Energy bill cost breakdown – where your money goes

With energy bills soaring, Saloni Sardana looks at how the average energy bill is made up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Energy prices are soaring across the globe, and it is no secret that higher bills are crippling consumer finances. Most consumers may be scratching their heads wondering why prices are so high and asking: “how is my energy bill made up anyway?”

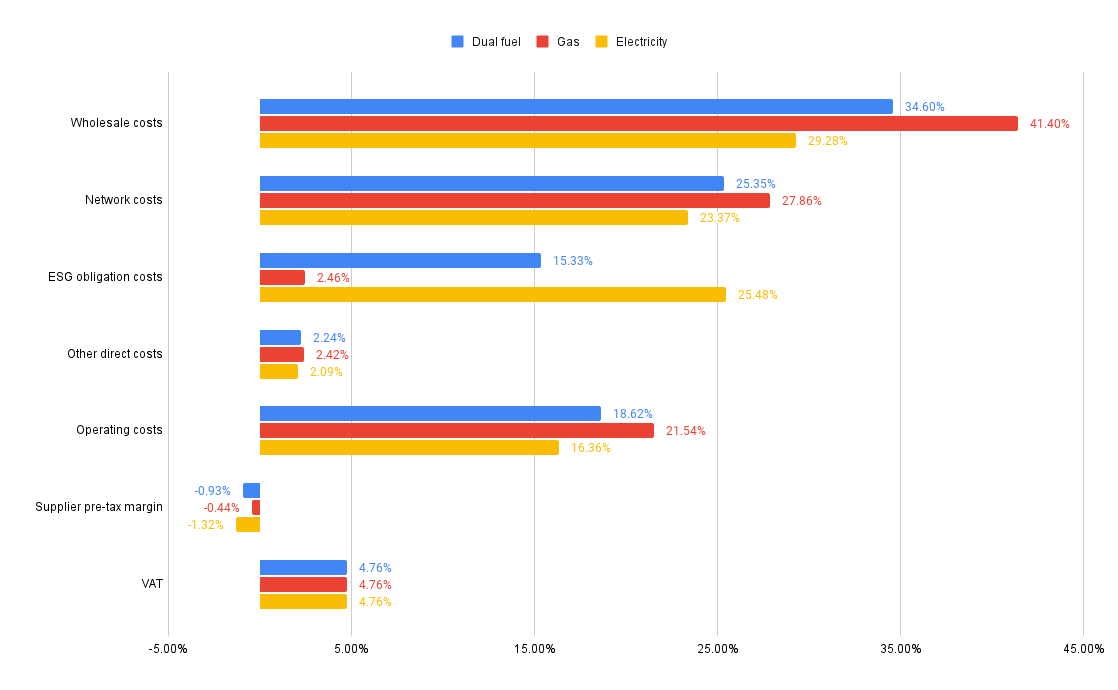

There are six main elements to an electricity bill, according to Ofgem, the UK’s energy regulator. These are: wholesale costs, network costs, social and environmental obligation costs, supplier margin costs, VAT costs, and other direct costs. Though it is worth noting that the proportion of each element varies depending on your type of energy bill, ie, whether it is a gas bill, an electricity bill, or a dual fuel plan, a type of plan which provides consumers with gas and electricity from the same energy supplier.

In the UK, rising wholesale costs have been the main culprit for higher energy prices as European gas prices jumped by more than 300% last year causing a spike in bills and prompting around 30 providers in the UK to go bust.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Ofgem breaks down what those six components are and what proportion they represent across gas, electric and dual plans. Figures are from August 2021, the latest available, but relate to costs in 2020.

Wholesale costs

Energy providers need to first buy electricity and gas on wholesale markets, often months or even years in advance. These costs differ from the retail energy price, which is the price at which companies sell the electricity to consumers. Prices on the wholesale market can fluctuate very rapidly depending on global economic events or even weather conditions – a significant cold snap can see a big rise in demand, for example.

In 2020, wholesale costs accounted for 41.4% of a gas bill, 34.6% for a dual fuel bill and 29.3% for an electricity bill, according to Ofgem.

Network costs

Network costs, also known as transportation costs, refers to the costs related with maintaining, building and operating the UK’s gas and electricity infrastructure. The company that run the network charge energy suppliers to use it.

Unlike choosing a domestic energy provider, consumers do not have a say in which energy network runs the infrastructure, as this is decided by Ofgem. In 2020, network costs accounted for 27.9% of a gas bill, 25.4% of a dual fuel bill and 23.4% of an electricity bill.

Environmental/social obligation costs

Environmental and social obligation costs are the costs that help pay for green policies, and the costs involved in looking after some of the most vulnerable energy consumers, for example those who are struggling to pay bills.

Environmental and social obligation costs include the costs of government programmes to conserve energy and reduce emissions. Programmes such as the Warm Homes Discount – a £140 energy bill discount for households on low incomes – are included, as well as the costs of policies intended to foster a faster transition to green energy.

Many suppliers have attributed growth in this component to “green levies”, which include policies such as Feed in Tariffs, which pay consumers for surplus energy produced at home through rooftop solar panels, for example; and the Energy Company Obligation – a government energy efficiency programme which helps reduce carbon emissions and address fuel poverty. The amount consumers pay on environmental levies could rise as the UK inches closer towards its net zero target of 2050.

As of 2020, environmental and social obligation costs accounted for 2.5% of a gas bill, 15.3% of a dual fuel bill and 25.5% of an electric bill.

Operating costs

Operating costs are all the costs that are involved in running a retail energy business and include such things as customer service, IT systems, billing, and premises. It also includes the cost of metering, such as the cost of providing the meter itself and the data handling responsibilities involved in meter readings.

Operating costs accounted for 21.5% of a gas bill, 18.6% of a dual fuel bill and 16.3% of an electric bill in 2020.

Supplier pre-tax margin

The supplier pre-tax margin is the difference between the payment that goes to your energy supplier and the cost the supplier charges to deliver the energy to you. As energy provider Octopus Energy points out, “this doesn't mean profit, since tax payments and other costs have to come out of this wedge, but profit will be an element of it”.

Supplier pre-tax margin accounted for -0.4% of a gas bill, -0.9% of a dual fuel bill meanwhile the figure is much higher for a dual fuel bill- at -1.3%- with suppliers having lost money on average because of the energy crisis.

VAT

The UK government is currently facing pressure from both politicians and campaigners to provide consumers with much needed relief on rising prices, and removing VAT on bills for a year is one of the proposals currently being considered.

But Adam Scorer, chief executive of National Energy Action, a campaign group, reckons cutting VAT will do little to give consumers respite as he argues that VAT accounts for only a minor proportion of the overall bill.

VAT makes up 4.7% of all bills.

Other direct costs

In reality, there can be so many other factors that influence a bill, but other direct costs can also play their part. These refer to a variety of smaller expenses and include such things as commissions paid to brokers that sell energy on behalf of a wholesale supplier. Ofgem says that other direct costs accounted for just above 2% for all bills.

While Ofgem has not explicitly mentioned the impact of mutualisation, which results in the cost of failed energy companies being spread across the sector – and the costs of bad debt in its graphic, they are still very important as they can significantly hike the cost of bills.

Companies collapsing also affects the Renewables Obligation – a mechanism intended to foster large-scale renewable electricity generation. All licensed electricity suppliers are obliged under the scheme to source a proportion of the electricity they supply from renewable sources.

“When energy companies collapse without paying their share of the Renewables Obligation (RO), the shortfall needs to be covered by other suppliers – even if those suppliers have already paid their share of the RO in full,” according to Choose, a price comparison website.

Bad debts usually raise the price of energy bills – customers unable to pay often leaves energy companies with little choice but to increase prices for other customers to make up the shortfall.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Saloni is a web writer for MoneyWeek focusing on personal finance and global financial markets. Her work has appeared in FTAdviser (part of the Financial Times), Business Insider and City A.M, among other publications. She holds a masters in international journalism from City, University of London.

Follow her on Twitter at @sardana_saloni

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Winter Fuel Payment cut to hit ‘1.5 million’ pensioners - what support does your energy supplier offer?

Winter Fuel Payment cut to hit ‘1.5 million’ pensioners - what support does your energy supplier offer?Advice The Winter Fuel Payment is being scrapped for most pensioners this year. But you may be able to access extra support from your energy supplier. Here’s what’s on offer.

-

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings account

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings accountUlster Bank is offering savers the chance to earn 5.2% on their cash savings, but you need to act fast as easy access rates are falling. We have all the details

-

Moneybox raises market-leading cash ISA to 5%

Moneybox raises market-leading cash ISA to 5%Savings and investing app MoneyBox has boosted the rate on its cash ISA again, hiking it from 4.75% to 5% making it one of top rates. We have all the details.

-

October NS&I Premium Bonds winners - check now to see what you won

October NS&I Premium Bonds winners - check now to see what you wonNS&I Premium Bonds holders can check now to see if they have won a prize this month. We explain how to check your premium bonds

-

The best packaged bank accounts

The best packaged bank accountsAdvice Packaged bank accounts can offer great value with useful additional perks – but get it wrong and you could be out of pocket

-

Bank of Baroda closes doors to UK retail banking

Bank of Baroda closes doors to UK retail bankingAfter almost 70 years of operating in the UK, one of India’s largest bank is shutting up shop in the UK retail banking market. We explain everything you need to know if you have savings or a current account with Bank of Baroda

-

How to earn cashback on spending

How to earn cashback on spendingFrom credit cards and current accounts to cashback websites, there are plenty of ways to earn cashback on the money you spend

-

John Lewis mulls buy now, pay later scheme

John Lewis mulls buy now, pay later schemeThe CEO of John Lewis has said the retailer will consider introducing buy now, pay later initiatives for lower-priced items.