Atul Gawande: the writer shaking up US medicine

Atul Gawande doesn’t have the sort of CV you’d expect for someone running a healthcare joint venture between Amazon, Berkshire Hathaway and JPMorgan. That’s exactly why he was chosen. Jane Lewis reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

When Amazon, Berkshire Hathaway and JPMorgan Chase announced a healthcare joint venture for their US employees earlier this year to tackle soaring costs, it wiped billions from the market value of health insurers. The trio offered scant detail, says the Financial Times. Yet the mighty combo of an e-commerce giant, Buffett's investment conglomerate, and America's largest bank by asset value was seen as a huge threat to one of America's biggest industries.

Starting a healthcare revolution

The appointment of Dr Atul Gawande to lead the "ABC coalition" was in some ways a relief for healthcare's vested interests, however. Gawande is that rare thing: a surgeon-journalist. He teaches at Harvard Medical School and writes for The New Yorker. He has gained "national recognition" as a best-selling author chronicling the state of America's "broken" medical system. But he has never run a major business.

For an industry running scared about a big disruption, that seems like a stay of execution. Gawande's arrival suggests the new entity "may be focused more on experimenting with technology and data" than on "the more radical step of launching a managed-care provider that would directly compete with the biggest US healthcare players".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Industry insiders have been quick to highlight Gawande's lack of experience, says Forbes. They don't seem to understand that "Jeff Bezos, Warren Buffett and Jamie Dimon did not hire a big-thinking industry outsider to set up a conventional insurance system or haggle with doctors and hospitals over prices". Gawande was selected to "change how healthcare is structured, paid for and provided". His job is "to make traditional health plans obsolete, and to create a bold new future for American healthcare".

It would be hard to find anyone better qualified, says The Independent. Born in New York in 1965 to immigrant Indian doctors, Gawande initially "toyed with a political career", taking a degree in biology and political science at Stanford, followed by a Rhodes scholarship at Oxford, where he read politics, philosophy and economics. Returning to the US, he went to Harvard to study medicine in 1990, but then ditched the course to become head of health and social policy to Bill Clinton, later following him to the White House as a senior adviser.

From politics to medicine

To the relief of Gawande's parents, he eventually completed his medical studies and began practising: "I didn't like the idea of my future being dependent on politics". Yet it is for his writing that he is most admired. Encouraged by his friend Malcolm Gladwell, Gawande "quickly garnered acclaim and awards for his elegant essays on public health and medicine", says the FT.

Four subsequent books have expanded his reach. His third, The Checklist Manifesto, became "a manual for medical reform". Hospitals following his basic advice "found their death rates nearly halved". It was a 2009 article questioning the extraordinarily high costs of the US medical system that first attracted the attention of Warren Buffett and his business partner Charlie Munger, says Bloomberg. "Munger thought the article so socially useful that he mailed Gawande a $20,000 cheque."

"A tall, gangly figure", Gawande is "softly spoken, modest, contained", says The Independent. He has a ferocious work ethic, getting his writing done in the 45 minutes between surgical cases. There will be little time for that now he is writing a blueprint for mass reform, says Forbes. "The good news for healthcare's incumbents is that the change process will likely take five to ten years The bad news is that the clock just started ticking."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jane writes profiles for MoneyWeek and is city editor of The Week. A former British Society of Magazine Editors (BSME) editor of the year, she cut her teeth in journalism editing The Daily Telegraph’s Letters page and writing gossip for the London Evening Standard – while contributing to a kaleidoscopic range of business magazines including Personnel Today, Edge, Microscope, Computing, PC Business World, and Business & Finance.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

What is Bernard Arnault's net worth?

What is Bernard Arnault's net worth?We look into Bernard Arnault's net worth – how did he make his billions?

-

What is Jeff Bezos' net worth?

What is Jeff Bezos' net worth?Jeff Bezos' net worth stems from his large holdings in Amazon stock. We look at how he established the world’s biggest e-retailer, his space and media investments, and what’s in store for the James Bond franchise

-

What is Warren Buffett’s net worth?

What is Warren Buffett’s net worth?Warren Buffett, sometimes referred to as the “Oracle of Omaha”, is considered one of the most successful investors of all time. How did he make his billions?

-

Harley Finkelstein’s Shopify: the “Amazon for entrepreneurs”

Harley Finkelstein’s Shopify: the “Amazon for entrepreneurs”Profiles Shopify started as a snowboard shop that baulked at gifting its customers to Amazon. Now,it is an essential part of the internet’s infrastructure. Harley Finkelstein, the firm’s driving force, is aiming higher.

-

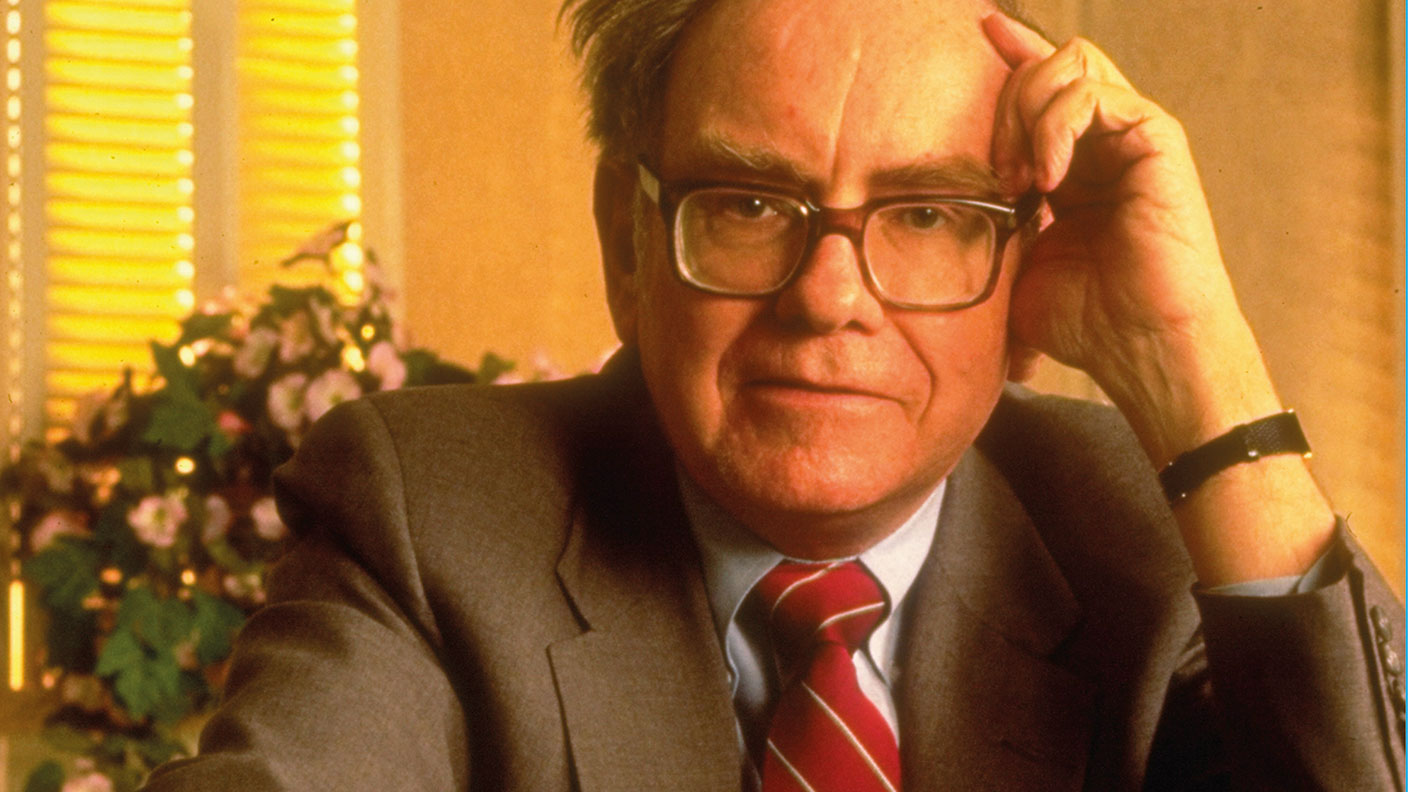

The making of Warren Buffett

The making of Warren BuffettProfiles The man who “triumphed in the long game by practising a simpler, purer version of capitalism” is widely hailed as the world’s greatest living investor. How did he get to where he is today?

-

Five questions for Daniel Burton, founder & CEO of Wondrwall

Five questions for Daniel Burton, founder & CEO of WondrwallFeatures Daniel Burton's company, Wondrwall, converts standard homes into “intelligent” ones.

-

Irving Kahn: The 108-year-old investment manager

Profiles The world's oldest investment manager fondly recalls making his first trade in the feverish summer or 1929.