The charts that matter: bitcoin rises and a mixed week for tech

Tech stocks suffered a volatile week. Here’s how it affected the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Welcome back.

On the cover of this week’s magazine, we’ve got Japan’s stockmarket and why it is looking promising. Japan offers investors access to the Asian growth story combined with the comforts of investing in a developed market, says Alex Rankine.

Meanwhile, our big investment feature this week is how to profit from pampered pets beyond the pandemic. When widespread Covid-19 lockdowns began, many people bought a pet to survive the lack of human interaction. But “the surge in pet ownership induced by the pandemic merely reinforced a long-standing trend,” says Matthew Partridge.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you’re not already a subscriber, sign up for MoneyWeek magazine now.

This week’s “Too Embarrassed To Ask” video explains what an “index” is. Even if you don’t invest, you have most certainly heard the term. The best-known indexes tend to be the ones that represent individual countries’ stock markets. Here's what it means and why it matters.

And joining Merryn on the podcast this week is AVI Japan Opportunity Trust’s Joe Bauernfreund. They talk about how the Japanese market is valuable despite being hugely under-researched. Find out what Joe has to say here.

Here are the links for this week’s editions of Money Morning and other web articles you may have missed:

- Monday Money Morning: Coal is far from dead. What should investors do about it?

- Web article: Chinese tech firms are moving from listing in New York to Hong Kong. Are they worth buying?

- Tuesday Money Morning: After a stunning 2020, how is 2021 shaping up for investment trusts?

- Web Article: What’s behind China’s stockmarket meltdown?

- Merryn’s Blog: Signs of a top? One of the world’s oddest bubbles is back

- Wednesday Money Morning: Oil is taking a well-earned rest. But the bull market isn’t

- Web Article: Big tech smashes expectations with bumper profits

- Thursday Money Morning: What does the US dollar’s sudden about-turn mean for the markets?

- Friday Money Morning: Two private equity trusts: one to buy, one to avoid

Now for the charts of the week.

The charts that matter

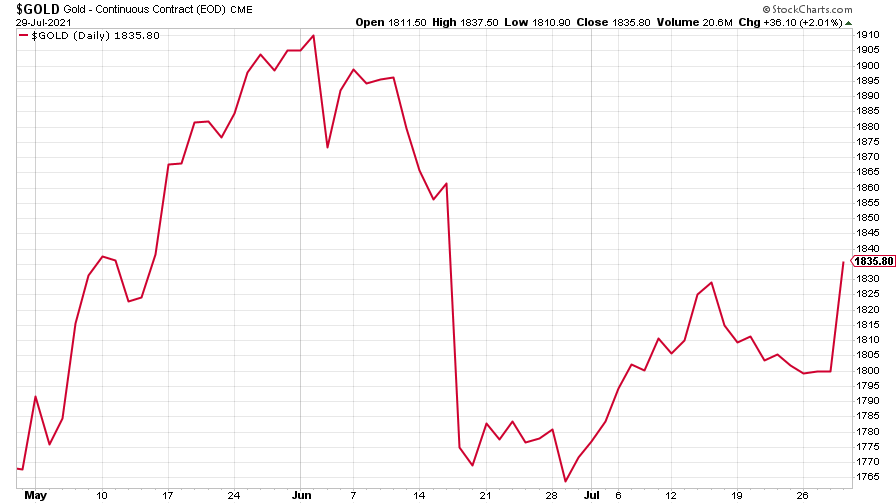

The gold price rose a little after the metal had lost a little ground in the previous week.

(Gold: three months)

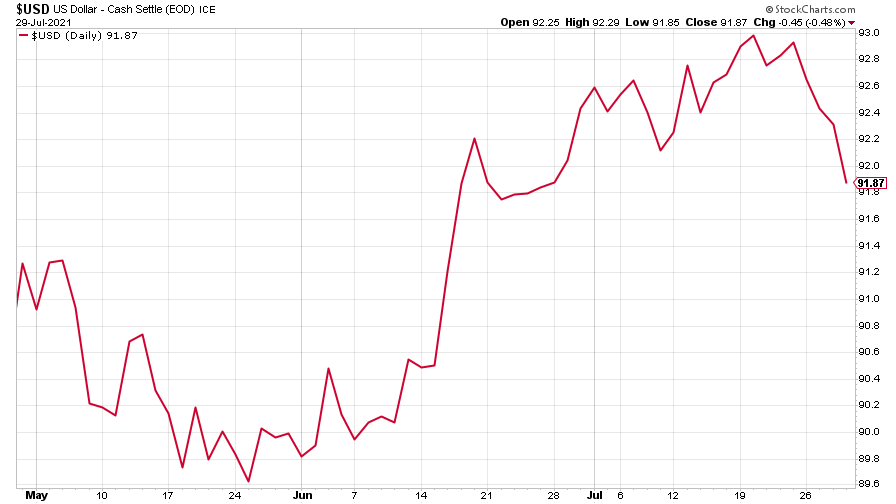

The US dollar index (DXY – a measure of the strength of the dollar against a basket of the currencies of its major trading partners) fell week-on-week (which partly explains the slight uptick in gold prices.

(DXY: three months)

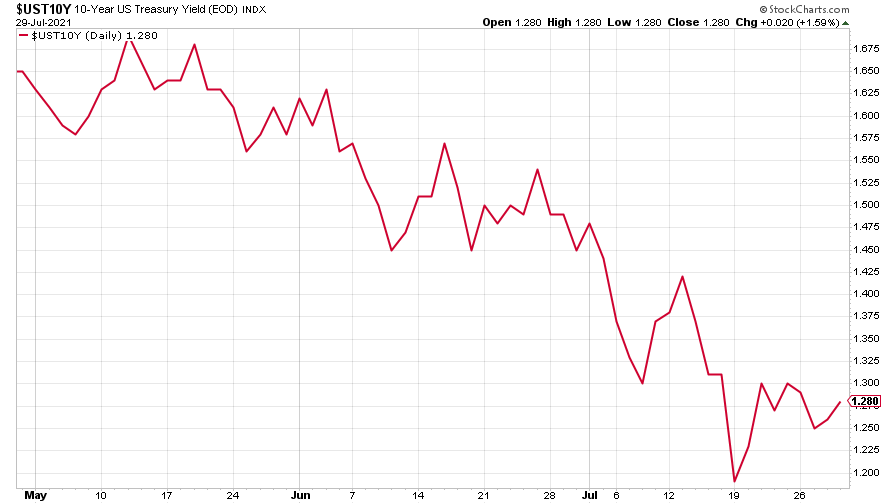

The yield on the ten-year US government bond rose after a weak auction on Thursday contributed to risk-on sentiment.

(Ten-year US Treasury yield: three months)

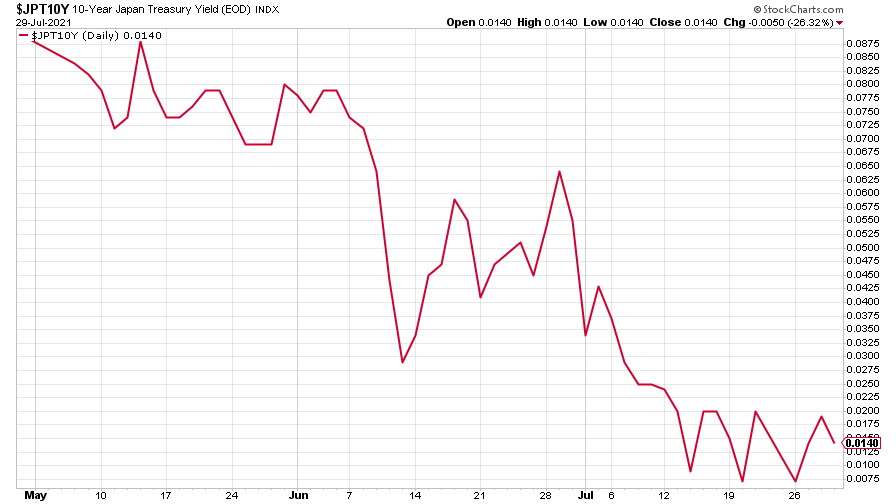

The yield on the Japanese ten-year bond had a volatile week ending slightly higher than where it started.

(Ten-year Japanese government bond yield: three months)

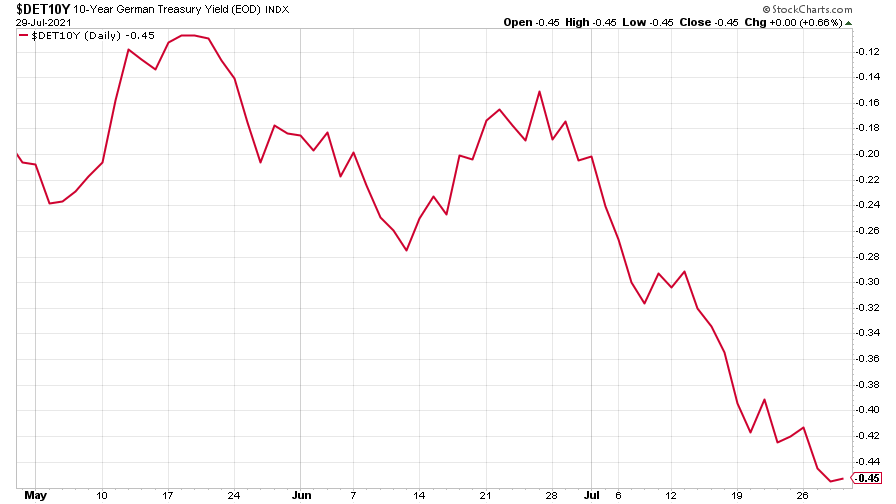

And the yield on the ten-year German Bund fell too.

(Ten-year Bund yield: three months)

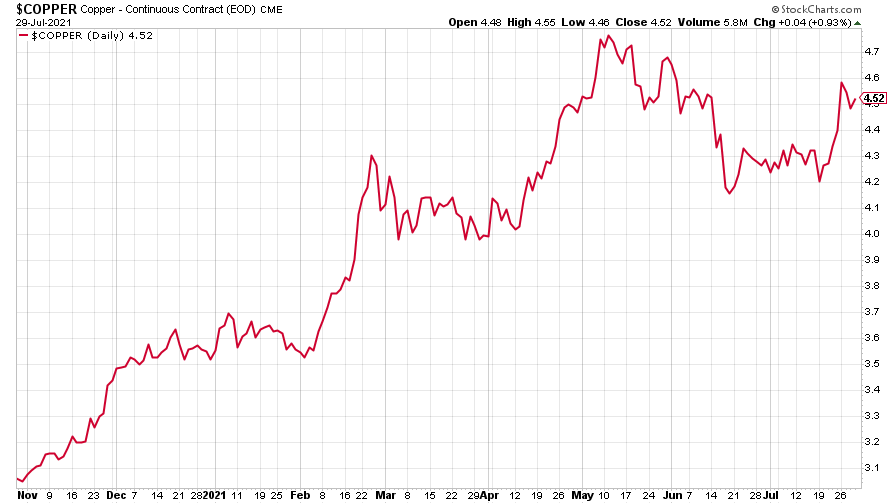

Copper rose compared to the previous week as investors bet on strong demand for the metal in the second half of 2021.

(Copper: nine months)

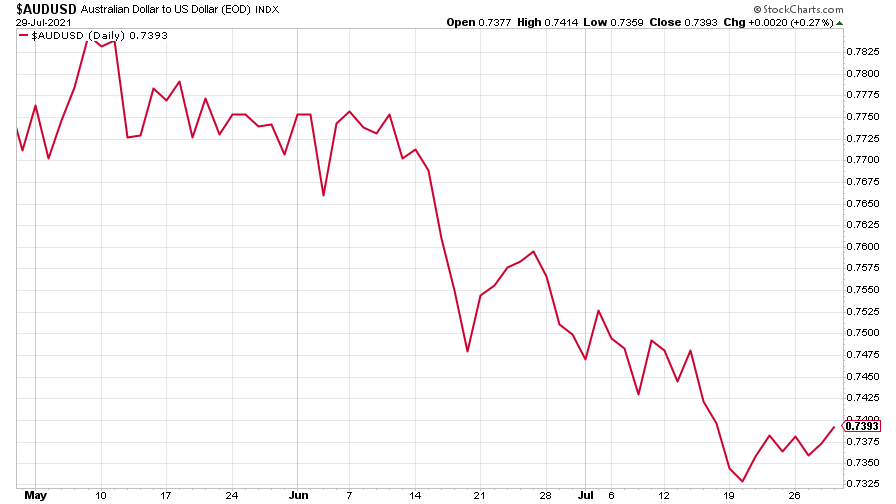

The closely-related Aussie dollar rose a little in the week after the dollar gave up some gains.

(Aussie dollar vs US dollar exchange rate: three months)

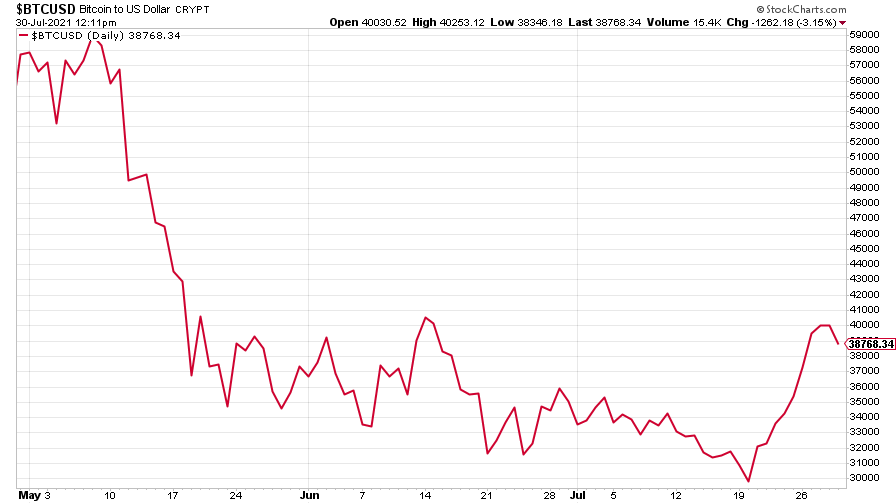

Bitcoin rose in the week after news broke out that Amazon may tap into cryptocurrencies.

(Bitcoin: three months)

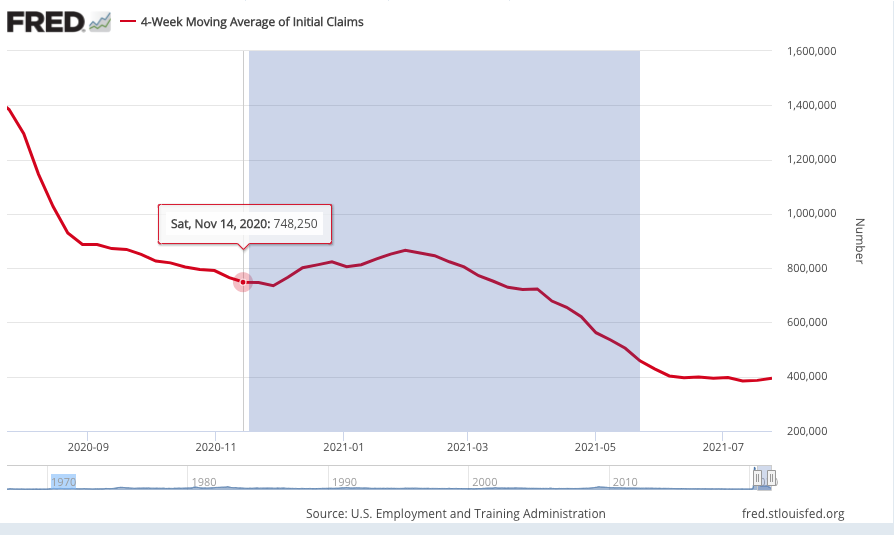

US weekly initial jobless claims fell by 24,000 to 400,000. The four-week moving average was 394,500, an increase of 8,000 from the previous week's revised average.

(US initial jobless claims, four-week moving average: since Jan 2020)

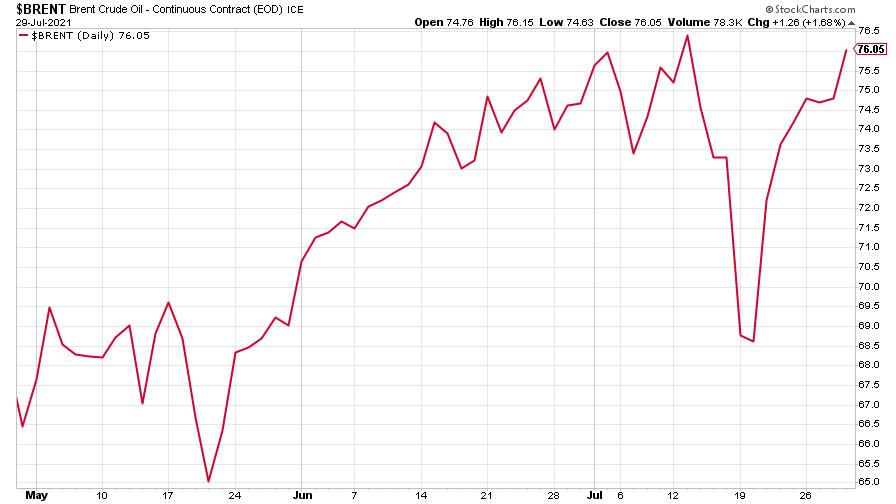

The oil price rose after US inventories fell below the five-year average.

(Brent crude oil: three months)

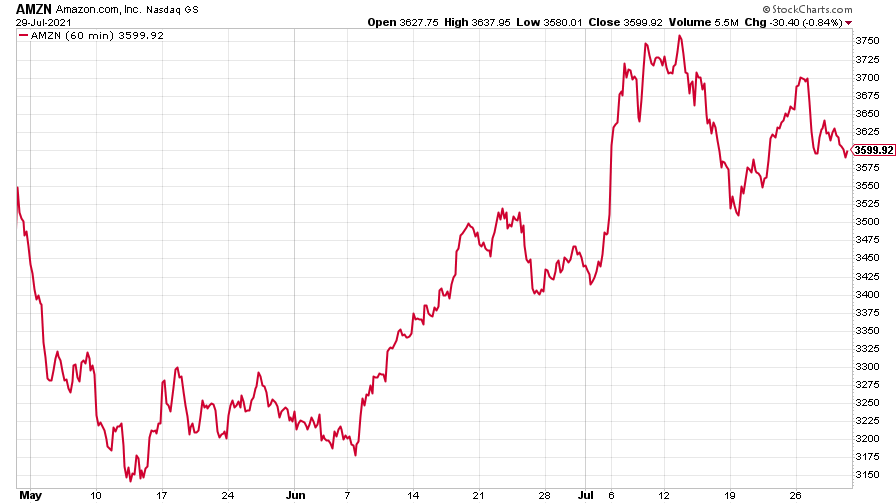

Amazon turned sharply lower after China sparked a wider sell-off and after the company was fined €746m by Luxembourg’s officials for breaching EU privacy laws.

(Amazon: three months)

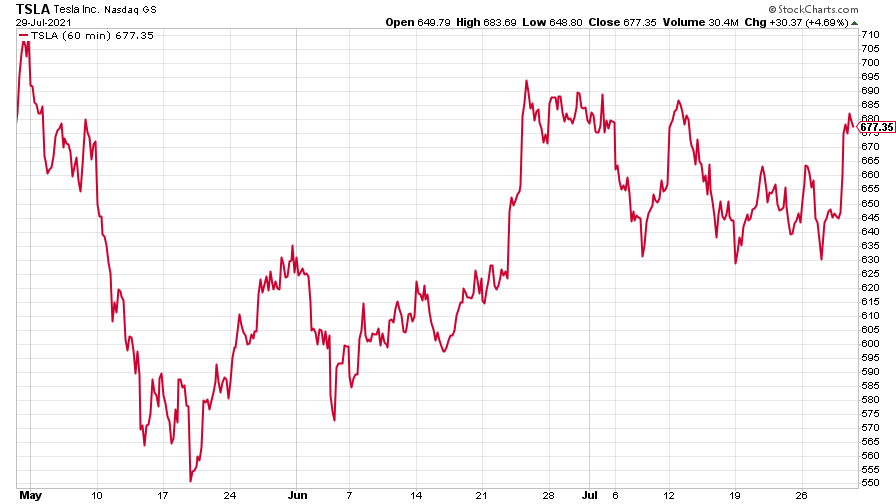

And Tesla rose after posting strong second quarter earnings.

(Tesla: three months)

Have a great weekend.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify

-

UK wages grow at a record pace

UK wages grow at a record paceThe latest UK wages data will add pressure on the BoE to push interest rates even higher.

-

Trapped in a time of zombie government

Trapped in a time of zombie governmentIt’s not just companies that are eking out an existence, says Max King. The state is in the twilight zone too.

-

America is in deep denial over debt

America is in deep denial over debtThe downgrade in America’s credit rating was much criticised by the US government, says Alex Rankine. But was it a long time coming?

-

UK economy avoids stagnation with surprise growth

UK economy avoids stagnation with surprise growthGross domestic product increased by 0.2% in the second quarter and by 0.5% in June

-

Bank of England raises interest rates to 5.25%

Bank of England raises interest rates to 5.25%The Bank has hiked rates from 5% to 5.25%, marking the 14th increase in a row. We explain what it means for savers and homeowners - and whether more rate rises are on the horizon

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

-

Is my pay keeping up with inflation?

Is my pay keeping up with inflation?Analysis High inflation means take home pay is being eroded in real terms. An online calculator reveals the pay rise you need to match the rising cost of living - and how much worse off you are without it.