If you’d invested in: Just Eat and Dialight

Food delivery service Just Eat is growing nicely, while LED maker Dialight has suffered profit warnings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

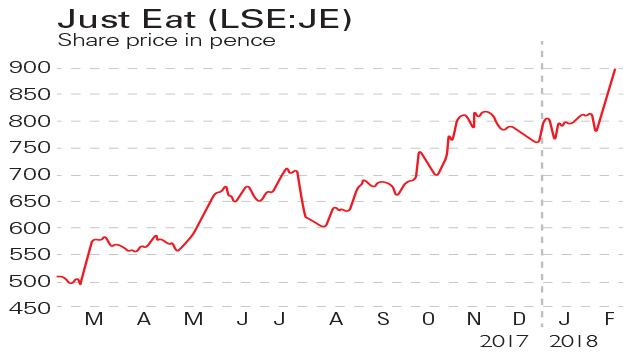

Just Eat (LSE:JE) is a digital marketplace for takeaway food delivery operating worldwide. The firm, which floated in April 2014 at 260p, joined the FTSE 100 in November last year. Since the initial public offering its shares have more than tripled and its market value has surged to £5.8bn. Last year Just Eat was given the final go-ahead for its £240m takeover of rival Hungryhouse. The company is forecast to post a rise in its bottom line of 42% in the current year, followed by further growth of 30% next year.

Be glad you didn't...

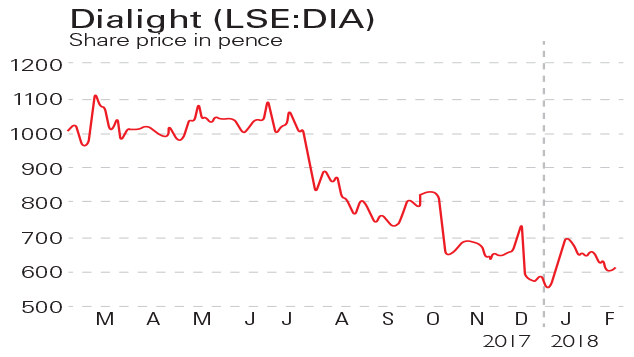

Dialight (LSE:DIA) manufactures and sells light-emitting diode (LED) products for the electronics industry. Last October it warned that profits would be lower than expected due to "short-term" production issues following the transfer of manufacturing to its outsourcing partner Sanmina. In December it announced a significant number of orders were unlikely to be fulfilled, blaming an "unexpected update" from Sanmina. Its annual forecasts were also lowered from £13.5m-£15.5m to "not less than £9m".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.

-

Just Eat’s merger with Takeaway.com delayed

Just Eat’s merger with Takeaway.com delayedNews The £6.2bn merger between food delivery giants Just Eat and Takeaway.com has hit a hitch.

-

Just short Just Eat

Just short Just EatFeatures The online takeaway platform has gobbled up as much of the market as it can, says Matthew Partridge.

-

Five of Britain’s best-known $1bn ‘unicorn’ companies

Five of Britain’s best-known $1bn ‘unicorn’ companiesFeatures Britain is currently home to more ‘unicorn companies’ than any other country in Europe. Natalie Stanton looks at five of the best.

-

Company in the news: Just Eat

Company in the news: Just EatFeatures The newly listed takeaway middleman has a lot of growing to do, says Phil Oakley.