Five of Britain’s best-known $1bn ‘unicorn’ companies

Britain is currently home to more ‘unicorn companies’ than any other country in Europe. Natalie Stanton looks at five of the best.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain is currently home to more unicorn companies' than any other county in Europe. At least, according to a recent report by tech-focused investment bank, GP Bullhound.

A unicorn' so named because of its rarity is defined as a technology company, founded in 2000 or later, with a valuation of more than $1bn. People tend to think of Silicon Valley as the natural home of unicorns, but there are now 17 of these elusive creatures in the UK that's 11 more than nearest rival, Sweden. Germany and Russia are next in line, housing four unicorns apiece. Meanwhile, France is home to three.

The latest to join the UK's growing herd of unicorns is cyber-security firm Sophos (LSE: SOPH), which has just listed on the London Stock Exchange with a market value of around £1bn.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Here are the stories of five other unicorns that have come to dominate the UK market:

ASOS

ASOS (AIM:ASC)

The business was originally based in London, but has ventured further afield over the past five years, opening stores in France, Germany, the USA, Australia, Italy and Spain.

It has grown spectacularly over the past few years, and in 2013 it became one of the 100 most valuable London-listed companies. However, it missed out on a spot in the FTSE 100 because it's still listed on Aim. At its share price peak, ASOS was worth almost as much as Marks & Spencer.

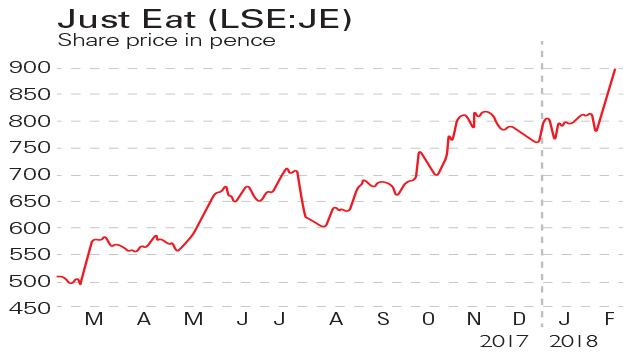

Just Eat

Just Eat

(LSE: JE)

Since then, it has looked further afield launching operations from the Netherlands to India to Brazil. It currently has a presence in 13 countries, and is looking at prospects in Australia.

In April 2014, Just Eat floated on the London Stock Exchange. It was the first firm to list on the exchange's high growth' segment, where companies don't have to float as much of their equity as for a premium listing.

Skyscanner

Skyscanner

More than 35 million people use Skyscanner each month. While the bulk of its business relates to flights, it is currently pushing to diversify its offering. Last year, Skyscanner's non-flight contribution to overall revenues increased by 47%.

In October 2013, Silicon Valley venture capital group Sequoia Capital acquired a stake in the business, but Skyscanner's management insists that it has no plans to raise additional funding right now.

Wonga

Wonga

But Wonga has been heavily criticised for its high interest rates (which ring in at 5,853% annually). It has also been embroiled in a number of scandals, and was forced to pay compensation to thousands of customers who received threatening letters from fake law firms.

As a result, Wonga has since recruited a new management team, and is attempting to restructure its business model in response to a Financial Conduct Authority crackdown on the payday loans industry.

Zoopla

Zoopla

Like many other unicorns, Zoopla grew through a number of mergers and acquisitions. In fact, it wiped out almost all of its key competitors, before its owner the Daily Mail and General Trust chose to float the company on the London Stock Exchange in June 2014.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Natalie joined MoneyWeek in March 2015. Prior to that she worked as a reporter for The Lawyer, and a researcher/writer for legal careers publication the Chambers Student Guide.

She has an undergraduate degree in Politics with Media from the University of East Anglia, and a Master’s degree in International Conflict Studies from King’s College, London.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Just Eat’s merger with Takeaway.com delayed

Just Eat’s merger with Takeaway.com delayedNews The £6.2bn merger between food delivery giants Just Eat and Takeaway.com has hit a hitch.

-

Just short Just Eat

Just short Just EatFeatures The online takeaway platform has gobbled up as much of the market as it can, says Matthew Partridge.

-

If you’d invested in: Just Eat and Dialight

If you’d invested in: Just Eat and DialightFeatures Food delivery service Just Eat is growing nicely, while LED maker Dialight has suffered profit warnings.

-

Company in the news: Just Eat

Company in the news: Just EatFeatures The newly listed takeaway middleman has a lot of growing to do, says Phil Oakley.