Company in the news: Just Eat

The newly listed takeaway middleman has a lot of growing to do, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Unless the government is the selling shareholder, it is usually a good idea to stay clear of new flotations or initial public offerings (IPOs) on the stock exchange. That's because the seller is usually cashing out a high price, especially if the owner is a venture capitalist or private equity company.

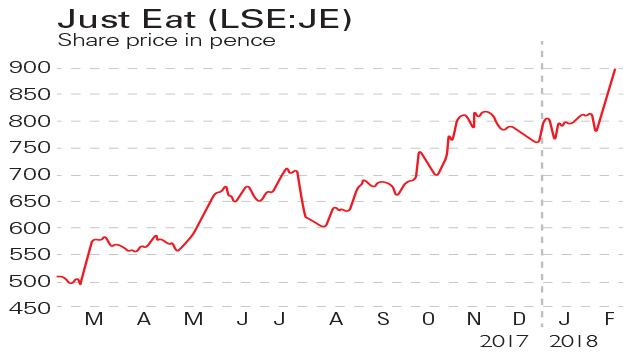

Just Eat (LSE: JE)is a classic and extreme case of this. The company acts as a middleman, allowing customers to order takeaway food over the internet. The plan is to scale the business across the world and make lots of money.

Given that it is essentially a website, it has a lot of fixed costs, so the scope for big profit gains is huge if the number of orders grows rapidly.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, it seems that the valuation of this business can only be justified with some very heroic assumptions about future profits growth. The 260p per share float price valued the business at £1.46bn. To put this in perspective, this amountsto 218 times the £6.8m trading profits it made in 2013.

A mature business with the same market value might have trading profits of around £150m. Just Eat has a lot of growing to do.

A read through the prospectus something you should alwaysdo reveals a lot of risks about this company. It makes moneyby charging takeaway restaurants a fee of around 10% of theorder value. That is a lot of money to give away, and might notbe sustainable.

Also, Just Eat makes a decent amount of money from credit anddebit card charges. Instead of just covering the card processingfees, it charges an extra margin on top, which makes itparticularly bad value for customers. This accounts for around12% of Just Eat's revenue.

The practice of charging more thanthe processing fee has been banned in Denmark. If it happenselsewhere, then profits could take a hit.

What's even more worrying is that the company's IT modelis not protected by any patents, which leaves it vulnerable tocompetition. Barriers to entry are essential for businesses tomake big profits, and Just Eat doesn't seem to benefit fromthem. These shares look like they could fall by a long way.

Verdict: stay away

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Just Eat’s merger with Takeaway.com delayed

Just Eat’s merger with Takeaway.com delayedNews The £6.2bn merger between food delivery giants Just Eat and Takeaway.com has hit a hitch.

-

Just short Just Eat

Just short Just EatFeatures The online takeaway platform has gobbled up as much of the market as it can, says Matthew Partridge.

-

If you’d invested in: Just Eat and Dialight

If you’d invested in: Just Eat and DialightFeatures Food delivery service Just Eat is growing nicely, while LED maker Dialight has suffered profit warnings.

-

Five of Britain’s best-known $1bn ‘unicorn’ companies

Five of Britain’s best-known $1bn ‘unicorn’ companiesFeatures Britain is currently home to more ‘unicorn companies’ than any other country in Europe. Natalie Stanton looks at five of the best.