AstraZeneca fight rumbles on

The proposed takeover of AstraZeneca is proving to be one of the most controversial yet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The £63bn takeover offer for Anglo-Swedish pharmaceutical group AstraZeneca by its US rival Pfizer is shaping up to be one of the most controversial takeover battles to involve a UK-based company.

British politicians fear that the enlarged Pfizer would cut research spending in the UK, endangering jobs and damaging Britain's science base. On the other side of the Atlantic, there has been considerable criticism of Pfizer's proposal to domicile the combined group in the UK for tax purposes.

In the past week, Pfizer's chief executive appeared before MPs in an attempt to reassure them about his firm's plans for investment and employment. Meanwhile, the firm is reported to be planning an increased hostile bid if it's unable to win the support of AstraZeneca's board.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What the commentators said

Normally in these situations, the takeover will go ahead as seen in Kraft's acquisition of Cadbury in 2010. Dangle the prospect of "jam today" in front of shareholders and they will bite, regardless of whether it represents a good long-term outcome.

This reflects the "dysfunctional nature of the relationship" between company management, fund managers, the investors in the funds they run and the rest of society, agreed John Plender in the FT.

Executives are incentivised to boost short-term earnings through takeovers and cost-cutting, while fund managers are judged on short-term performance and leap at the chance to make a profit.

Yet there is ample evidence that takeovers are "a highly effective mechanism for uncreative destruction" rather than a boon to either investors or the economy: take Pfizer itself, which has spent $240bn on three big takeovers in 15 years, yet has a market cap today of just $185bn. "The only consistent winners are the investment bankers and other advisers."

That may be true in general, but this particular deal "is a poor test case for almost any question about big corporate acquisitions", said Edward Hadas on Breakingviews.com.

"The would-be US acquirer, the British target, the UK government and the whole pharmaceutical industry are all tainted. They are guilty, respectively, of a tax fixation, cutting research, empty words and inadequate drug discovery. So there is really no one with the moral authority to say whether this is a good deal."

The best outcome would be for the UK and US to tackle the weakest part of the bid: Pfizer's attempt to game the tax system. If the firm is still interested after that, it can come back with a fresh bid.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

The ‘mirror will’ flaw which could mean your savings end up with strangers – how to protect your legacy

The ‘mirror will’ flaw which could mean your savings end up with strangers – how to protect your legacyWriting a will lets you pass your wealth onto your loved ones. But couples with a so-called ‘mirror will’ could unintentionally leave their family exposed to being cut out.

-

Saba comes for Edinburgh Worldwide’s board... again

Saba comes for Edinburgh Worldwide’s board... againSaba Capital Management has announced fresh plans to displace the board of Edinburgh Worldwide despite having been decisively beaten in a recent vote

-

AstraZeneca’s Covid troubles could see it pull out of making vaccines

AstraZeneca’s Covid troubles could see it pull out of making vaccinesNews AstraZeneca has suffered a series of setbacks with its Covid-19 jab and may exit the inoculation subsector altogether. Matthew Partridge reports

-

AstraZeneca’s shareholders rebel over pay

AstraZeneca’s shareholders rebel over payNews Shareholders in AstraZeneca have rebelled over proposals to raise bonus levels for its bosses.

-

If you'd invested in: AstraZeneca and Mitie Group

If you'd invested in: AstraZeneca and Mitie GroupFeatures Pharmaceutical giant AstraZeneca is expected to grow its earnings, while outsourcer Mitie's share rice has been hit by a series of profit warnings.

-

Major setback for AstraZeneca

Features Pharma giant AstraZeneca was banking on a key clinical trial for its cancer drugs. It was a flop. What comes next? asks Alice Gråhns.

-

A revolutionary new cancer treatment – and the blue-chip stock set to benefit

A revolutionary new cancer treatment – and the blue-chip stock set to benefitFeatures A new kind of cancer therapy could make a big difference to survival rates - and transform the fortunes of one big UK drugs company. Matthew Partridge explains.

-

Company in the news: AstraZeneca

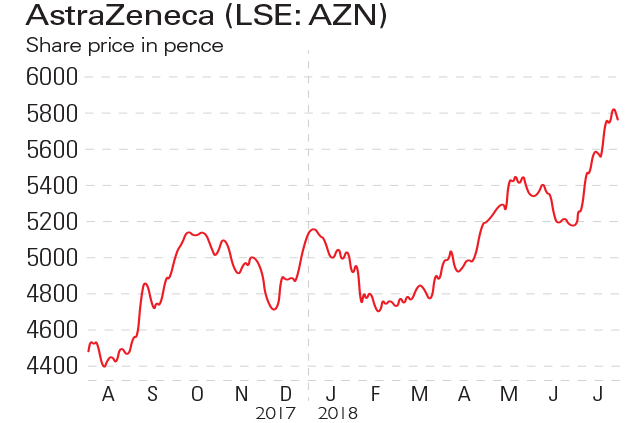

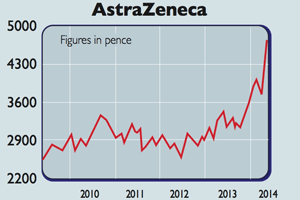

Company in the news: AstraZenecaFeatures Drugs giant AstraZeneca is at the centre of a takeover tussle with US rival Pfizer. Phil Oakley looks at how the shares have been affected.

-

Buy Big Pharma – the deal spree could be just beginning

Buy Big Pharma – the deal spree could be just beginningFeatures With pharmaceutical stocks still looking cheap and some very smart deals being done, it’s a good time to buy in to the sector. John Stepek explains how.