Alex Rankine

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

Latest articles by Alex Rankine

-

Will the gas market keep inflating?

Analysis Energy prices are exploding in value, and the European market has been particularly hit hard. Alex Rankine explains whether gas prices will still march higher or fall soon.

By Alex Rankine Published

Analysis -

Are stocks back in a bull market or is this just a bear market rally?

News The S&P 500 index gained 17% between its June lows and 16 August, while the Nasdaq Composite rose more than 20%. So are stocks back in a bull market or is this just a brief rally before they resume their slide?

By Alex Rankine Published

News -

European stocks are ignored and cheap – but possibly not for long

News European stocks are out of favour, with some analysts predicting their worst year since 2008. But the worst of the sell-off could be over, and European value shares in particular look appealing.

By Alex Rankine Published

News -

US inflation may have peaked, but it remains a threat

News US inflation fell to 8.5% in July, down from 9.1% the previous month. But structural, not transitory, forces are pushing inflation higher. It could be around for some time yet.

By Alex Rankine Published

News -

A turning point in economic history as globalisation comes to an end

News Nancy Pelosi’s visit to Taiwan could mark a turning point as Western firms swap low costs for resilience, moving away from China to more “friendly” countries.

By Alex Rankine Published

News -

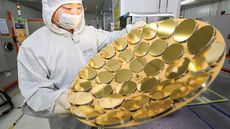

Semiconductor shortage: industry heads for “supersize bust”

News The semiconductor shortage could soon become a semiconductor glut as demand for electronic gadgets falls while state subsidies could mean a surplus of supply.

By Alex Rankine Published

News -

Is the Australian economy weakening?

Analysis Tighter monetary policy is weighing on several parts of the Australian economy, but commodities is providing some respite. Alex Rankine reports.

By Alex Rankine Published

Analysis -

The Bank of England's gloomy forecast for inflation and the UK economy

Analysis The Bank of England has warned that inflation will peak around 13% this year and the UK will fall into recession. Alex Rankine reports.

By Alex Rankine Last updated

Analysis -

Why complacent Germany needs to get a grip

Briefings The gas-supply crisis is merely the most conspicuous sign of the complacency and drift besetting Europe’s largest economy. Germany’s national business model needs an overhaul.

By Alex Rankine Published

Briefings -

China’s property downturn deepens

News Chinese house prices have fallen for ten months in a row, made worse by a residential “mortgage strike”.

By Alex Rankine Published

News -

Enjoy the bear market rally while it lasts

News Investors seem to think that a weaker US economy will cool inflation and see the Fed relent on interest rate rises. But that optimism may be misplaced, with July’s stockmarket gains looking very much like a bear-market rally.

By Alex Rankine Published

News -

Britain’s resilient blue chips – a refuge in the inflationary storm

News The UK's blue-chip FTSE 100 index has been the best-performing major stockmarket index so far this year.

By Alex Rankine Published

News -

Beware of cheap emerging markets

News Emerging markets look cheap, but tread carefully – they tend to be highly cyclical and a global recession would weigh heavily on them.

By Alex Rankine Published

News -

Who will follow Sri Lanka into a debt crisis?

News Sri Lanka defaulted on its debt in May as soaring global food prices and a tourism slowdown collided with years of profligate state spending. Which countries could follow?

By Alex Rankine Published

News -

Chinese stocks are cheap – but for good reasons

News Chinese stocks are trading at an “undeniably cheap” 11.9 times earnings. But they are cheap for good reasons, and this may not be the buying opportunity it appears to be.

By Alex Rankine Published

News -

Eurozone economy heads for paralysis

News Record high energy prices, the threat of recession in Germany and squabbling in Italy's government has left the eurozone fighting fires on all fronts.

By Alex Rankine Published

News -

The junk-bond bubble bursts

News Yields in the US high-yield bond market (AKA junk bonds) have soared to more than 8% since the start of the year as prices collapse.

By Alex Rankine Published

News -

An era of high inflation has arrived

News In recent weeks investors had started to bet on signs that inflation may be peaking – but we’re in a new economic age. Expect high inflation to be here for some time to come.

By Alex Rankine Published

News -

Base metal prices are in freefall – will growth follow?

News The price of copper has fallen to its lowest level since November 2020, with aluminium, nickel and many other base metal prices in freefall, too.

By Alex Rankine Published

News -

Investors dash into the US dollar

News The value of the US dollar has soared as investors pile in. The euro has hit parity, while the Japanese yen and the Swedish krona have fared even worse.

By Alex Rankine Published

News -

The global property bubble bursts

News After a two-year long worldwide boom in house prices fuelled by ultra-low interest rates, central bankers are tightening monetary policy and the global property bubble is starting to deflate.

By Alex Rankine Published

News -

Hong Kong’s crown slips as Singapore takes over

News As international sentiment sours on Hong Kong, other Asian financial hubs – primarily Singapore – are snapping up business.

By Alex Rankine Published

News -

Price of gas soars as Moscow turns off the taps

News As Russia cuts its gas exports to the EU, the price of natural gas continues to rise. Restricted supplies could see energy rationing and recession in Germany, Europe’s biggest economy.

By Alex Rankine Published

News -

Low growth and high inflation: a toxic cocktail for anxious markets

News Low growth, high inflation, central bank tightening, a strong dollar, and the risk of recession is proving a toxic cocktail for world stockmarkets – and for emerging markets in particular.

By Alex Rankine Published

News