Cris Sholto Heaton

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is especially interested in international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers. He often writes about Asian equities, international income and global asset allocation.

Cris began his career in financial services consultancy at PwC and Lane Clark & Peacock, before an abrupt change of direction into oil, gas and energy at Petroleum Economist and Platts and subsequently into investment research and writing. In addition to his articles for MoneyWeek, he also works with a number of asset managers, consultancies and financial information providers.

He holds the Chartered Financial Analyst designation and the Investment Management Certificate, as well as degrees in finance and mathematics. He has also studied acting, film-making and photography, and strongly suspects that an awareness of what makes a compelling story is just as important for understanding markets as any amount of qualifications.

Latest articles by Cris Sholto Heaton

-

Protect yourself from mobile-banking app scams

Features Security flaws in some mobile-banking apps are being exploited by crooks.

By Cris Sholto Heaton Last updated

Features -

The best ways to save with railcards

Advice The cost of train tickets keeps going up, but there are ways to save. We’ve rounded up all the railcards you can use to cut costs.

By Cris Sholto Heaton Published

Advice -

Will Silicon Valley Bank’s collapse spark a new crisis?

Analysis The fall of Silicon Valley Bank and the rescue of Credit Suisse have sent shockwaves through the financial system. However, they’re unlikely to lead to another 2008-style bank crisis says Cris Sholto Heaton

By Cris Sholto Heaton Published

Analysis -

How to earn a higher rate on your spare cash in ISAs and SIPPs

Tips Money-market funds can help investors get more interest on balances in Isas and Sipps

By Cris Sholto Heaton Published

Tips -

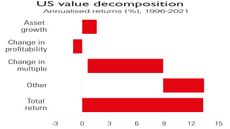

The US stock market – should you put more into the S&P 500?

Analysis Everything went right for the US stock market in the past decade. It will be hard to repeat that as interest rates rise. We look at how attractive the S&P 500 is right now.

By Cris Sholto Heaton Published

Analysis -

Open-ended property funds and the illusion of liquidity

Analysis The pension crisis is once again showing why real-estate investment trusts (Reits) are a better choice than open-ended property funds

By Cris Sholto Heaton Published

Analysis -

Why the Bank of England intervened in the bond market

Analysis A sudden crisis for pension funds exposed to rapidly rising bond yields meant the Bank of England had to act. Cris Sholto Heaton looks at the lessons for all investors.

By Cris Sholto Heaton Published

Analysis -

Mortgage interest rates are signalling a return to lower inflation

Analysis The pricing of fixed-rate mortgage deals shows that markets are still betting on a return to lower inflation and low rates, says Cris Sholto Heaton.

By Cris Sholto Heaton Published

Analysis -

Can energy futures tell us where our fuel bills are going next?

Analysis It’s tempting to think that energy futures tell us where our energy bill might be heading next. But in reality, markets are just too complex. Cris Sholto Heaton explains why.

By Cris Sholto Heaton Published

Analysis -

How to avoid risk when investing in real estate

Analysis For all the talk of working from home and shifting demand for offices, the outlook for interest rates matters more for investors in real estate.

By Cris Sholto Heaton Published

Analysis -

Holding too much cash: the peril of playing it safe

Advice Holding too much cash is painful in a high-inflation world, even if you expect the market to tread water. Cris Sholto Heaton explains why.

By Cris Sholto Heaton Published

Advice -

Fill your portfolio with your very best ideas

Analysis Fund managers’ top picks beat the market, but the rest of their portfolios often add little value, says Chris Sholto Heaton.

By Cris Sholto Heaton Published

Analysis -

An investment trust offering a double discount on South Korean stocks

Tips The Weiss Korea Opportunity Fund offers a way to buy leading South Korean stocks at a 50% discount, says Cris Sholto Heaton.

By Cris Sholto Heaton Published

Tips -

MoneyWeek ETF portfolio update: taking a lesson on inflation from the 1970s

Tips Inflation is here to stay. Time to protect our ETF portfolio with some energy exposure, says Cris Sholto Heaton

By Cris Sholto Heaton Last updated

Tips -

Value stocks: when cheaper isn’t cheap enough

Advice Value stocks will probably beat growth stocks in the years ahead, but that won’t necessarily mean high returns, says Cris Sholto Heaton

By Cris Sholto Heaton Published

Advice -

Margin lending: investors are loading up on cheap debt to buy stocks

Advice Central banks will be slow to raise rates, but even small changes matter with US margin debt at record highs

By Cris Sholto Heaton Published

Advice -

Lessons for investors from the 1800s

Advice New data suggests that factors such as value, momentum and low beta have a long history of success

By Cris Sholto Heaton Published

Advice -

Index-linked bonds could prove a costly inflation hedge

Advice Index-linked bonds are designed to keep pace with inflation, but at these prices you are locking in a loss

By Cris Sholto Heaton Published

Advice -

Why you should always be sceptical of new funds promising miracle returns

Advice Many market-beating strategies could be an illusion caused by the constant search for new ways to sell funds, says Cris Sholto Heaton.

By Cris Sholto Heaton Published

Advice -

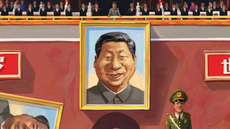

The three key risks for investors in China, and how to tackle them

Cover Story Xi Jinping’s vision for the future of China is very different to the past. Stricter social control and the slow struggle to tackle problems in the economy may not be good news for markets, says Cris Sholto Heaton.

By Cris Sholto Heaton Published

Cover Story -

Post-pandemic recovery stocks run out of puff

Analysis The Covid-19 vaccines have been successful. Many plays on the global recovery have not done so well.

By Cris Sholto Heaton Published

Analysis -

Russia's rigged election won’t rattle investors

News Russian stocks are soaring, despite last week’s blatantly rigged election.

By Cris Sholto Heaton Published

News -

Iron-ore price fall hits mining stocks

News The iron-ore price hit a record high of over $235 a tonne in May. But it has since fallen to below $100, sparking a sell-off in mining stocks.

By Cris Sholto Heaton Published

News -

Xi Jinping’s crackdown spreads to Macau and Hong Kong

News The Chinese government is cracking down on Macau's gambling sector and Hong Kong's property companies.

By Cris Sholto Heaton Published

News