Should you take a 25% lump sum from your pension fund?

If you’re approaching retirement, think twice before exercising your right to take 25% of your pension fund savings as a tax-free cash lump sum.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you're approaching retirement, think twice before exercising your right to take 25% of your pension fund savings as a tax-free cash lump sum.

If you're a member of a final-salary scheme, the tax-free lump sum available to you on retirement depends on a "commutation factor". This is the formula that determines how much cash you qualify for and, just as critically, how much annual pension income you'll forgo by taking the money. The higher the commutation factor your scheme offers, the more generous it is.

But the factor also gives you a rough idea of how long you have to live to miss out overall by taking the cash. A commutation factor of 12 broadly means that 12 years into your retirement you'll have given up more in regular pension income than you received as your lump sum.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Men and women aged 65 today can expect to live for another 19 and 21 years respectively. So for many people, a higher annual pension with no lump sum paid upfront will be a better bet.

In defined-contribution schemes, the calculation is more difficult. You can take a straight 25% of the fund upfront, but this will mean less annual annuity income or a smaller fund to invest if you're opting to draw cash down directly from your pension scheme. If the former, you can do some quick calculations by getting annuity quotes with and without taking the lump sum; if the latter, you'll have to make a judgement about the investment returns you're missing out on.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

David Prosser is a regular MoneyWeek columnist, writing on small business and entrepreneurship, as well as pensions and other forms of tax-efficient savings and investments. David has been a financial journalist for almost 30 years, specialising initially in personal finance, and then in broader business coverage. He has worked for national newspaper groups including The Financial Times, The Guardian and Observer, Express Newspapers and, most recently, The Independent, where he served for more than three years as business editor.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

How to protect your pension pot from market turmoil

How to protect your pension pot from market turmoilAdvice The traditional way to protect your pension fund from market risk is to begin shifting your savings out of equities well ahead of retirement. But there are some problems with this approach, says David Prosser.

-

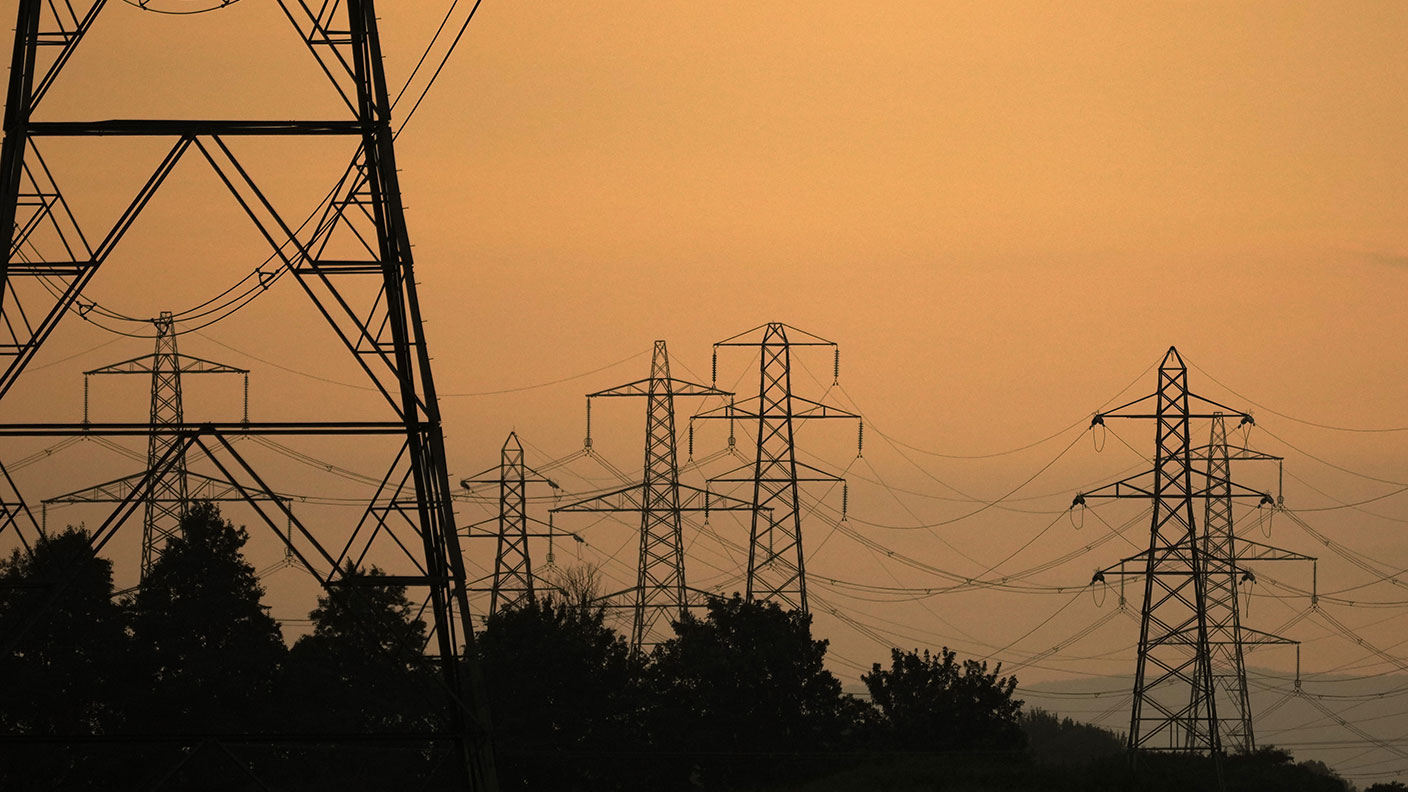

With energy bills rising prepare for a cold, expensive winter

With energy bills rising prepare for a cold, expensive winterAnalysis Soaring energy bills will be a shock once temperatures fall. Prepare now, says Philip Pilkington.

-

Energy bill cost breakdown – where your money goes

Energy bill cost breakdown – where your money goesNews With energy bills soaring, Saloni Sardana looks at how the average energy bill is made up.

-

An unwelcome return for roaming charges in the EU

Advice EE will be the first network to bring back roaming charges for mobile phone users in Europe. It's unlikely to be the last.

-

Travel to the EU: how the Brexit deal affects you

Travel to the EU: how the Brexit deal affects youAdvice The Brexit deal will mean some administrative changes when you next travel to the EU. Here are the most important ones.

-

How Brexit affects expats’ state pensions and other entitlements

Advice Existing British expatriates' state pensions are protected under the Brexit deal, and they retain the right to receive free healthcare. But there are no guarantees about the future.

-

How to claw back tax overpaid when opting for pension drawdown

How to claw back tax overpaid when opting for pension drawdownAdvice Many retirees opting for drawdown schemes – taking money out of their pension savings – have overpaid tax. Here’s what to do to get it back.

-

The pension income-drawdown time bomb

The pension income-drawdown time bombFeatures Some pension savers being paid a regular income from their retirement funds could be heading for disaster.