Currency Corner: A lesson from two of the world’s “hardest” currencies

Dominic Frisby looks at the Swiss franc and Singaporean dollar and what our politicians can learn from these two fiscally responsible nations.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Last week we wrote about how the euro was setting up for a buy signal against the yen. I thought I should alert you straight away that the buy signal never came.

The market reversed this week, so we never got the moving average cross we were looking for. The downtrend (in the euro) continues.

As we were looking at the currencies of two nations Japan and the EU (perhaps I should say "regions") whose central banks are intent on devaluing their money, I thought this week it might be instructive to compare the currencies of two nations whose fiscal policy has proved rather more sound: Switzerland and Singapore.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The currency of Switzerland (and of its neighbouring microstate, Liechtenstein) is the franc. Long considered a safe-haven currency, the Swiss franc was, I believe, the last currency to be gold-backed, only abandoning its gold standard in 2000.

Back then, it was Swiss law that the currency be 40% backed by gold, which is actually, by gold standard terms, quite a high percentage. In the 19th century, for example, the pound was, on average, around 25% backed by gold, research by analyst Thomas Paterson has shown. In times of economic contraction that figure would rise to around 50%, and in times of expansion it was as low as 12.5%.

If you divide the Swiss money supply buy its gold reserves, even today it is around 20% (compared to 3%-4% for the UK).

As money fled to Switzerland during the Greek economic crisis earlier this decade, the Swiss franc appreciated considerably. The Swiss response which took forex markets very much by surprise was to cap the franc against the euro at CHF1.20 to halt its "excessive" advance. The franc immediately lost nearly 10% of its value.

However, the advance resumed, and at one stage in 2014 the Swiss had to resort to negative rates to keep a lid on their currency. In 2015 the Swiss gave up trying to keep a lid on things with another surprise announcement that saw a one-day 30% leap in the franc against the euro.

I remember skiing with three friends in France a couple of weekends later. We agreed that we would take it in turn to buy lunch. One day we crossed the border into Switzerland. My poor friend whose turn it was to buy lunch that day! Fortunately not me.

The evolution of the Singaporean dollar

So to the Singapore dollar. It was pegged to the pound until the early 1970s, when it switched briefly to the dollar before, in 1973, pegging itself to a basket of currencies. This basket was trade-weighted but also went undisclosed. It lasted until 1985 when the dollar became more free-floating, though still closely monitored by the Monetary Authority of Singapore (MAS), to ensure its exports remain competitive. So does it operate today.

Against both the US dollar and the pound, both currencies are a lot higher than they were 20 years ago. You could buy a Swiss franc for about $0.55 back in 2000. Today the US dollar and the Swiss franc trade at parity. A Singapore dollar was $0.53 in 2000 and today it is $0.73.

So how have the Swiss franc and the Singapore dollar fared against each other?

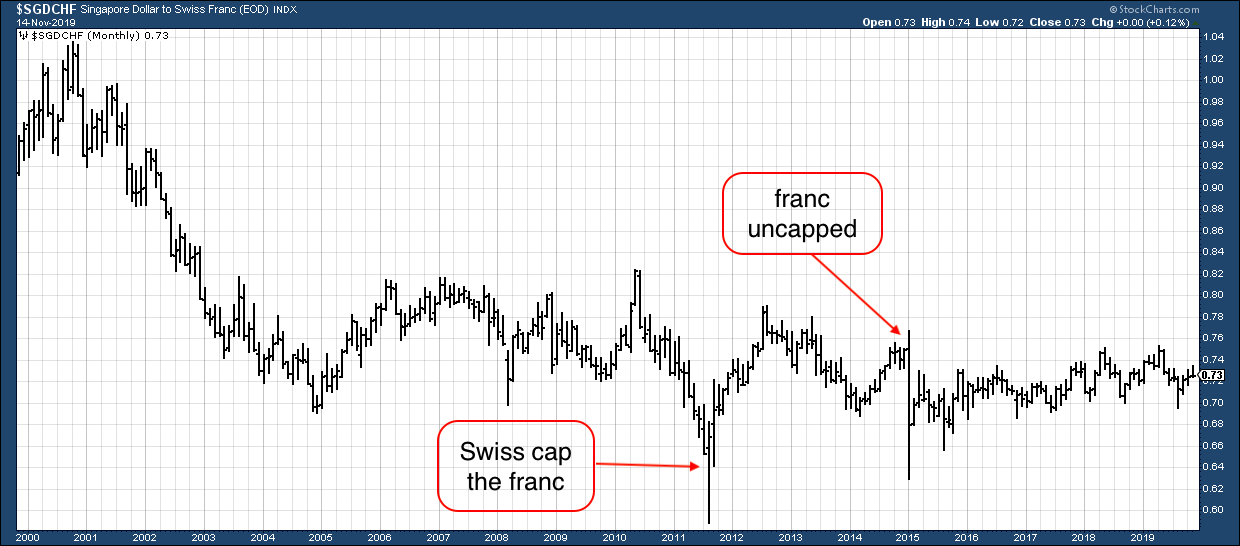

Here's a 20-year chart, which shows how many francs it takes to buy a Singapore dollar. The fewer francs it takes, the stronger the franc. Thus if the chart below is falling, the franc is strengthening and the Singapore dollar is weakening.

I've also highlighted those two big events in 2011 and 2015, which affected the valuation of the Swiss franc. The high for the Swiss franc came in 2011 during the Greek crisis.

You can see how the Swiss franc outperformed the Singapore dollar in the early part of the century, but since around 2003 the two have been in a fairly narrow range. There has been nothing like the extremes seen between other currency pairs.

Since 2015 the range has closed and been even more narrow, between around S$0.68 and S$0.75.

Two nations with relatively sound fiscal policy, and the result is very little volatility in the forex markets.

Those who are pledging such government largesse in the lead-up to this General Election in the UK, take note.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.