You’ve heard of Kondratiev waves – now meet the Frisby flux, the pound's eight-year cycle

Dominic Frisby thinks he’s found an eight-year cycle in the pound, which he’s dubbed the ‘Frisby Flux’. Here’s what it is, what it means, and how to trade it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As soon as the word cycles' comes up in investing, I breathe out and try and erect a defensive mental wall.

I want as little of that stuff as possible getting into my head. I think I've heard more of the proverbial spouted about cycles than anything else.

It is easy to look back at events, find some arbitrary pattern and declare it a cycle. All of a sudden, you're a cycles expert and you've got a newsletter.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There is the Kondratiev cycle, the 14-year cycle in real estate, the seven-year crash cycle, the commodities super-cycle, the demographics cycle and those are the better ones.

So it is with no little trepidation that I present you with the topic of today's Money Morning I think I've found a cycle

Cycles are easy to spot, but trading them is another matter

Cycles are all very well in theory, and they make a great topic for discussion, but trading them in real time is a different prospect altogether. Is this a shortened 40-year Kondratiev wave or an extended 60-year wave, for example? How does one know?

Even straightforward-sounding cycles are tricky to trade. Take the four-year "presidential cycle" in US stocks. (I'm aware that GMO's Jeremy Grantham, one of its main proponents, recently said that it doesn't work any more because the US Federal Reserve has broken it, but let's use it for example's sake.)

The idea is that economic sacrifices are made during the first two years of a president's term (while it's still OK to be unpopular). This results in the "four-year cycle low" in the stockmarket. Then, in the final two years of the term, the focus shifts towards stimulus, to boost the economy ahead of the next election.

But how do you trade that? It's fine in hindsight any academic can dig around after the event, find a low in a president's second year of office, then declare: "Look! A cycle!" But knowing that you're seeing a significant high or low as it actually happens is a very different prospect.

Nevertheless, cycles do exist we have the seasons, the moons, the cycle of life and so on. There are good times and bad times. There are bull markets and bear markets.

Mining is very prone to cycles. Tech stocks go through a clear cycle as they evolve. And thinking in terms of cycles does help you to frame the bigger picture: it can give you an idea where you are in the grand scheme of things.

And, guess what? I was look at a long-term chart of the pound the other day and you'll never believe what I've found. A cycle. Yup.

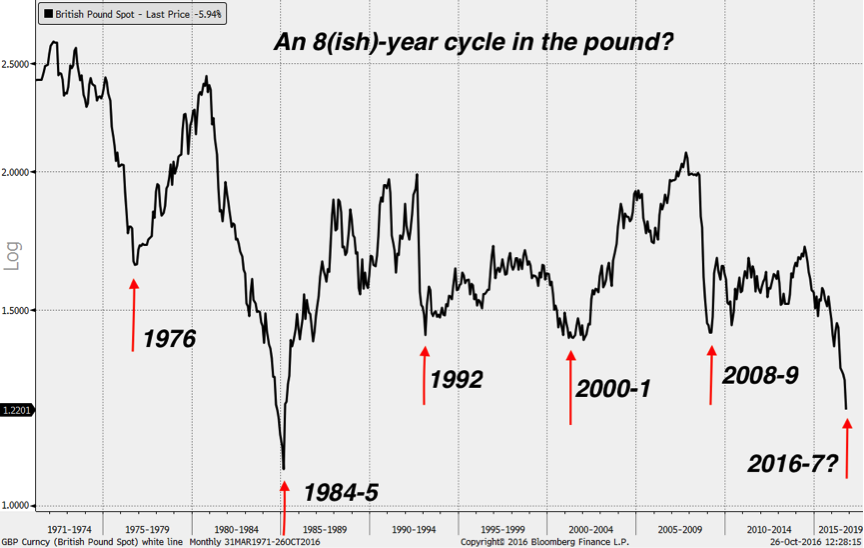

This one lasts eight years. It needs a name. The eight-year cycle in the pound is too dull. How about the Frisby Flux?

Trading the Frisby Flux

Every eight years or so, the pound seems to falls to a point where it makes a significant low against the US dollar.

With the flash crash a fortnight ago, the pound hit $1.18 according to Bloomberg though some trading houses have it at $1.14. From $1.26 to $1.14 in two minutes. How about that!

While last week, according to the Bank of England, measured against the currencies of Britain's trading partners, the pound sunk to its lowest level ever (or at least since this measure began, which is 1975). Using the $1.18 figure, from the high in 2014 of $1.70, there has been a 30% drop.

In the financial crisis off 2007-09, we got an even bigger drop. $2.11 was the high and $1.36 low, a loss of 35%.

Before that, while the dotcom bubble was noisily bursting, the pound was discreetly going about its own little bear market. From 1999 to 2001, it lost 20% of its value.

Track back eight years to 1992, and we're in Black Wednesday territory, when George Soros and others notoriously sold the pound so hard that the Bank of England was forced to take the UK out of the European Exchange Rate Mechanism. It went from $2 to $1.40 a 30% loss.

Go back another eight years and in 1984-85 we have the all-time low for the pound against the dollar. The miners' strike was in full flight here in the UK, while the US dollar was so strong that the governments of France, West Germany, Japan, the US and the UK all agreed to depreciate the dollar against the Japanese yen and German mark (the Plaza Accord).

This was the biggest drop of the lot. From 1981 to 1984 the pound went from $2.40 almost to parity. The loss was over 55%.

Go back another eight years, and you will find another cycle low in 1976. Then the pound hit $1.60. $1.60 sounds like a lot compared to $1.22 today, but in 1973 the pound was $2.60. So that drop was almost 40%.

Have I convinced you then that there is an eight-year cycle in the pound?

Here's the long-term chart for your perusal.

According to Frisby's Flux, we should then be looking for a low in the pound somewhere between now and next spring. I'm wary about calling the low because I called it at $1.27 was given a decisive slap in the face by Mrs Market.

But the conditions are ripe for a low. We have extreme bearishness, with record short positions in sterling. We have extreme uncertainty. Nobody seems to agree quite how we will leave the EU and under what terms, while there is a movement underfoot to undermine the exit where possible.

Can those extremes get more extreme? Possibly.

But moving forward we know that Bank of England boss Mark Carney will have to end his latest bout of quantitative easing (QE) at some stage, particularly with anti-QE sentiment finally getting some momentum. One should not underestimate the impact that the latest bout of QE and reduction in rates has had on the pound. When it is reversed, it will add strength.

And as we move into spring, the path of Brexit will become clearer. Yesterday I was talking to Peter Lilley MP, who is involved in the negotiations. (I'm speaking tonight at a dinner he's arranging, but our discussion quickly got on to Brexit.) He seems to think the exit is much simpler than the media would currently have you believe. He may be right. The end result, like most things, will, I expect, be worse than hoped and better than feared.

Maybe $1.18 needs to be re-tested, maybe we've already had the low, maybe we will see another leg lower early next year perhaps towards parity. Nobody knows.

But Frisby's Flux says the bear will be over by the spring.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?