The lesson from the Uber lobbying scandal

Tech firms should openly stand up for free markets, says Matthew Lynn. Uber’s mistake was that it chose to stay in the shadows while lobbying politicians for change.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The massive leak of files from Uber last week has blown open the minicab giant’s lobbying machine. European commissioners were rushing from meeting to meeting with lobbyists; politicians were dazzled with campaign donations, jobs for families and friends, and the promise of lucrative consultancy contracts.

Meanwhile, Uber’s staff openly boasted about how the company was built on law-breaking, tearing up labour laws and suppressing dissent; drivers were encouraged to get into fights with their opponents because violence works; managers were instructed to hit the “kill switch” to delete data whenever regulators or police threatened to seize it.

Overall, the picture is of a firm rising to dominance using methods that the Corleone family in The Godfather might have found a little on the pushy side. Yet while nobody would deny that Uber went over the top, we shouldn’t lose sight of the real scandal here: the fact that the companies were not able to make their case in the open.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We should recall that Uber was taking on and challenging one of the most restrictive industries in the world. Before it arrived on the scene, it was virtually impossible to get a taxi in Paris (a report in 2000 found the city had fewer taxis than in 1920). In London, the black cabbies kept an iron grip on the trade, charging sky-high prices, while anyone hoping to get back to zone five after midnight could expect to be advised to find an alternative method of transport (except in more colourful language). And in New York, cab licences were so tightly controlled that they changed hands for tens of thousands of dollars.

Uber’s super-slick app broke cartels in major cities around the world, providing lots of flexible, well-paid work to drivers (mostly recent immigrants, as it happens), and lots more choice to consumers. In London, a service that had become largely restricted to executives on expense accounts was suddenly opened up to teenagers getting home from a club in the middle of the night.

Make the case for freedom

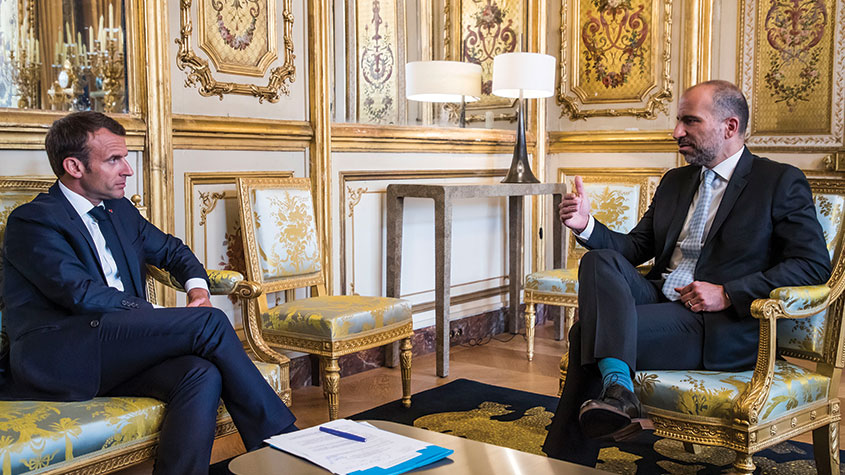

Uber’s mistake was that it chose to stay in the shadows while trying to change this. It should not have been Emmanuel Macon, then still France’s finance minister, that it was lobbying to help re-write the country’s taxi regulations (or London mayor Sadiq Khan in the UK), but ordinary voters. Because it failed to do so, it ended up being heavily regulated anyway.

Drivers now have to be offered holiday pay and a range of other benefits. The result is that prices have gone up, the availability of cars is down, and the company’s share price has collapsed, falling by 50% so far this year alone.

We can see the same fate befalling other tech giants. The UK government is clamping down hard on Airbnb rentals, with the result that hotels are now often cheaper than borrowing someone’s flat. The social-media players are collaborating with the government’s online harm bill, turning themselves into petty censors. Amazon stays meekly silent as its marketplaces that open up industries to micro-entrepreneurs are regulated out of existence. Google is too timid to explain how search and maps increase choice instead of restricting it.

Yet giant tech companies should be standing up for free markets and free speech. Uber had a perfectly respectable case about how it was benefiting consumers. So do Airbnb, Amazon, Tesla and many others. The lesson from the Uber leaks is surely that backdoor lobbying doesn’t work. Only making a robust case for freedom and choice is effective in the long run.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.