Just short Just Eat

The online takeaway platform has gobbled up as much of the market as it can, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The online takeaway platform has gobbled up as much of the market as it can

After a long day many of us can't be bothered to cook or go out to a restaurant. So we succumb to temptation and order a takeaway. One firm that has managed to take advantage of this is Just Eat. It is an online portal that connects users with a range of local takeaways. Unlike some of its sector rivals, it doesn't do any delivering itself, which has helped it evade the controversy over employment practices. But its platform makes it easier for consumers to see what's on offer and helps restaurants drum up business.

Up until now, this model has worked a treat, with revenue growing almost 19-fold from £34m in 2011 to £658m this year. Its emphasis on not getting involved with the mechanics of delivery means it has very high margins and needs very little working capital, allowing it to generate £150m in free cash flow.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

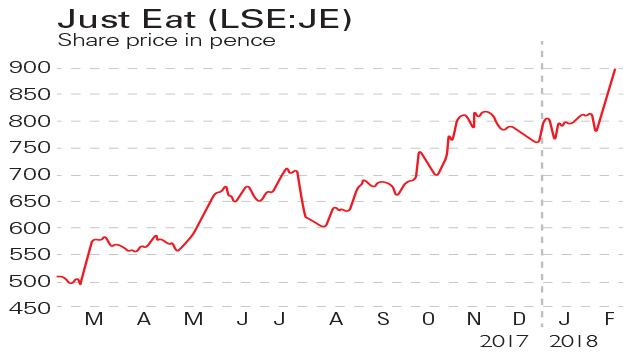

Given this strong performance, it should come as no surprise that the shares have also done very well, with Just Eat joining the FTSE 100 last November. Had you bought the shares when they had floated and then sold them in February 2018, you would have nearly quadrupled your money.

Getting indigestion

However, the past seven months haven't been so kind to the company, with the shares sliding by a quarter. Growth in both overall sales and the number of restaurants it has deals with has slowed. The company thinks this is only a consequence of the unusually warm summer, but a more likely explanation is that there is a limit to the number of takeaways people are willing to order, especially in an age where we are increasingly concerned about obesity, and trying to eat more healthily.

One obvious way to keep the company growing would be to expand the range of offerings to include more upmarket restaurants. The problem here, however, is that rival services such as Deliveroo and Uber Eats rumoured to be in talks to merge are working hard to forge exclusive deal with chains, taking advantage of the fact that they can organise deliveries.

One of the reasons I am not keen on Just Eat is because delivery times can be extremely variable. While Just Eat has floated the idea of getting involved in deliveries, it will take time for them to catch up with their competitors.

At present Just Eat is pinning its hopes on expansion into other markets such as Spain, Italy and Mexico. However, this is likely to be difficult, especially since the other online delivery firms are all trying to do the same thing.

Even if it manages to fend off the competition, Just Eat (LSE: JE) looks overpriced on a 2019 price/earnings ratio of 28. We therefore suggest you go short at the current price of 660p at £3 per 1p (IG Index has a minimum of £1 per 1p). We recommend you put a stop-loss at 825p. This gives you a potential downside of £500.

Trading techniques... dealing in Big Macs

It's easy to forget that the foreign exchange markets are the largest part of the global financial system, with more than $5trn traded every day.

One of the most popular foreign exchange strategies is the "Big Mac index". This compares the price of a Big Mac in two countries with the actual exchange rate between the two currencies to gauge whether they are under- or overvalued in relation to each other. So if a Big Mac costs $3 in the US and £2 in the UK, then that would imply an exchange rate of £1 to $1.50. But if in the actual forex market the pound is only buying $1.30, then the pound is undervalued, and you should buy pounds and short dollars.

The Big Mac index is based around the Law of One Price. This economic theory posits that something should cost the same, based on market exchange rates, wherever you buy it. Some traders like to use the price of a Big Mac as a yardstick because it is sold around the world by McDonald's and is a highly standardised product. A more sophisticated version of this strategy is to use data sets that measure differences in prices across the world. The overall approach involved in both trading techniques is also known as purchasing power parity. But the evidence that you can take advantage of any divergence between the real-world exchange rates and those implied by the Big Mac index or wider data sets is weak. In 1997, a Belgian study discovered that the currencies the Big Mac index model suggested were undervalued didn't subsequently outperform those it implied were overvalued. And Danish research has found that using purchasing power parities to build a portfolio only slightly outperformed the market.

How my tips have fared

Over the past few weeks I have been contemplating closing my position in IG Group. In the event, however, the decision was taken out of my hands as the share price plunged from 885p a fortnight ago to 760p owing to disappointing earnings data.

Fortunately, I had set a stop-loss of 850p, which is well above the 570.5p it was trading at when we originally recommended it in May 2017 (issue 846). This means that if you had followed our recommendation to buy it at £2 per point, you would have made a profit of £559.

Our remaining long positions have had their ups and downs. Next is up to £56 while Shire has climbed marginally to £45.35. Premier Oil also rose by more than 13% to 135p thanks to oil prices climbing to a four-year high. However, Redrow has fallen to 588p (from 599p), while Wizz is down to £28.71 (from £30.65). Greene King is essentially unchanged at 500p. The upshot is that if you take away the money we made on IG Group, we are now losing £510 on our long positions.

The shorts are just as mixed, with three rising in price, which is bad news for us, and two falling. Tesla has climbed to $301.96 (from $285.50), Netflix has gone up to $370.47(from $348.41), while bitcoin has risen to $6,419 (from $6,311).

However, these are counterbalanced by the fact that Twitter is now at $28.63 ($30.54) and Snap costs $9.12 ($9.85). Overall, then, our short positions are making a profit of £1,404 (pretty much the same as the £1,398 they were making a fortnight ago).

Greene King is still making money, so I am inclined to stick with it for the time being, although I will increase the stop-loss to 475p. I will also lower the level at which we'll cover our bitcoin short to $8,000 (from $8,250).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets

-

Just Eat’s merger with Takeaway.com delayed

Just Eat’s merger with Takeaway.com delayedNews The £6.2bn merger between food delivery giants Just Eat and Takeaway.com has hit a hitch.

-

If you’d invested in: Just Eat and Dialight

If you’d invested in: Just Eat and DialightFeatures Food delivery service Just Eat is growing nicely, while LED maker Dialight has suffered profit warnings.

-

Five of Britain’s best-known $1bn ‘unicorn’ companies

Five of Britain’s best-known $1bn ‘unicorn’ companiesFeatures Britain is currently home to more ‘unicorn companies’ than any other country in Europe. Natalie Stanton looks at five of the best.

-

Company in the news: Just Eat

Company in the news: Just EatFeatures The newly listed takeaway middleman has a lot of growing to do, says Phil Oakley.