FTSE turns 40 - these are the stocks that have stood the test of time

The FTSE has turned 40 today - we look at the stocks that still form part of the index and how it has changed

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The FTSE 100 has hit its 40th birthday milestone and has delivered many happy returns for investors during its lifetime.

The UK’s premier stock market index celebrates turning 40 today ( 3 January 3), with a quarter of its original constituents still making up the blue-chip index.

Like many 40-year-olds, it has seen plenty of ups and downs during its lifetime, such as the dotcom boom and bubble, the financial crisis and more recently the pandemic and cost of living crisis which have all weighed on performance.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It still contains 26 of its founder members that were included when the index first started, of which 14 still have the same name.

“The FTSE 100 launched on 3 January 1984, to replace the FT-30, and the stock market benchmark’s make up has changed a lot since then,” says Russ Mould, investment director for fund and stockbroking platform AJ Bell.

“Just fourteen founder members are still in the index and still using the very same name, while 12 more are still part of UK plc’s corporate elite, but under a different guise.

“The other 74 have either fallen down through the ranks into the realms of mid- and small- caps, been acquired, been broken up or in three instances gone out of business, as the index has taken on a less domestic and more international flavour.”

The five largest companies in the FTSE 100 - Shell, AstraZeneca, HSBC, Unilever and BP - now represent nearly a third of the entire index.

How has the FTSE 100 changed?

The index has taken on a less domestic and more international flavour over the past four decades, according to AJ Bell.

Of the 100 firms, just 26 of its founder members are still in the index.

This is split between 14 that even have the same name, although Whitbread, for example, is a different company now after shifting from breweries to becoming a hotel and restaurant group.

- Associated British Foods

- Barclays

- Barratt Development

- Land Securities

- Legal & General

- Lloyds Bank

- Marks & Spencer

- Pearson

- Sainsbury

- Smith & Nephew

- Standard Chartered

- Tesco

- Unilever

- Whitbread

Source: AJ Bell

The other 12 have remained but have since changed name and sometimes corporate structure due to mergers and acquisitions or changes in strategy.

| Old name | New name | Header Cell - Column 2 |

|---|---|---|

| BAT Industries | British American Tobacco | Financial services business sold, and BAT spun out (1998) |

| British Aerospace | BAE Systems | Created by merger with defence arm of GEC, which then became Marconi (1999) |

| British Petroleum | BP | Row 2 - Cell 2 |

| Commercial Union | Aviva | Merged with General Accident (1988); Merged with Norwich Union to create CGU (2000); renamed 2009 |

| Glaxo | GSK | Result of Glaxo's merger with Wellcome (1995) and also SmithKlineBeecham (2000) |

| Imperial | Imperial Brands | Acquired by Hanson (1985), Imperial Tobacco spun out (1996). Renamed Imperial Brands (2016). |

| Prudentia Assurance | Prudential / M&G | Spun off M&G (2019) and Jackson Financial (2021) |

| Reckitt & Colman | Reckitt Benckiser | Created by merger with Benckiser (1999) |

| Reed International | RELX | Merged with Elsevier (1992) to create Reed Elsevier. Renamed RELX in 2015. |

| Rio Tinto-Zinc | Rio Tinto | Row 9 - Cell 2 |

| Royal Bank of Scotland | NatWest | Renamed NatWest Group (2020) |

| Shell Transport & Trading | Shell | Merger between legally separate Shell and Royal Dutch entities (2005). Name changed to Shell and dual structure scrapped in 2021. |

Source: AJ Bell

Another 13 including Beecham and Ladbrokes have been acquired and became part of a current FTSE 100 member.

| Acquired, part of FTSE 100 firm | New owner | Header Cell - Column 2 |

|---|---|---|

| Allied Lyons | Diageo | Merged with Pedro Domecq (1994). Acquired and broken up by Pernod Ricard, Fortune and Diageo |

| Beecham | GSK | Now part of GSK |

| British Electric Traction | Rentokil Initial | Acquired by Rentokil (1996) and now part of Rentokil Initial (RTO) |

| Britoil | BP | Acquired by BP (1988) |

| Distillers | Diageo | Now part of Diageo |

| General Accident | Aviva | Part of Aviva |

| Great Universal Stores | Experian, Sainsbury | GUS broke itself up by demerging Experian and Home Retail in 2006. Home Retail (Argos, Homebase) was acquired by Sainsbury in 2016 for £1.4 billion. Sainsbury sold Homebase to Wesfarmers for £340 million and kept Argos. |

| Guest, Keen & Nettlefolds | Melrose Industries, Dowlais | Acquired by Melrose Industries (2018), which then spun off parts of the GKN business as Dowlais in 2023 |

| Ladbrokes | Entain | Merged with Coral (2016). Acquired by GVC (2018), now known as Entain and a FTSE 100 firm. |

| Midland Bank | HSBC | Now part of HSBC |

| National Westminster Bank | NatWest Group | Now part of NatWest, having been acquired by Royal Bank of Scotland, which became RBS and was then renamed (2020) |

| Plessey | BAE Systems | Acquired by GEC and Siemens (1989) and then merged to form BAE Systems (1999) |

| Wimpey (George) | Taylor Wimpey | Now part of Taylor Wimpey |

Source: AJ Bell

Two more spawned what are now FTSE 100 firms thanks to spin-offs, demergers and break-ups

Diageo can trace itself back to both Grand Metropolitan and Allied Domecq, while Racal demerged what is now Vodafone.

Another 40 brands such as Boots, Burton, Cable & Wireless and House of Fraser have been acquired and since gone private, while 11 including Cadbury Schweppe and General Electric have broken up and subsequently de-listed.

Five are still quoted but are members of a different UK index - Hammerson, Johnson Matthey, Rank, Edinburgh Investment Trust and Elementis.

Just three have gone bankrupt, British and Commonwealth Shipping, Ferranti and MFI Furniture.

“Given the rate of change in technology, consumer tastes and regulation to name but three things that may have posed difficulties for companies over the past 40 years, a 3% failure rate does not look too bad,” adds Mould.

“This may help to explain the attraction the FTSE 100 has for many investors, as its member firms’ very scale means they tend to be very dependable and can be excellent sources of cashflow and thus dividends given their maturity. FTSE 100 firms are also subject to the very highest levels of scrutiny, and corporate governance has to be top notch to withstand the market’s examinations.”

How much have investors earned from the FTSE 100?

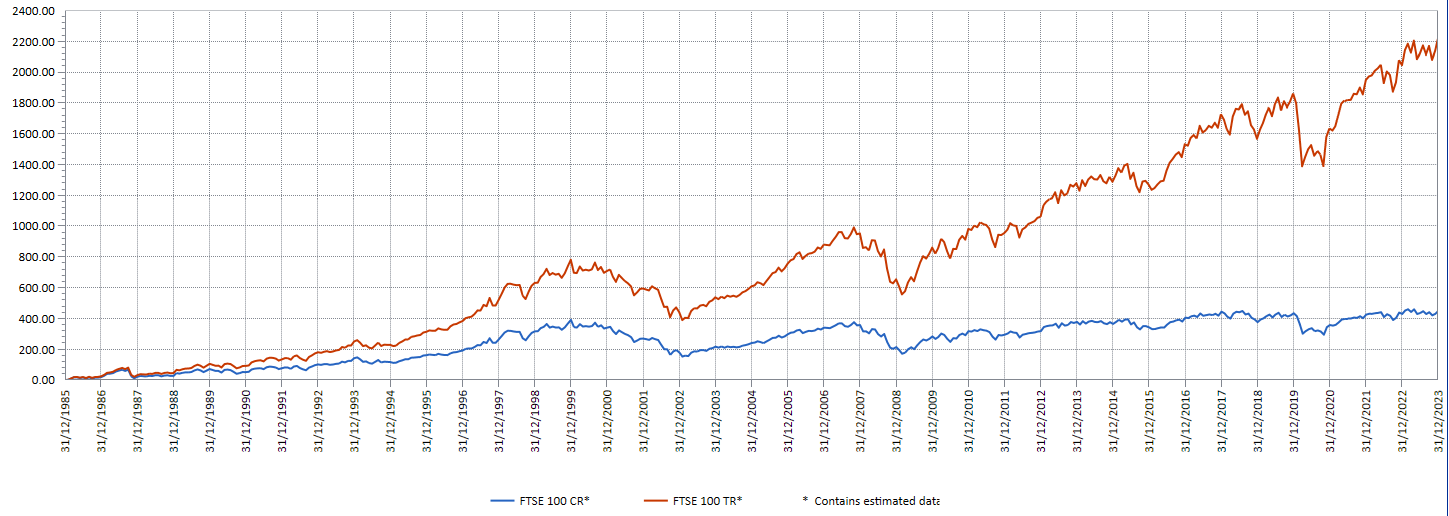

“Measured in point terms, the FTSE 100 has risen 447% since its inception and over the last five years it has seen a mere increase of just 15% which is particularly pedestrian compared to the US S&P 500 Index which has risen 90% over the same period," Jason Hollands of BestInvest says,

"While there is no denying that the FTSE 100 has been massively outgunned by US equity performance, the movement in FTSE 100 points is a very partial picture of returns made as the overwhelmingly majority of total returns made from the UK stock market – in fact virtually all the real returns once inflation is factored in - have come from the dividend payments. When these are included and reinvested, the total return from the FTSE 100 over the last forty years is 2,219% and over five years it is 39%".

Below are the FTSE 100 returns in capital and total returns (dividends reinvested).

Source: BestInvest

Has the FTSE 100 moved with the times?

Many people hit age 40 and worry that they are over the hill. They may no longer recognise footballers, pop music or the latest fashion trends.

A similar accusation could be thrown at the FTSE 100.

“Critics will argue the FTSE 100 has, however, ossified since the turn of the century,” adds Mould.

“The index peaked at 6,930 on December 31 1999, just as the technology, media and telecoms bubble began to leak air, and since then it has grubbed out a capital return of just 9.7%.

“That equates to a turgid compound annual return of 0.4% and comes nowhere close to covering the compound annual rate of inflation of 3.4%, based on the RPI over the past twenty-four years.”

Some may say the FTSE 100 hasn’t done enough to move with the times and has become too dependent upon a small number of behemoths that have been in the index for a long time.

Just a dozen FTSE 100 firms make up half of its current market cap, says Mould.

“ Eight of them – Shell, Unilever, BP, Rio Tinto, BAT, GSK, RELX and Reckitt Benckiser – were there in 1984, in one way shape or form and two more (HSBC and Diageo) have their origins in founder members of the index, in the shape of Midland Bank (HSBC) and Allied Lyons, Distillers and Grand Metropolitan (Diageo),” adds Mould.

“Eight of the forecast twelve biggest contributors to the FTSE 100’s 2023 aggregate-pre-tax profit were also there at the start in 1984 – Shell, BP, Rio Tinto, BAT, Unilever, Barclays, GSK and Lloyds – while NatWest and HSBC can be traced back to two more founder members, National Westminster Bank and Midland Bank.

“And six of the forecast twelve biggest payers of dividends in 2023 also hail from the first crop of FTSE 100 firms. They are Shell, BAT, Rio Tinto, BP, Unilever and GSK, while HSBC and Diageo can trace their origins back to the first crop of constituents.

But when you actually look at the makeup, Mould suggests that the FTSE 100 is still managing to evolve over time – albeit slowly - as can be seen from a simple comparison of the index on 3 January 1984 and 30 September 2023.

| FTSE 100 founders, 3 January 1984 | FTSE 100, 30 September 2023 |

|---|---|

| Allied Lyons | 3i |

| Associated British Foods | Admiral Group |

| Associated Dairies | Anglo American |

| BICC | Antofagasta |

| BOC | Ashtead |

| BPB Industries | Associated British Foods |

| BTR | AstraZeneca |

| Barclays | Auto Trader |

| Barratt Development | Aviva |

| Bass | B&M European Value Retail |

| Beecham | BAE Systems |

| Berisford | Barclays |

| Blue Circle | Barratt Developments |

| Boots | Beazley |

| British Aerospace | Berkeley |

| British & Commonwealth Shipping | BP |

| British Electric Traction | British American Tobacco |

| British Home Stores | BT |

| British Petroleum | Bunzl |

| Britoil | Burberry |

| Bowater | Centrica |

| Burton | Coca-Cola HBC |

| Cable & Wireless | Compass |

| Cadbury Schweppes | ConvaTec |

| Charterhouse J. Rothschild | Croda |

| Commercial Union | DCC |

| Consolidated Gold Fields | Dechra Pharmaceuticals |

| Courtaulds | Diageo |

| Dalgety | Diploma |

| Distillers | Endeavour Mining |

| Edinburgh Investment Trust | Entain |

| English China Clays | Experian |

| Exco International | F & C Investment Trust |

| Ferranti | Flutter Entertainment |

| Fisons | Frasers |

| General Accident | Fresnillo |

| General Electric | Glencore |

| Glaxo | GSK |

| Globe Investment Trust | Haleon |

| Grand Metropolitan | Halma |

| Great Universal Stores | Hargreaves Lansdown |

| Guardian Royal Exchange | Hikma Pharmaceuticals |

| Guest, Keen & Nettlefolds | Howden Joinery |

| Hambro Life | HSBC |

| Hammerson | IMI |

| Hanson Trust | Imperial Brands |

| Harrisons & Crosfield | Informa |

| Hawker Siddeley | InterContinental Hotels |

| House of Fraser | International Cons. Airlines |

| ICI | Intertek |

| Imperial Continental Gas | JD Sports Fashion |

| Imperial | Kingfisher |

| Johnson Matthey | Land Securities |

| Ladbrokes | Legal and General |

| Land Securities | Lloyds |

| Legal & General | London Stock Exchange |

| Lloyds Bank | M & G |

| MEPC | Marks & Spencer |

| MFI Furniture | Melrose Industries |

| Magnet & Southerns | Mondi |

| Marks & Spencer | National Grid |

| Midland Bank | NatWest Group |

| National Westminster Bank | Next |

| Northern Foods | Ocado |

| Pearson | Pearson |

| Peninsular & Oriental Steam | Pershing Square |

| Pilkington | Phoenix Group |

| Plessey | Prudential |

| Prudential Assurance | Reckitt Benckiser |

| RMC | RELX |

| Racal | Rentokil Initial |

| Rank | Rightmove |

| Reckitt & Colman | Rio Tinto |

| Redland | Rolls Royce |

| Reed | RS Group |

| Rio Tinto-Zinc | Sage |

| Rowntree Mackintosh | Sainsbury |

| Royal Bank of Scotland | Schroders |

| Royal Insurance | Scottish Mortgage Inv. Trust |

| Sainsbury | SEGRO |

| Scottish & Newcastle | Severn Trent |

| Sears | Shell |

| Sedgwick | Smith & Nephew |

| Shell Transport & Trading | Smith DS |

| Smith & Nephew | Smiths Group |

| Standard Chartered | Smurfit Kappa |

| Standard Telephone & Cables | Spirax-Sarco Engineering |

| Sun Alliance & London Insurance | SSE |

| Sun Life Assurance | St. James's Place |

| Tarmac | Standard Chartered |

| Tesco | Taylor Wimpey |

| Thorn EMI | Tesco |

| Trafalgar House | Unilever |

| Trusthouse Forte | Unite |

| Ultramar | United Utilities |

| Unilever | Vodafone |

| United Biscuits | Weir Group |

| Whitbread | Whitbread |

| Wimpey (George) | WPP |

“Further changes are likely, thanks to the final index reshuffle of 2023,” he adds.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

ISA quiz: How much do you know about the tax wrapper?

ISA quiz: How much do you know about the tax wrapper?Quiz One of the most efficient ways to keep your savings or investments free from tax is by putting them in an Individual Savings Account (ISA). How much do you know about ISAs?