Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

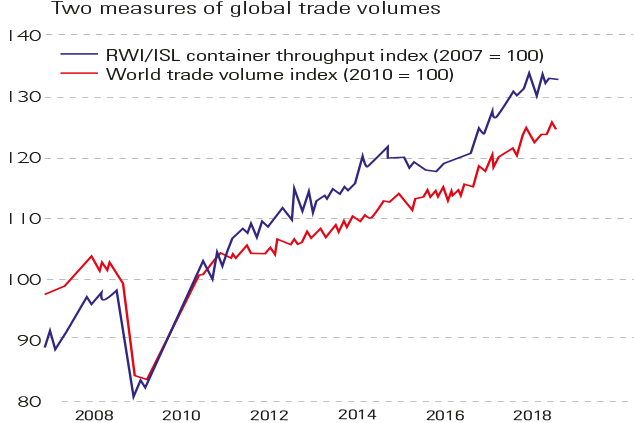

"The gloomsters have been saying for some time that global trade was already suffering from the imminent escalation of the US-China trade war," says Jonathan Allum on The Blah! But the data suggest otherwise.

Global trade volume slipped 1.1% in September, but that followed a record peak the previous month. An index tracking containers moving through ports has been treading water for two months, but has yet to fall.

Meanwhile, Chinese goods exports to all countries grew 15.6% year-on-year in October; those to the US, which comprise a fifth of the total, rose 13.2%, says Gabriel Wildau in the Financial Times. This has so far, at least defied "predictions that American tariffs would hit demand for Chinese goods".

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Viewpoint

"What is wrong with Britain's leading companies? It's plainly something quite serious, judging by the performance of the FTSE 100... Today the index is barely higher than it was at the turn of the century, 18 years ago. That compares badly... with the German Dax and even the Nikkei in Japan, land of the everlasting bear market. The Nikkei is up 14% over that time frame, the Dax 60% and America's S&P 500 80%... One obvious explanation is that the UK does not have anything to speak of in the way of a quoted tech sector, which is where the big rise in stock values has taken place in the US and beyond... another problem might be that Britain's biggest investors, including its legacy pension funds, have, under pressure from regulators and outdated convention, been selling down their equities in favour of bonds... This has been... a one-way street out of UK equities."

Jeremy Warner, The Sunday Telegraph

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

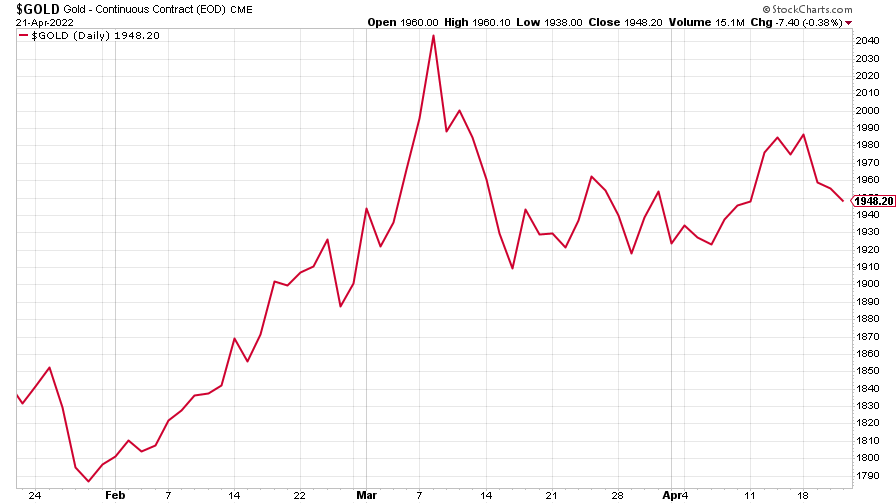

The charts that matter: bond yields and US dollar continue to climb

The charts that matter: bond yields and US dollar continue to climbCharts The US dollar and government bond yields around the world continued to climb. Here’s what happened to the charts that matter most to the global economy.

-

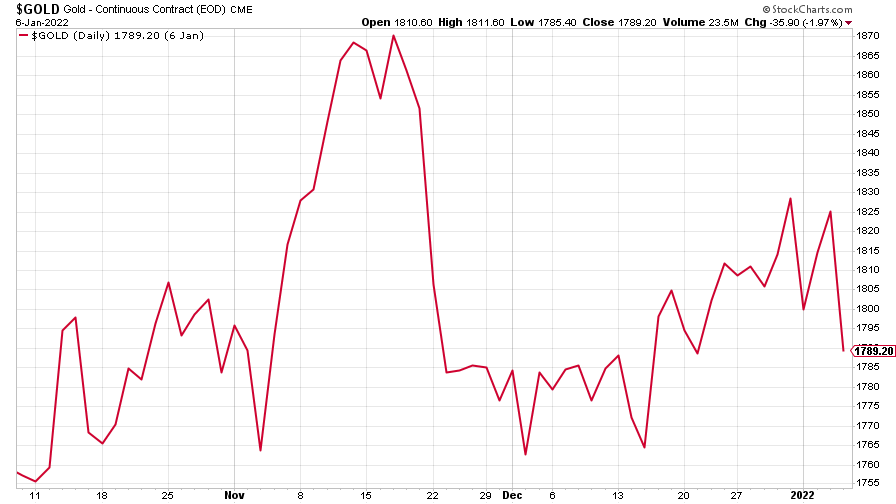

The charts that matter: markets start the year with a crash

The charts that matter: markets start the year with a crashCharts As markets start 2022 with a big selloff, here’s what happened to the charts that matter most to the global economy.

-

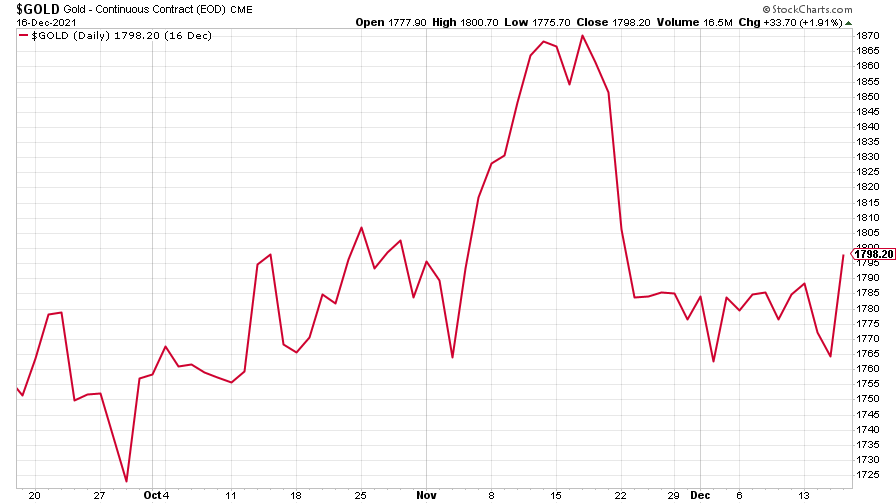

The charts that matter: Fed becomes more hawkish

The charts that matter: Fed becomes more hawkishCharts Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: a tough week for bitcoin

The charts that matter: a tough week for bitcoinCharts Cryptocurrency bitcoin slid by some 20% this week. Here’s what else happened to the charts that matter most to the global economy.

-

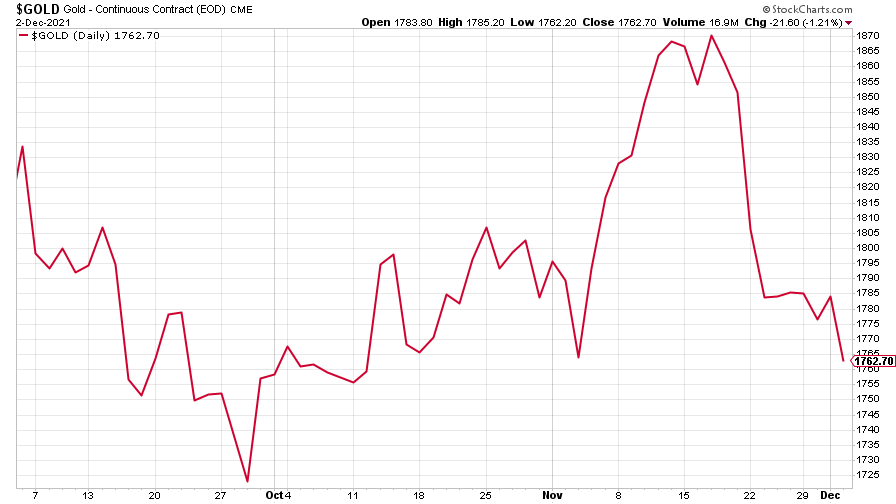

The charts that matter: omicron rattles markets

The charts that matter: omicron rattles marketsCharts Markets were rattled by the emergence of a new strain of Covid-19. Here’s how it has affected the charts that matter most to the global economy.

-

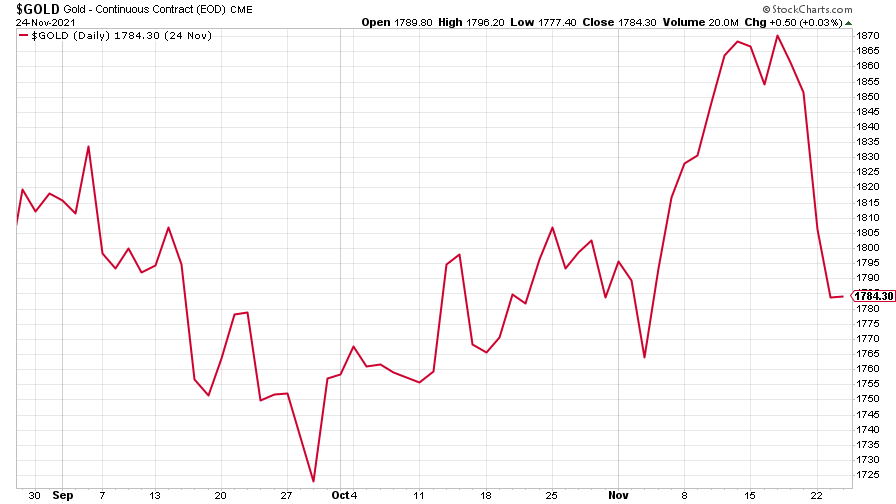

The charts that matter: the US dollar keeps on strengthening

The charts that matter: the US dollar keeps on strengtheningCharts The US dollar saw further rises this week as gold and cryptocurrencies sold off. Here’s how that has affected the charts that matter most to the global economy.

-

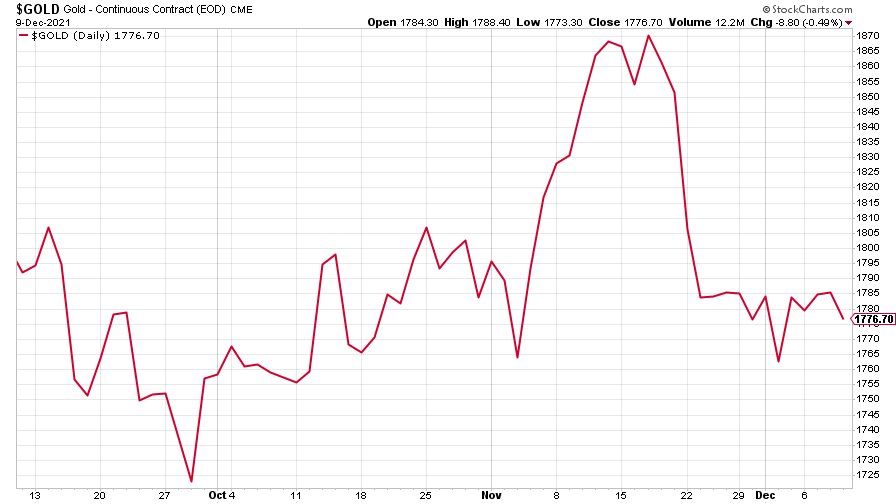

The charts that matter: gold hangs on to gains while the dollar continues higher

The charts that matter: gold hangs on to gains while the dollar continues higherCharts The gold price continued to hang on to last week’s gains, even as the US dollar powered higher this week. Here’s how that has affected the charts that matter most to the global economy.

-

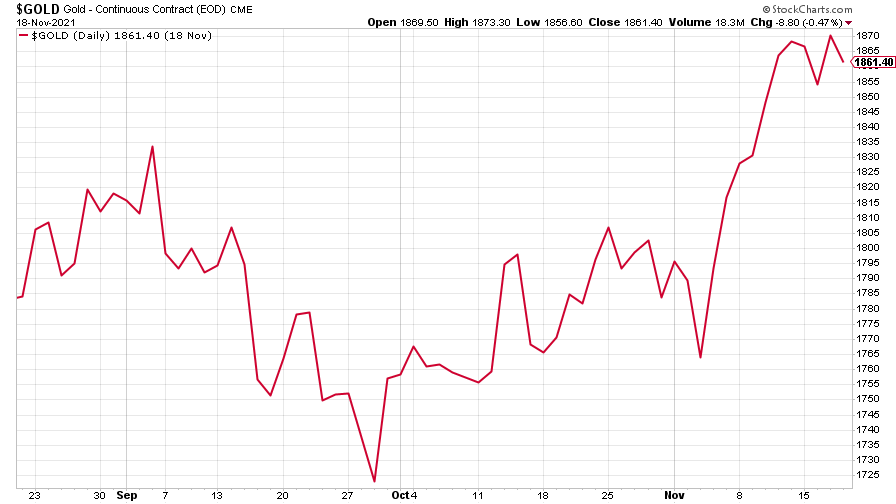

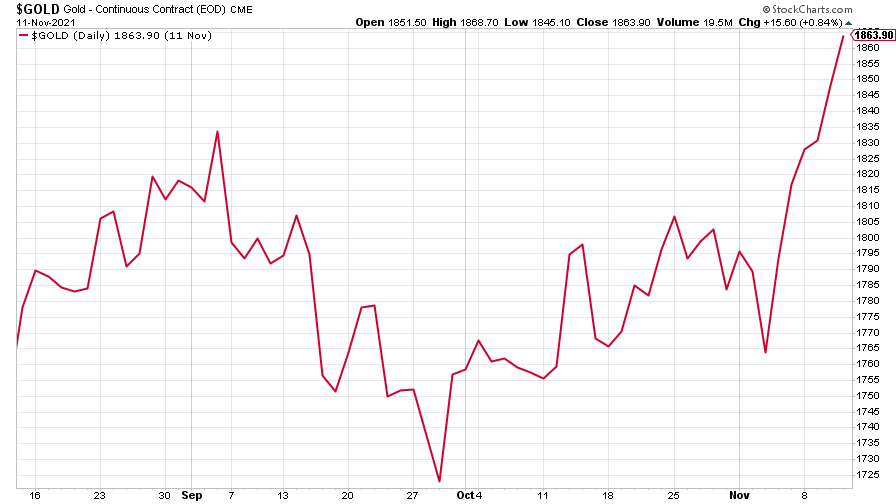

The charts that matter: inflation fears give gold a much needed boost

The charts that matter: inflation fears give gold a much needed boostCharts US inflation hit its highest in 30 years this week, driving gold and bitcoin to new highs. Here’s how that has affected the charts that matter most to the global economy.