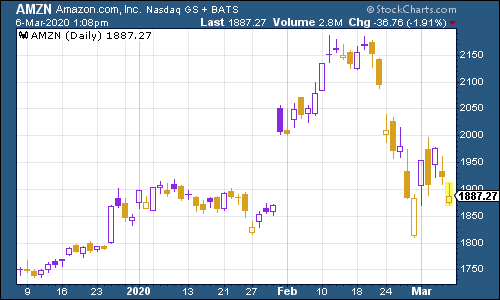

By the end of Thursday, retail giant Amazon had risen and fallen with the wider market but was actually still higher than it was at the end of last week.

(Amazon: three months)

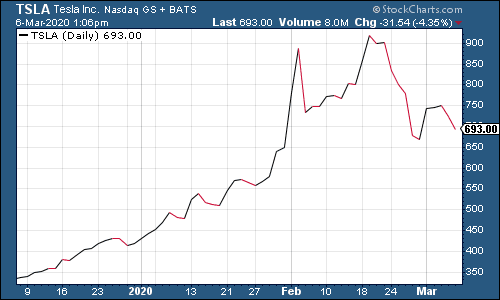

Similarly, electric car group Tesla, probably the world’s most famous speculative stock, is trading a little higher than it was at the end of last week too.

(Tesla: three months)

Have a great weekend. Don’t touch your face.

John

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.