Premium Bonds: a better bet for savers when interest rates are low

Cash is a dull investment with interest rates near zero – but there is one way to make it more exciting without risk

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Cash is a crucial part of a portfolio. It provides you with reserves to draw on for large planned or unplanned expenses, and it allows you to take advantage of any major buying opportunities in the markets. How much cash you hold as part of your investments – as opposed to what’s in your current account to cover routine outgoings – will vary depending on the size of your portfolio, the level of your regular, reliable income and whether you are expecting any major outlays in the next couple of years, but many people keep between 5% and 10% of their assets in cash.

Unfortunately, cash also seems dull. The interest you can earn is usually modest compared to the potential returns on other assets. At present, with inflation likely to stay high and interest rates firmly on the floor, you are guaranteed to lose money in real terms: UK inflation was 2.4% in June, compared with a best rate of about 0.5% on an easy access account and 1% if you lock your money up for a year. So the temptation today to move your cash into higher-yielding investments is huge. The problem is that investments with a higher potential return carry more risk to your capital, and the point of cash is to have complete security and easy access.

Popular, but normally not attractive

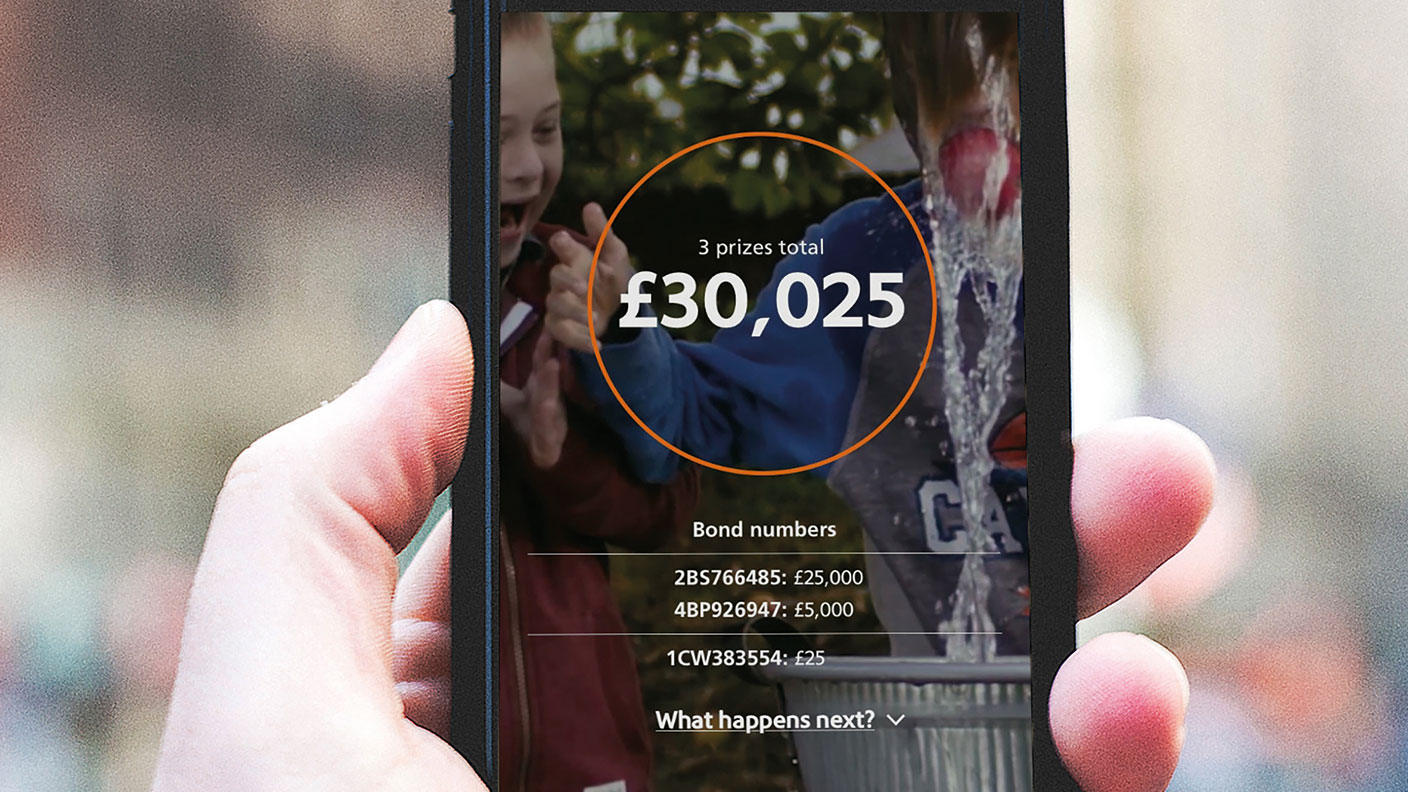

However, there is one popular investment that probably looks better in today’s conditions than usual: the government-backed National Savings & Investments Premium Bonds. These don’t pay interest – instead they run a monthly prize draw, with an annual prize rate that varies over time to reflect what’s available on savings accounts. This rate is now 1%, down from 1.4% last year. The tax-free prizes range from £25 (where each £1 Premium Bond has a roughly one in 35,000 chance of winning) to £1m (about one in 55 billion). You can save up to £50,000 and there’s no notice period for withdrawals.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That 1% prize rate doesn’t represent the typical return, because it’s skewed by the handful of large prizes. Your expected return depends on how many bonds you hold. A saver who has £1,000 is unlikely to win anything in a year. One with £35,000 will average one £25 prize each month (an annual rate of 0.85%) – but around half of savers will do worse.

Lumpy returns like this make Premium Bonds fairly unattractive in normal conditions. But with interest rates so low relative to inflation, even the unlucky won’t end up much worse off than with a savings account. The capital is safe and there is a tiny probability of a bigger payoff. Very few investments that have that risk profile. So long as the prize rate stays competitive against savings, Premium Bonds can be a simple way to make cash a little more exciting without adding risk.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

NS&I February Premium Bonds winners revealed – did you win £1 million?

NS&I February Premium Bonds winners revealed – did you win £1 million?More than 2.7 million historic Premium Bonds prizes are still waiting to be claimed, NS&I says

-

ISA reforms will destroy the last relic of the Thatcher era

ISA reforms will destroy the last relic of the Thatcher eraOpinion With the ISA under attack, the Labour government has now started to destroy the last relic of the Thatcher era, returning the economy to the dysfunctional 1970s

-

Why UK stocks are set to boom

Why UK stocks are set to boomOpinion Despite Labour, there is scope for UK stocks to make more gains in the years ahead, says Max King

-

Should ISA investors be forced to hold UK shares?

Should ISA investors be forced to hold UK shares?The UK government would like ISA investors to hold more UK stocks – but many of us are already overexposed

-

Premium Bonds winners announced – did you scoop the September jackpot?

Premium Bonds winners announced – did you scoop the September jackpot?NS&I has announced the winners for September’s Premium Bonds prize draw, with two lucky savers becoming overnight millionaires. Did you win this month?

-

NS&I announces August 2025 Premium Bonds winners – did you win £1 million jackpot?

NS&I announces August 2025 Premium Bonds winners – did you win £1 million jackpot?NS&I has released details about August 2025’s Premium Bonds jackpot winners. We look at who won a big prize this month

-

How long does it take to win a Premium Bonds prize?

How long does it take to win a Premium Bonds prize?It could take much longer than you think to win something in the Premium Bonds prize draw

-

Parents face £1,000 'nanny tax' – how to afford it

Parents face £1,000 'nanny tax' – how to afford itHiring a nanny is about to become even more of an expensive hassle for families, especially those in London. Here's how to cut costs