A revolutionary new cancer treatment – and the blue-chip stock set to benefit

A new kind of cancer therapy could make a big difference to survival rates - and transform the fortunes of one big UK drugs company. Matthew Partridge explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A revolution in medicine is picking up steam a revolution that could transform the prospects of many cancer patients.

For years there have been three main ways to fight cancer: surgery, radiation and chemotherapy. They all boil down to destroying the cancer cells, either by cutting them out, burning them or poisoning them.

In many cases this works, but sadly not for everyone.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The good news is that scientists are now developing a new kind of cancer therapy, one that could make a big difference to survival rates.

And it could also transform the fortunes of one big UK drugs company.

Using the body's own immune system to fight cancer

The first person to actively use this knowledge to fight the disease was William Coley, a New York surgeon and bone cancer specialist. After one of his first patients died of cancer, he searched for treatments that could improve survival rates. He observed that those who developed infections from surgery were, paradoxically, more likely to survive afterwards.

Taking a gamble, he injected streptococcus bacteria into a patient who had cancer. The patient's malignant tumour shrank. Coley went on to use the method (known as Coley's Toxins') on over 1,000 patients until his death in 1937.

Yet his breakthrough was ignored by most of the medical profession. Doctors of the time used case studies rather than proper trials. This made it hard to gauge survival rates for particular therapies. And modern trials of Coley's Toxins have produced mixed results compared to modern therapies, though the treatment may have some use in advanced cases.

Meanwhile, the development of radiation therapy and early forms of chemotherapy which seemed to provide more immediate benefits also reduced interest in Coley's techniques. Their use finally died out in the 1950s.

Three new approaches to attacking cancer

Basically, there are three distinct strands to this, each of which has produced useful treatments.

The simplest idea is to develop antibodies that can stimulate the immune system to identify, and then then attack, cancer cells. Rituximab, the first antibody targeting blood cancer, was approved in 1998, and is now a standard treatment. Additional antibodies have been released, and several more are in development.

A similar approach which is gaining traction is based on evidence that cancer cells produce molecules (known as PD-1, PD-L1 and PD-L2) that act like brakes on the immune system and prevent them from being destroyed. Targeting and turning off these molecules can allow the body's defences to do their work.

An even more radical approach is to attempt to re-engineer a person's immune system altogether. This involves taking white blood cells from the patient's body and modifying them using genetic engineering, so that they can more effectively deal with the cancer when they're back in the body.

Make no mistake these are all high-risk approaches. Trying to find drugs that will allow the immune system to fight cancer is a case of trial and error. Individual cancers vary from person to person. Many people may not receive any benefit at all from these approaches.

And a stimulated immune system can spin out of control, causing auto-immune diseases that attack healthy tissue or even organs. Patients may also develop antibodies that target or interfere with cancer drugs they are using.

As a result, these treatments have mainly been tested on people with advanced cancers that are otherwise untreatable.

However, despite all the caveats, the results for this group have been promising. For instance, one PD-1 inhibitor (ipilimumab) has shrunk the tumours of more than half of people with a sub-type of an incurable lung cancer, and dramatically boosted their survival rates.

Pfizer wasn't just looking to dodge taxes when it bid for Astra

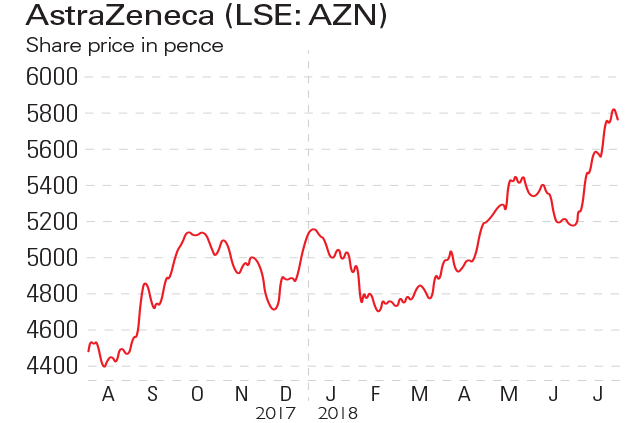

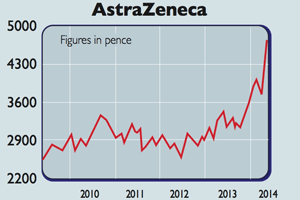

AstraZeneca

)

In 2011 it bought the rights to Tremelimumab, which inhibits molecules that protect cancer cells, from Pfizer. When Pfizer tried to buy Astra earlier this year, it wasn't just for the tax breaks (attractive though they were). It was partly to get the rights to Tremelimumab back.

In an effort to increase the speed of drug development, Astra has just signed partnership deals with Japanese firm Kyowa Hakko Kirin and Advaxis, which specialises in immunotherapies.

At 17 times 2015 earnings, AstraZeneca is by no means cheap. However, its strong pipeline should allow it to generate enough cash to maintain its dividend of 3.8%.

There are some smaller stocks in this field which, while higher risk, are certainly worth investigating. My colleague Tom Bulford covers one of these and lots of other exciting medical breakthroughs in his Red Hot Biotech Alert newsletter. If you'd like to know more about subscribing to his in-depth research, call our customer services team on 020 7633 3602.

Red Hot Biotech Alert is a regulated product issued by Fleet Street Publications Ltd. Your capital is at risk when you invest in shares, never risk more than you can afford to lose. Forecasts are not a reliable indicator of future results. Please seek independent financial advice if necessary. Fleet Street Publications Ltd. 0207 633 3600.

Our recommended articles for today

The one word I'm sick of hearing

Investors should head for the bunkers

SUBSCRIBERS ONLY

Tensions are rising between the West and Russia. This will have a serious impact on the economy. John Stepek explains how you can protect your investments.

On this day in history

1 August 1981: MTV goes on air

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

AstraZeneca’s Covid troubles could see it pull out of making vaccines

AstraZeneca’s Covid troubles could see it pull out of making vaccinesNews AstraZeneca has suffered a series of setbacks with its Covid-19 jab and may exit the inoculation subsector altogether. Matthew Partridge reports

-

AstraZeneca’s shareholders rebel over pay

AstraZeneca’s shareholders rebel over payNews Shareholders in AstraZeneca have rebelled over proposals to raise bonus levels for its bosses.

-

If you'd invested in: AstraZeneca and Mitie Group

If you'd invested in: AstraZeneca and Mitie GroupFeatures Pharmaceutical giant AstraZeneca is expected to grow its earnings, while outsourcer Mitie's share rice has been hit by a series of profit warnings.

-

Major setback for AstraZeneca

Features Pharma giant AstraZeneca was banking on a key clinical trial for its cancer drugs. It was a flop. What comes next? asks Alice Gråhns.

-

AstraZeneca fight rumbles on

AstraZeneca fight rumbles onNews The proposed takeover of AstraZeneca is proving to be one of the most controversial yet.

-

Company in the news: AstraZeneca

Company in the news: AstraZenecaFeatures Drugs giant AstraZeneca is at the centre of a takeover tussle with US rival Pfizer. Phil Oakley looks at how the shares have been affected.

-

Buy Big Pharma – the deal spree could be just beginning

Buy Big Pharma – the deal spree could be just beginningFeatures With pharmaceutical stocks still looking cheap and some very smart deals being done, it’s a good time to buy in to the sector. John Stepek explains how.