With Brexit back in the news, which way now for the pound sterling?

Whether the UK and EU come to a Brexit deal or not, we’re unlikely to see any nasty surprises in the currency markets, says Dominic Frisby. Here, he explains why, and looks at what the coming days, weeks and months might hold for the pound.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As we struggle towards “deal” or “no deal”, today we consider the outlook for the once great currency that is the pound sterling. With no deal looking likely last week, and now this week being told a deal is possible, you can assume that all outcomes are priced in. The forex markets will have observed the negotiators’ every utterance, every nuance, every syllable of their body language.

In other words, we shouldn’t get any surprises of the undesirable variety that so spooked markets as, for example, when the UK surprisingly voted “Leave” in 2016; when fat-fingered foreign traders fumbled a flash crash (it’s alliteration Wednesday) that same year; or when Covid-19 struck in 2020. So what might the coming days, weeks and months hold for the pound?

Remember the days when a pound could fetch you more than two US dollars?

In the volatility of February and March, sterling took a thrashing. When financial markets crash, as happened this year or in 2008, sterling always seems to go the same way, presumably because our economy is so geared to finance. But since the spring, sterling has been in something of an uptrend. This week it touched the highs last seen in the overnight euphoria following the Tories’ election win in December 2019 – $1.35 is the figure. Much of that climb, however, is really down to US dollar weakness.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Against the euro, sterling has been, shall we say, declining gently. While it touched €1.20 Before Covid (BC), over the last six months it has ranged between €1.13 and €1.08. Currently we sit at €1.10. The euro, no doubt to the annoyance of EU-based exporters trying to rebuild after the pandemic, is in even more of a bull market versus the dollar than the pound is. To put today’s price of €1.10 into some kind of context, the all-time high for sterling against the euro came shortly after the turn of the century at €1.74. The low came in early 2009 at €1.02 – almost parity. So today we are at the lower end of the range. On a purchasing power parity basis, fair value is probably 10c or so higher from here.

The pound was a different beast in the days before quantitative easing (QE), zero interest rates, and money printing. In 2008 it got you $2.11 – imagine that! At today’s price of $1.34, to be talking of a bull market in that historical context seems absurd, but that is what we are in. $1.40 (or just below) was an extremity beneath which we never sank – with one brief exception during the miners’ strike in 1984, and the exceptional US dollar strength in the lead up to the Plaza Accord of 1985, when the G5 agreed to devalue the dollar. But here we are today below that level. We’ve been below it since 2016.

Frisby’s flux still points to a bit more upside for the pound

Anyway – “cable”, as the pound-dollar exchange rate is known, is more a function of US dollar strength and weakness than it is sterling. The US dollar is just so much bigger. Currently the US dollar is in a bear market – it had a limp-wristed rally in September, but since then, the bear that began with Covid has resumed.

The remarkable rallies that we have seen in commodities this year, and indeed stocks, are as much a function of US dollar weakness as they are of underlying fundamentals. I’m bullish about the prospects for many commodities by the way – there’s a huge infrastructure splurge coming that will require lots of them after several years of underinvestment (meaning supply shortages) – but the rallies would be nothing like as pronounced if the US dollar had been strong. In that context, I’m reasonably bullish about sterling’s prospects. It’s currently in an uptrend – though one that is now butting up against that long-term support-resistance line just below $1.40 ($1.36 is the precise number on a daily chart).

You know my long-term cynicism towards cycles. We see cycles around us all the time – the days, the seasons, people’s lives as they grow older, the rise and fall of empires. Cycles make terrific narratives and so the human brain tends to lock itself into them. They’re great things for hacks to write about because there is an obvious story. But, from an investment perspective, if you lock your mind too much into the idea of them they can be dangerous. We are in an economic winter you might think, and altogether overlook the reality that progress is an overwhelming march forward. You might declare there is an 18-year cycle in property, or a four-year cycle in stocks, and get so locked into the theory that you fail to see what is happening before your eyes. So they are useful for context, but do not rely on them, is my take.

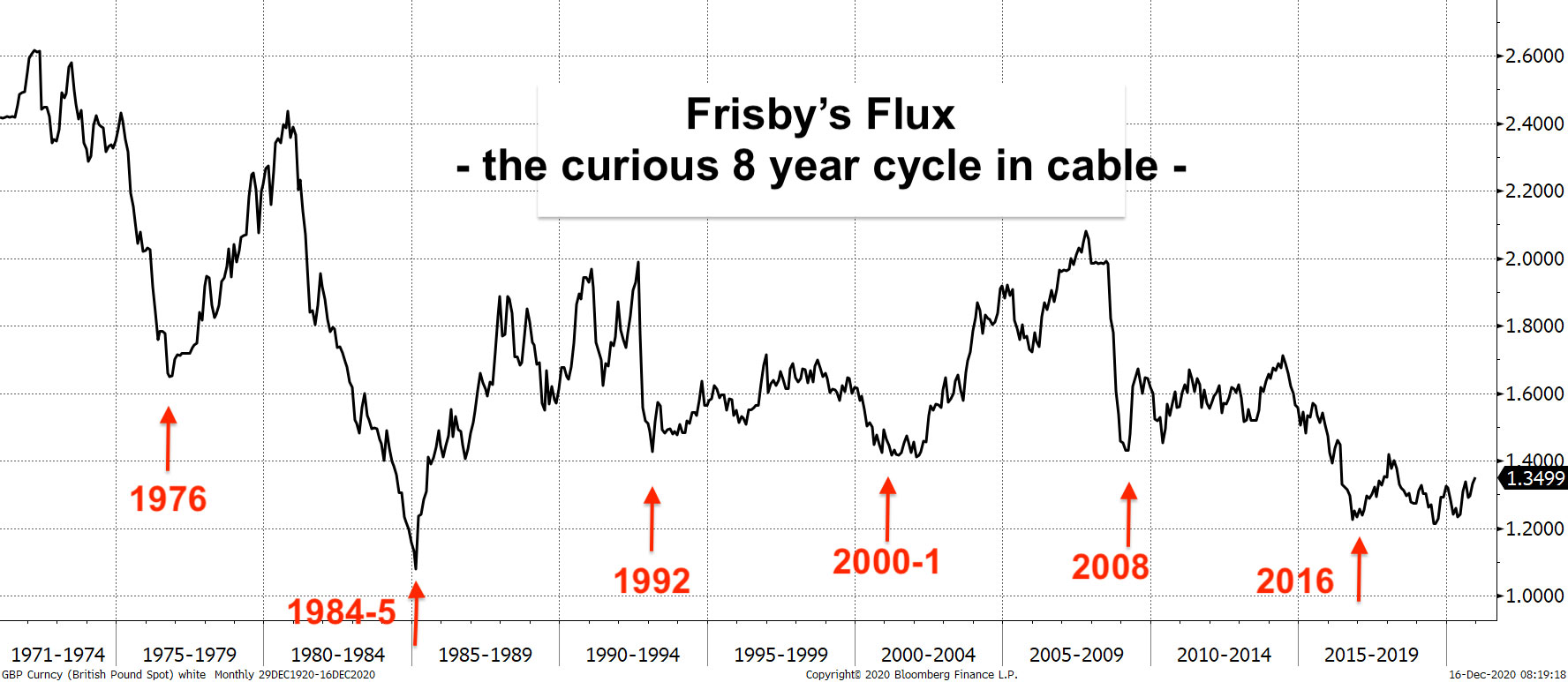

With that disclaimer aside, I remind you of the peculiar cycle in sterling that I have observed in which it seems to make a low every eight years. I call it “Frisby’s Flux” (for self-promotional reasons) as I appear to have been the first to have noticed it. There was Chancellor Dennis Healey going to the International Monetary Fund in 1976. There was the crash in 1984-1985 before the Plaza Accord. 1992 saw Black Wednesday. In 2000, sterling crashed along with dotcom. In 2008 it went the same way as banks. And in 2016 we got Brexit. Here it is illustrated below. (Bear in mind this is a monthly chart, so it doesn’t show the intraday extremities we saw for example with Flash Crash of 2016).

The projected post-2016 rally has been limp, and we got multiple retests of the lows – first with all the political instability of Theresa May’s prime ministership and then with Covid. But we are now in something of an uptrend that could carry us forward for a couple of years. And somewhere in the 2022 time frame, perhaps we should be looking to go short once again. But an outright short now? I’m not so sure.

Daylight Robbery – How Tax Shaped The Past And Will Change The Future is now out in paperback at Amazon and all good bookstores with the audiobook, read by Dominic, on Audible and elsewhere.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Why you should keep an eye on the US dollar, the most important price in the world

Why you should keep an eye on the US dollar, the most important price in the worldAdvice The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.

-

Are we heading for a sterling crisis?

Are we heading for a sterling crisis?News The pound sliding against the dollar and the euro is symbolic of the UK's economic weakness and a sign that overseas investors losing confidence in the country.