Major setback for AstraZeneca

Pharma giant AstraZeneca was banking on a key clinical trial for its cancer drugs. It was a flop. What comes next? asks Alice Gråhns.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The pharma giant was banking on a key clinical trial for its cancer drugs. It was a flop. What comes next? asks Alice Grhns.

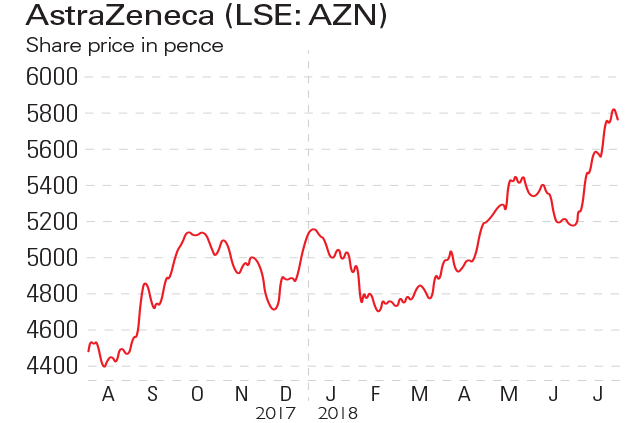

AstraZeneca's effort to gain ground in the market for immune-system-boosting cancer drugs received a setback last week when its trial treatment for lung cancer disappointed in clinical trials. The shares fell 15% on the news, wiping $14bn from AstraZeneca's value. The trial, named "Mystic", "was one Astra desperately needed to work", says Max Nisen on Bloomberg Gadfly. Now, the drugmaker clings to the hope that more-complete data, due next year, will salvage the programme. But even if the news is good, the firm "has already lost a lot of potential upside in lung cancer", the biggest market for the drugs on trial. Rivals Merck & Co and Bristol-Myers Squibb Co had a year-long start while "Astra tried to play catch-up by focusing on drug combos and with quick trials". (The Mystic trial was testing a combination of its already approved Imfinzi and a second drug.)

"AstraZeneca's investors knew the company was going over a cliff but it's now doing so without a safety net," says John Foley on BreakingViews.com. The share-price fall, the biggest one-day decline in its history, suggests shareholders had assigned a 60% chance to the therapies taking off, and "the question is whether those lost earnings can be replaced". Revenues are going in the wrong direction, "as competitors to big sellers such as anti-cholestrol drug Crestor eat into its sales", says Iain Withers in The Daily Telegraph. In its half-year results AstraZeneca saw an 11% drop in sales to $10.5bn and a 37% increase in operating profit to $1.8bn. "While sales declines were expected, they highlight the need for AstraZeneca to find replacement blockbusters."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

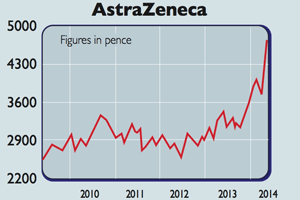

The disappointing trial data leaves the firm vulnerable to a takeover, says Chris Hughes on Bloomberg Gadfly. And "unfortunately for investors, the UK drugmaker's management lacks the credibility to mount a strong defence that would force any predator to pay a full price". The shares were trading at around £43 at the end of last week, roughly where they landed after the board fought off a £55 per share takeover proposal from Pfizer in May 2014. "If Pfizer's 2014 takeover had succeeded, AstraZeneca's investors would be enjoying big gains."

Nevertheless, chief executive Pascal Soriot "is not finished as a top-ranking pharma baron", says the FT's Lex column. With the shares still rated above those of rival GlaxoSmithKline, "shareholders should sit tight for the moment. So should Mr Soriot".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

AstraZeneca’s Covid troubles could see it pull out of making vaccines

AstraZeneca’s Covid troubles could see it pull out of making vaccinesNews AstraZeneca has suffered a series of setbacks with its Covid-19 jab and may exit the inoculation subsector altogether. Matthew Partridge reports

-

AstraZeneca’s shareholders rebel over pay

AstraZeneca’s shareholders rebel over payNews Shareholders in AstraZeneca have rebelled over proposals to raise bonus levels for its bosses.

-

If you'd invested in: AstraZeneca and Mitie Group

If you'd invested in: AstraZeneca and Mitie GroupFeatures Pharmaceutical giant AstraZeneca is expected to grow its earnings, while outsourcer Mitie's share rice has been hit by a series of profit warnings.

-

A revolutionary new cancer treatment – and the blue-chip stock set to benefit

A revolutionary new cancer treatment – and the blue-chip stock set to benefitFeatures A new kind of cancer therapy could make a big difference to survival rates - and transform the fortunes of one big UK drugs company. Matthew Partridge explains.

-

AstraZeneca fight rumbles on

AstraZeneca fight rumbles onNews The proposed takeover of AstraZeneca is proving to be one of the most controversial yet.

-

Company in the news: AstraZeneca

Company in the news: AstraZenecaFeatures Drugs giant AstraZeneca is at the centre of a takeover tussle with US rival Pfizer. Phil Oakley looks at how the shares have been affected.

-

Buy Big Pharma – the deal spree could be just beginning

Buy Big Pharma – the deal spree could be just beginningFeatures With pharmaceutical stocks still looking cheap and some very smart deals being done, it’s a good time to buy in to the sector. John Stepek explains how.