If you'd invested in: AstraZeneca and Mitie Group

Pharmaceutical giant AstraZeneca is expected to grow its earnings, while outsourcer Mitie's share rice has been hit by a series of profit warnings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

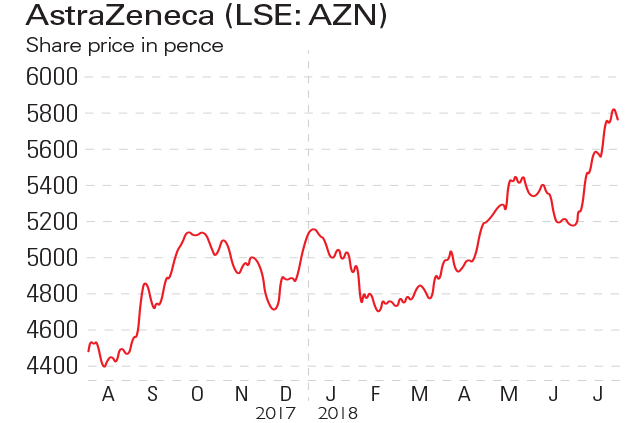

Pharmaceutical giant AstraZeneca (LSE: AZN) is expected to grow its earnings per share (EPS) in 2018, after four years of stagnant profits. Last month Astra reported that drug sales fell by 2% to $10bn (in constant currency terms) in the first half of 2018, while core operating profits were down 34% to $2.2bn. However, sales from new medicines rose by 69%, thanks largely to a strong performance from its cancer drugs including Tagrisso, which has benefited from its recent approval as the first-choice treatment for lung-cancer patients in Europe.

Be glad you didn't buy...

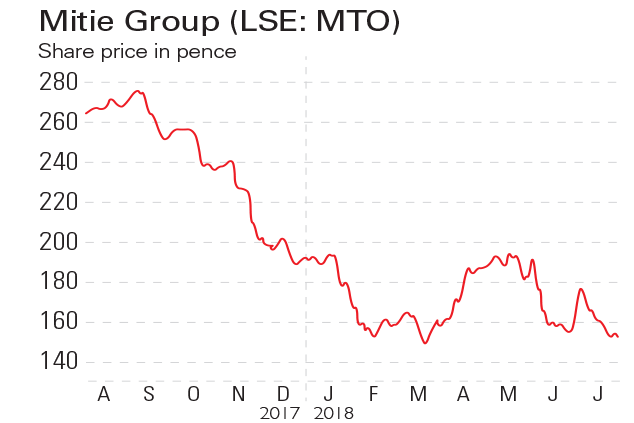

Mitie Group (LSE: MTO) provides services to owners and occupiers of commercial and industrial properties. The outsourcer, which was hit by several profit warnings and investigations by financial regulators last year, came under scrutiny after Carillion's collapse in January this year. However, in June it reported a pre-tax loss of £24.7m, down from £58.2m the previous year, while revenues rose 3.8% to £2.2bn. Mitie's chief executive Phil Bentley claims the firm's turnaround is on track and that it will return to profit this year as cost saving measures start to take effect.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

AstraZeneca’s Covid troubles could see it pull out of making vaccines

AstraZeneca’s Covid troubles could see it pull out of making vaccinesNews AstraZeneca has suffered a series of setbacks with its Covid-19 jab and may exit the inoculation subsector altogether. Matthew Partridge reports

-

AstraZeneca’s shareholders rebel over pay

AstraZeneca’s shareholders rebel over payNews Shareholders in AstraZeneca have rebelled over proposals to raise bonus levels for its bosses.

-

Major setback for AstraZeneca

Features Pharma giant AstraZeneca was banking on a key clinical trial for its cancer drugs. It was a flop. What comes next? asks Alice Gråhns.

-

A revolutionary new cancer treatment – and the blue-chip stock set to benefit

A revolutionary new cancer treatment – and the blue-chip stock set to benefitFeatures A new kind of cancer therapy could make a big difference to survival rates - and transform the fortunes of one big UK drugs company. Matthew Partridge explains.

-

AstraZeneca fight rumbles on

AstraZeneca fight rumbles onNews The proposed takeover of AstraZeneca is proving to be one of the most controversial yet.

-

Company in the news: AstraZeneca

Company in the news: AstraZenecaFeatures Drugs giant AstraZeneca is at the centre of a takeover tussle with US rival Pfizer. Phil Oakley looks at how the shares have been affected.

-

Buy Big Pharma – the deal spree could be just beginning

Buy Big Pharma – the deal spree could be just beginningFeatures With pharmaceutical stocks still looking cheap and some very smart deals being done, it’s a good time to buy in to the sector. John Stepek explains how.