The charts that matter: a time to take stock

After a hectic week, John Stepek takes a look at the charts that matter most to the global economy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I don't want to be alarmist but...

it's only six days to go until the MoneyWeek Wealth Summit don't miss it! Check out the full agenda and book your ticket here.

Book now before someone nationalises it!

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Podcasts, Money Morning, and Currency Corner

It's been a bit hectic prepping for next week's conference so no new podcast from Merryn and I this week, but I did join The Week team for another podcast in which we discussed the Common Agricultural Policy and corruption, the lessons from history and Big Data, and Moody's recent decision to downgrade the entire world. Listen to it here.

If you missed any of this week's Money Morning articles, here are the links you need:

Monday: Want to lose all your money? Invest in an IPO

Tuesday: Reasons to be cheerful with Montanaro's Ed Heaven

Wednesday: Jim Mellon: dividend stocks look cheap but beware inflation

Thursday: Here's what I got up to at the Kilkenomics festival

Friday: Free broadband? Wait until this election campaign really gets going

Currency Corner: A lesson from two of the world's "hardest" currencies

Subscribe: Get your first 12 issues of MoneyWeek for £12

And if you're looking for a Christmas gift for the contrarian investor in your life, allow me to humbly recommend my own book, The Sceptical Investor.

The charts that matter

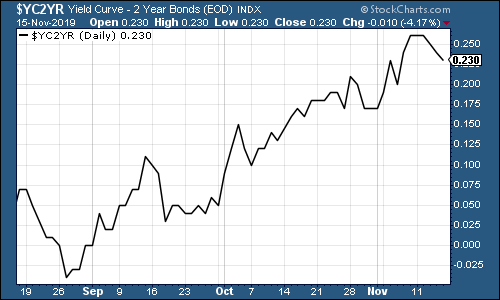

The yield curve didn't change much this week, after the previous week's surge higher. The yield on the ten-year US government bond is still higher than the yield on the two-year, which is as nature intended, at least in the normal course of things.

But for those who are new to this email, I have to remind you that the curve inverted towards the end of August (in other words, the yield on the two-year was higher than that of the ten-year), which history suggests as long as indicates that a recession is on the way within 18-24 months (so some time in 2020 or 2021). Now there are lots of clever reasons why this might not happen this time. But there have been great arguments every time.

(The gap between the yield on the ten-year US Treasury and that on the two-year, going back three months)

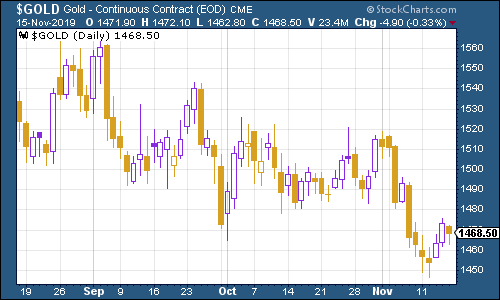

Gold (measured in dollar terms) rebounded a little this week after a tough time last week.

(Gold: three months)

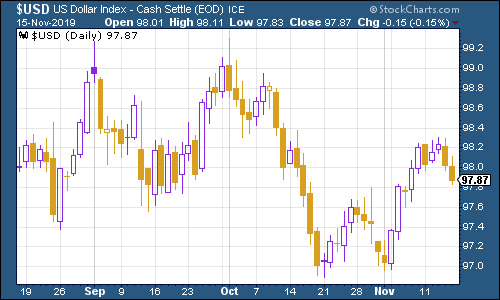

Meanwhile, the US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners bounced from the 97 level, but then dipped after hitting the 98 level. The bulls' hope that the US dollar will fall, as that will mean looser monetary policy for all, which should drive up asset prices.

(DXY: three months)

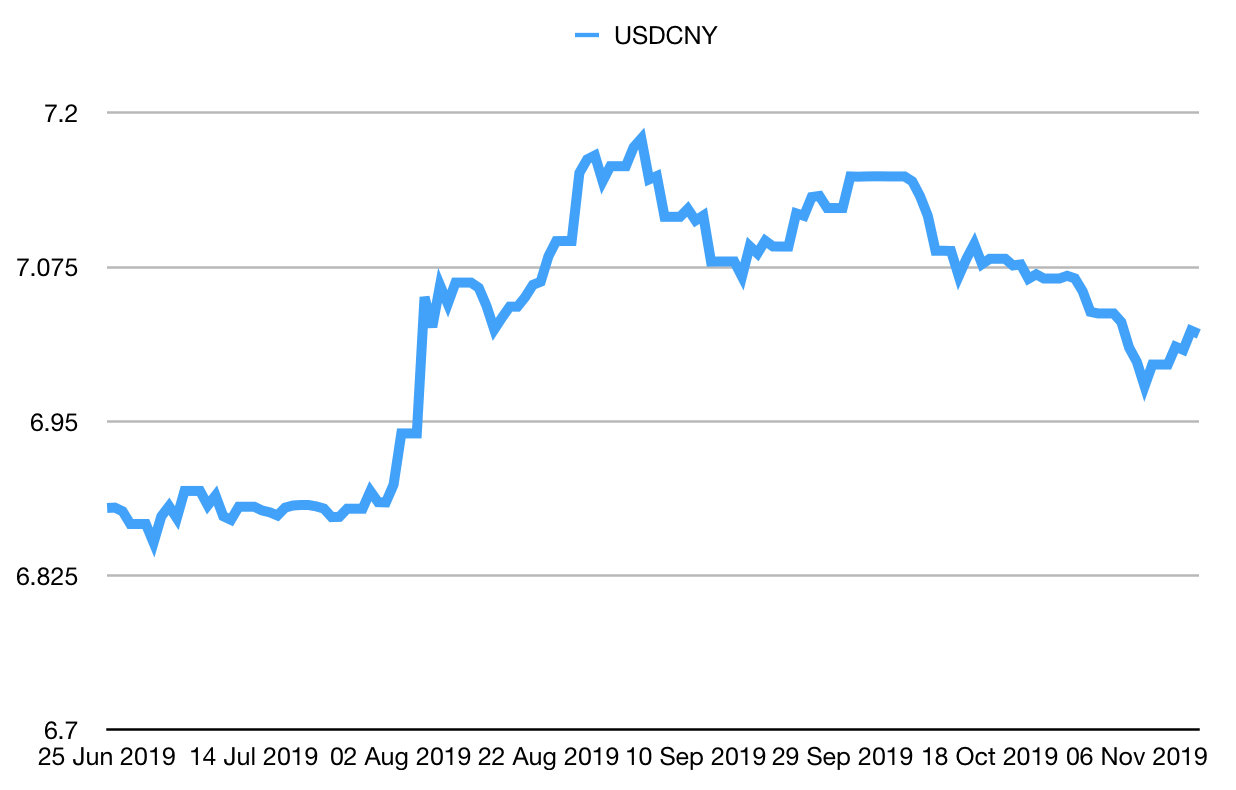

The number of Chinese yuan (or renminbi) you can get to the US dollar (USDCNY) ticked higher as the dollar strengthened. It's now back around the seven to the US dollar mark. That's not such a worry now as it was the first time it happened.

(Chinese yuan to the US dollar: since 25 Jun 2019)

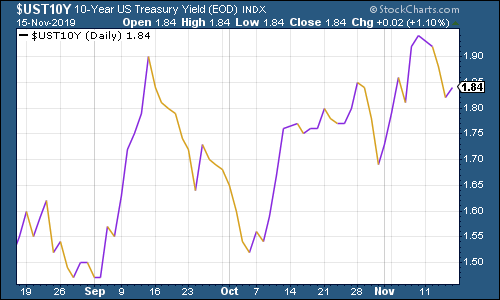

Yields on ten-year yields on major developed-market bonds dipped after the surge we saw the previous week. Here's the US...

(Ten-year US Treasury yield: six months)

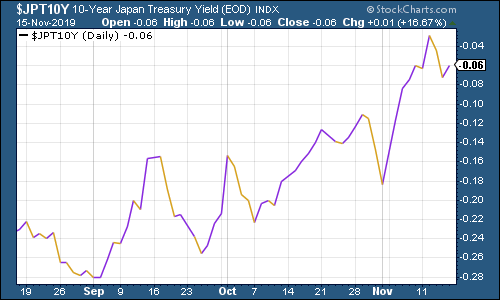

The Japanese ten-year is ever so slightly less negative than last month...

(Ten-year Japanese government bond yield: six months)

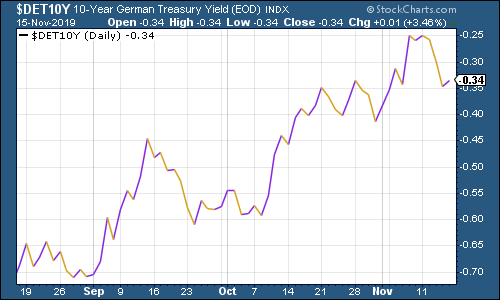

But the yield on the German bund was slightly more negative.

(Ten-year Bund yield: six months)

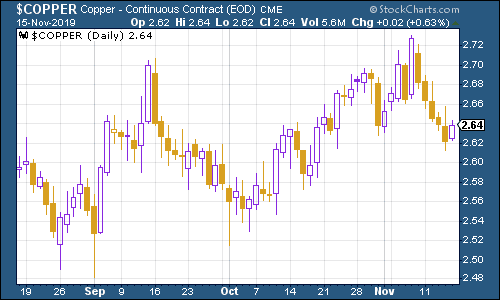

Similarly, having enjoyed a major bounce last week, copper relaxed somewhat this week and edged lower.

(Copper: six months)

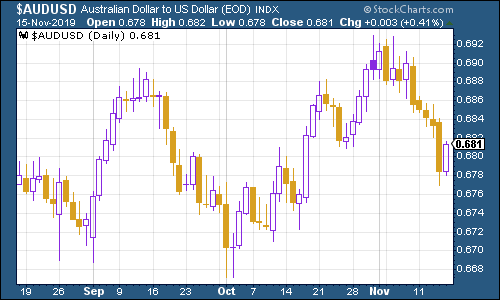

The Aussie dollar slipped back against the US dollar after weaker-than-expected employment data increased the odds that the Royal Bank of Australia (Australia's central bank) would cut interest rates.

(Aussie dollar vs US dollar exchange rate: three months)

Cryptocurrency bitcoin spent most of the week shuddering lower.

(Bitcoin: ten days)

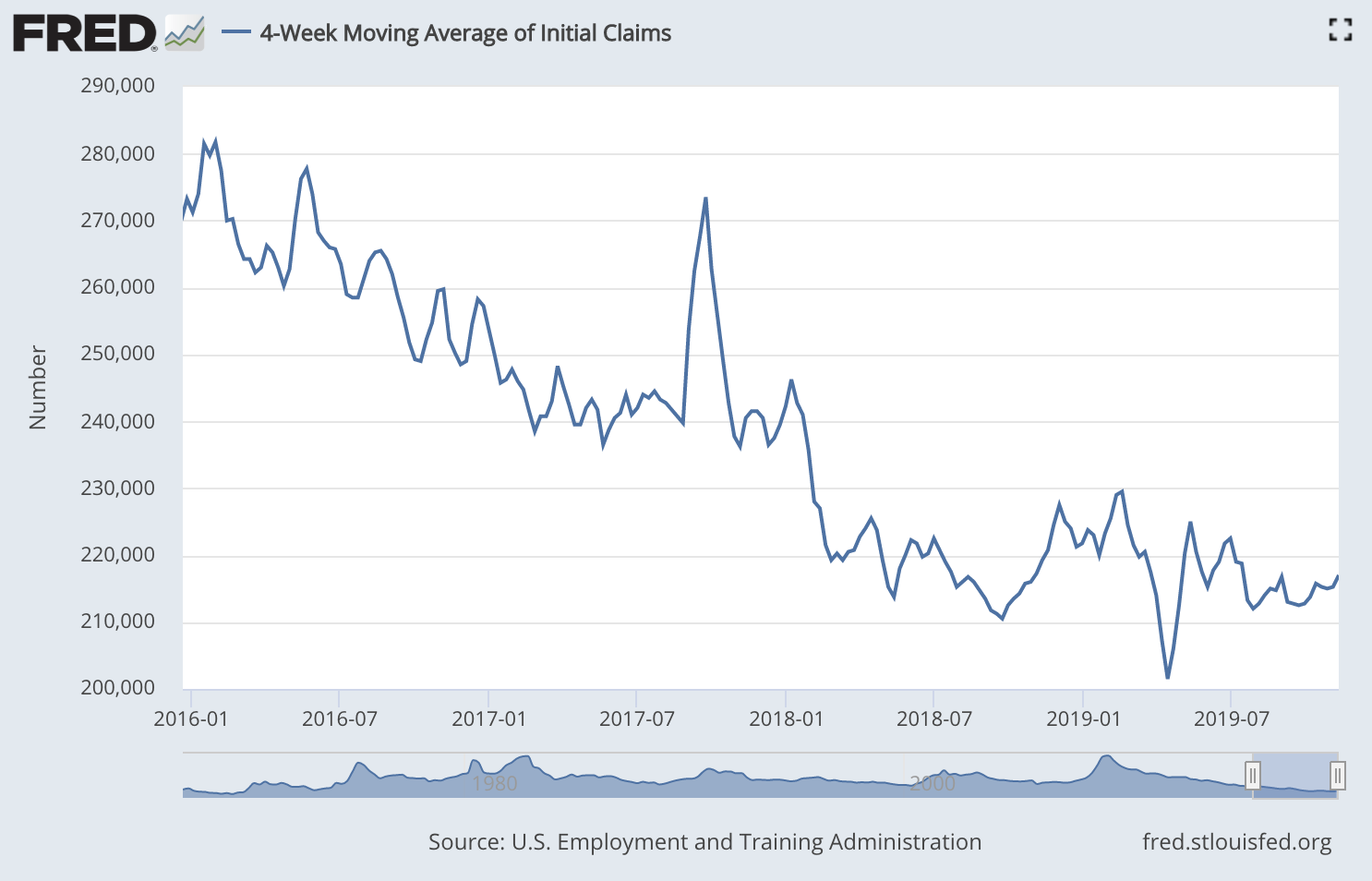

US weekly jobless claims jumped to 225,000 this week, a good bit worse than expected, from 211,000 last week, although most analysts put it down to "seasonal noise". The four-week moving average ticked higher to 217,000, but there's no obvious sign of a big uptrend yet.

(US jobless claims, four-week moving average: since January 2016)

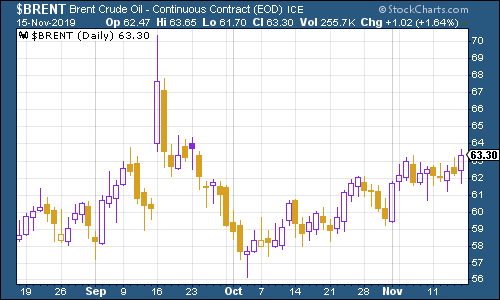

The oil price (as measured by Brent crude, the international/European benchmark) quietly crept higher this week.

(Brent crude oil: three months)

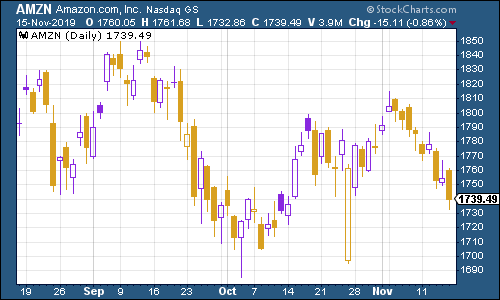

Internet giant Amazon slipped this week.

(Amazon: three months)

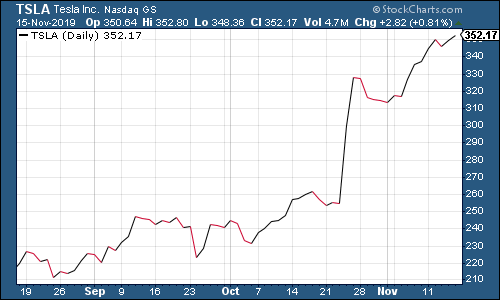

Meanwhile, shares in electric car group Tesla continued to gain.

(Tesla: three months)

Have a great weekend. 22 November is just a few short days away!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King