Energy

The latest news, updates and opinions on Energy from the expert team here at MoneyWeek

Explore Energy

-

The state of Iran’s economy – and why people are protesting

Iran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

By Simon Wilson Published

-

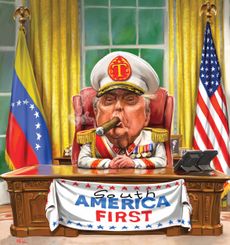

Why does Donald Trump want Venezuela's oil?

The US has seized control of Venezuelan oil. Why and to what end?

By Simon Wilson Published

-

Ovo Energy, British Gas, Octopus Energy: which are the best and worst energy suppliers?

Citizens Advice has ranked 16 energy suppliers for customer service but which one has been crowned the best and which one is the worst?

By Sam Walker Last updated

-

UK blue chips offer investors reliable income and growth

Opinion Ben Russon, portfolio manager and co-head UK equities, ClearBridge Investments, highlights three British blue chips where he'd put his money

By Ben Russon Published

Opinion -

Renewable energy funds: stuck between a ROC and a hard place

Renewable energy funds were hit hard by the government’s subsidy changes, but they have only themselves to blame for their failure to build trust with investors

By Bruce Packard Published

-

Did COP30 achieve anything to tackle climate change?

The COP30 summit was a failure. But the world is going green regardless, says Simon Wilson

By Simon Wilson Published

-

How to harness the power of dividends

Dividends went out of style in the pandemic. It’s great to see them back, says Rupert Hargreaves

By Rupert Hargreaves Published

-

Canadian stocks for a new era of deglobalisation

Greg Eckel, portfolio manager at Canadian General Investments, selects three Canadian stocks

By Greg Eckel Published

-

Renewable energy trusts: is there any hope for the sector?

The outlook for renewable energy trusts has gone from bad to worse this year, with the industry being caught in a 'perfect storm'

By Rupert Hargreaves Published