Company in the news: AstraZeneca

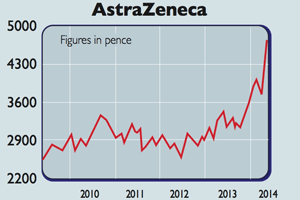

Drugs giant AstraZeneca is at the centre of a takeover tussle with US rival Pfizer. Phil Oakley looks at how the shares have been affected.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The stock market can be a funny place. Less than a year ago shares in AstraZeneca (LSE: AZN)were changing hands for just over £30 per share.

The company was seen as one of the weakest players in the global pharmaceutical industry, facing years of declining sales and profits as some of its blockbuster drugs came off patent and became exposed to competition from cheap generic ones.Yet value is often in the eye of the beholder.

US drug giant Pfizer has had two bids (the latest being tabled at £50 per share) for AstraZeneca rejected, because the management said that it undervalued the firm.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

AstraZeneca has been talking up the value of its drugs pipeline in development. It reckons that new drugs to treat cancer, diabetes and Alzheimer's, among others, could see its sales grow by 75% by 2023.

Given that these drugs have not yet seen the light of day in terms of regulatory approval, let alone sales and profits, this sounds like a valiant attempt to get Pfizer to pay up. But will it?

Maybe. Pfizer has a reputation for growing by buying other companies, rather than by making its own drugs.On top of that it strips out costs and boosts profits. It would seem that the time for Pfizer to do this again has arrived, hence its interest in AstraZeneca.

Pfizer's own sales are falling, because its big earning drugs, such as Lipitor and Viagra, are attracting fierce competition. It seems that Pfizer can chop a lot of costs out ofAstraZeneca but that there is also abigger prize of moving its headquartersto the UK and paying lower taxes than itdoes in America.

The UK government is under pressure tostop Pfizer sacking lots of highly trainedscientists and damaging the country'sscience base. The American governmentwill be keen to stop a big taxpayer likePfizer moving to Britain.

Pfizer has until 26 May to get its bidaccepted. If it does not, it will have toincrease it or pursue a hostile takeover. Should the deal fail, thenyou have to ask whether AstraZeneca'sshares are worth their current £46. That would put it on 18.5 times forecastearnings, compared with 15.3 timesfor the more highly regarded GlaxoSmithKline.

A year ago AstraZenecashares were probably too cheap, butbuying them now looks more risky.Existing shareholders should sit tight,but don't buy if you haven't already.

Verdict: hold

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

AstraZeneca’s Covid troubles could see it pull out of making vaccines

AstraZeneca’s Covid troubles could see it pull out of making vaccinesNews AstraZeneca has suffered a series of setbacks with its Covid-19 jab and may exit the inoculation subsector altogether. Matthew Partridge reports

-

AstraZeneca’s shareholders rebel over pay

AstraZeneca’s shareholders rebel over payNews Shareholders in AstraZeneca have rebelled over proposals to raise bonus levels for its bosses.

-

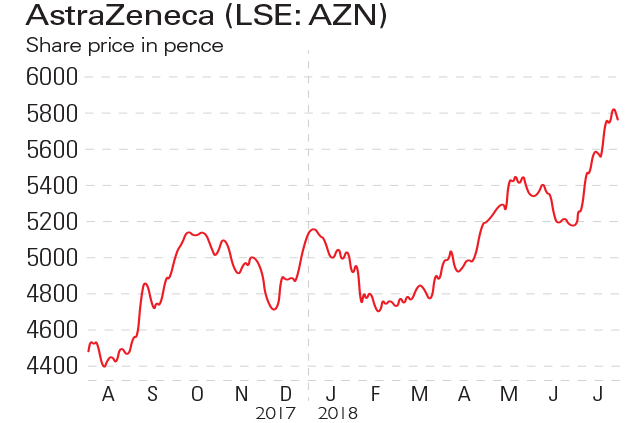

If you'd invested in: AstraZeneca and Mitie Group

If you'd invested in: AstraZeneca and Mitie GroupFeatures Pharmaceutical giant AstraZeneca is expected to grow its earnings, while outsourcer Mitie's share rice has been hit by a series of profit warnings.

-

Major setback for AstraZeneca

Features Pharma giant AstraZeneca was banking on a key clinical trial for its cancer drugs. It was a flop. What comes next? asks Alice Gråhns.

-

A revolutionary new cancer treatment – and the blue-chip stock set to benefit

A revolutionary new cancer treatment – and the blue-chip stock set to benefitFeatures A new kind of cancer therapy could make a big difference to survival rates - and transform the fortunes of one big UK drugs company. Matthew Partridge explains.

-

AstraZeneca fight rumbles on

AstraZeneca fight rumbles onNews The proposed takeover of AstraZeneca is proving to be one of the most controversial yet.

-

Buy Big Pharma – the deal spree could be just beginning

Buy Big Pharma – the deal spree could be just beginningFeatures With pharmaceutical stocks still looking cheap and some very smart deals being done, it’s a good time to buy in to the sector. John Stepek explains how.