Currency Corner: it might be time to back the euro against the yen

The euro is shaping up for a nice buy signal against the yen, says Dominic Frisby.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Today I thought I'd pick a currency pair at random, as is sometimes my way, and see where it takes us.

I was scanning through some charts this morning, and I found a pair that is shaping up for a nice "buy" signal (according to my trend-following system) so I thought we would go with that.

We are looking at the euro against the yen, two currencies whose central banks are in strong competition. It is difficult to know which has done more to debase its currency, as they strive to manipulate it lower.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Currently there are 120 to the euro.

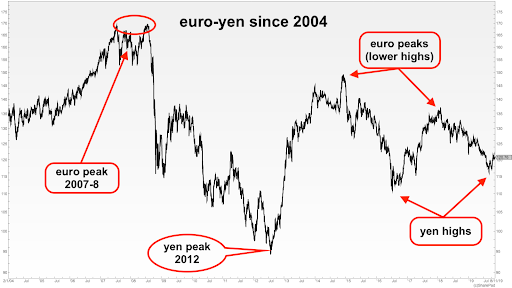

We will start, as ever, with a long-term chart to see the long-term parameters. This one was goes back to 2004.

The more yen there are to the euro, the stronger the euro (and the weaker the yen). So, when this chart is rising, it means the euro is strong. When the chart is sinking, the yen is strong.

In the 2000s the euro was strong, reaching an eventual high around 170 in 2007-8.

Many had been borrowing yen at low rates then using the money to invest in better-yielding assets abroad. This was the "Yen Carry Trade" and, as crisis enveloped global finance, it unwound in the years that followed 2008. There was a rush to return the yen that had been borrowed. That meant a lot of yen buying, and thus did the yen appreciate with all the demand.

By 2012, there were as few as 95 to the euro. From 170 to 95 in less than four years is quite some move.

A full three years of euro bull market/yen bear market followed. By 2015 we were at 150.

Since then, the euro has been in a downtrend. That downtrend, however, can be broken into three phases, each over a year.

From 150 to 110. Then a reversal from 110 to almost 140. Then from winter 2018 at close to 140 back to just above 115 in September.

A trend-follower's dream

What I like about this pair is the way you get extended trends that can go on for many years. It's a trend-follower's dream. Even the counter-trend rallies last many months.

And since that September low, there has been something of a reversal.

Now we zoom into a chart of the past 18 months. As well as the price (in black) also plotted are the 21- and six-week exponential moving averages. That is the average price of the past six and 21 weeks with greater weighting given to more recent weeks. The 21-week EMA is in blue and the six-week EMA is in red.

A reminder of the rules: a "buy" signal occurs when the red line crosses up through the blue line; both are flat or rising; and the price is above.

A "sell" signal occurs when the red line crosses down through the blue line; both are flat or sloping down; and the price is below.

We were on a 1\sell signal coming into this chart. We got a buy signal in September 2018, that quickly reversed into a sell the following month. The buy signal was a loss-making trade.

We have been on a sell since October, and the gains have more than made up for the failed buy.

Now however, the market appears to be reversing and the red line is on the verge of crossing up through the blue, giving us a buy signal.

It could turn out to be a failed buy signal. But I rather fancy this one's chances, assuming it triggers. You have seen from the long-term chart above how long yen-euro trends can go on for, and the hope is that this reversal marks the beginning another multi-month, even a year-plus trend.

If so, my moving average system will keep you long. If not, it will also tell you when to bail out.

Until next time,

Dominic Frisby

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge