What is Jeff Bezos' net worth?

Jeff Bezos' net worth stems from his large holdings in Amazon stock. We look at how he established the world’s biggest e-retailer, his space and media investments, and what’s in store for the James Bond franchise

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Jeff Bezos is a billionaire thanks to Amazon’s domination in the world of online shopping.

The founder of the e-commerce company trails behind some of the richest people in the world — namely, Elon Musk and Mark Zuckerberg — in the Bloomberg Billionaire Index with a net worth of $240 billion. Meanwhile, Forbes puts his wealth at $233.4 billion.

While the billionaire entrepreneur is often making headlines, all eyes are currently on Bezos and Lauren Sánchez’s wedding celebrations, a star-studded event that has reportedly cost millions.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There’s also a lot of buzz around what Amazon MGM Studios decides to do with the next James Bond movie as it assumes creative control of the 007 franchise.

We explore key factors that have expanded Jeff Bezos' net worth below.

How did Jeff Bezos start Amazon?

Jeff Bezos was born in Albuquerque, New Mexico, on 12 January 1964 and was raised in Houston, Texas and Miami, Florida. He studied computer science and electrical engineering at Princeton University and graduated with honours.

Bezos worked at many companies on Wall Street, including Fitel, Bankers Trust and D.E. Shaw. But despite his stable finance career, he made a risky move to e-commerce in 1994, by founding Amazon.com — an online bookstore that would revolutionise the way people shopped for books.

Initially, the company was run out of Bezos’ garage, with a handful of employees. In 1995, he managed to convince his siblings, Mark and Christina, to invest $10,000 each in the company. Their investment paid off, and within a year, the company was selling books to customers around the world.

In 1997, Amazon shares debuted via an initial public offering at $18 per share. It made Bezos a billionaire overnight. As of June 2025, Amazon’s market capitalisation is a staggering £1.728 trillion.

Bezos continued to expand Amazon's offerings, adding music, films and, eventually, just about everything else under the sun. Today, Amazon is the world's largest online retailer. The company was responsible for introducing the Kindle, an electronic book reader, in 2007.

In 2021, Bezos stepped down as Amazon CEO, and since then, he has shifted his focus towards other projects like Blue Origin.

Bezos now owns around 8.6% of Amazon, valued at roughly $190.56 billion. Last year, he sold about $13.5 billion worth of shares.

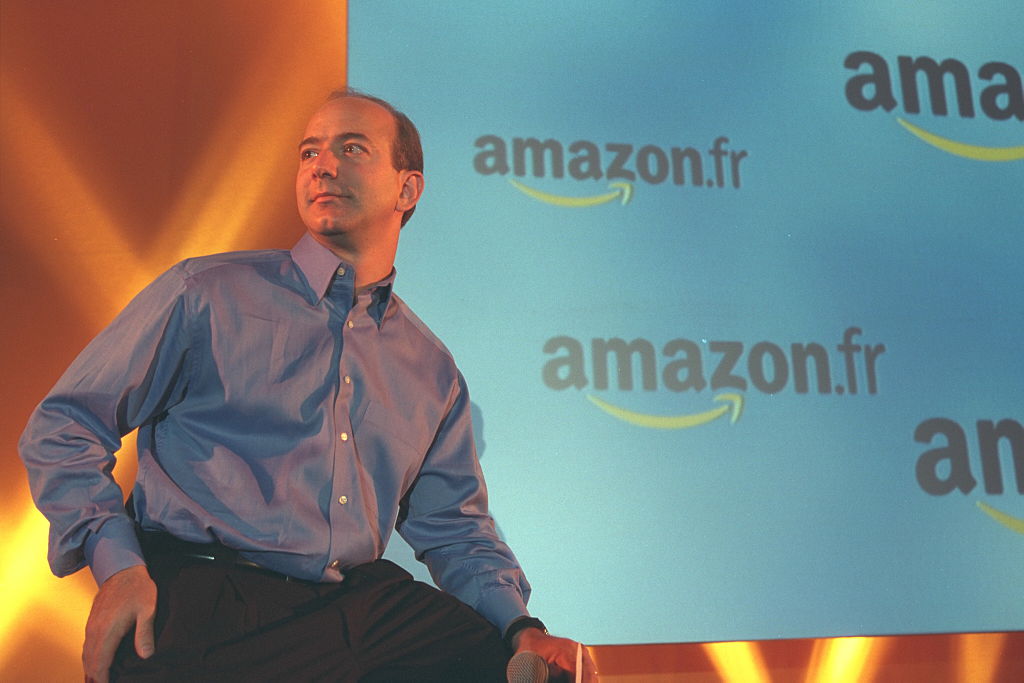

Jeff Bezos at the Amazon presentation in Paris for the launch of the site in August 2000

Other factors contributing to Jeff Bezos' net worth

In addition to his success with Amazon, Bezos has made several other investments and acquisitions that have contributed to his net worth.

He bought The Washington Post, one of the largest newspapers in the United States, for $250 million in 2013. Bezos also has a significant stake in Blue Origin, a space exploration company he founded in 2000. The all-female flight crew for its New Shepard rocket included singer-songwriter Katy Perry and TV star Gayle King.

Bezos also holds an extensive real estate portfolio stretching across 420,000 acres, making him America’s 23rd largest landowner, according to the Land Report. This includes a $165 million Warner Estate in Beverly Hills, a 14-acre compound in Maui that cost him $78 million, and three properties on an exclusive island near Miami, which he bought for a whopping $234 million, per the Wall Street Journal.

He also has a 417-foot superyacht, Koru, that cost him at least $500 million, two jets, and two helicopters.

Other than that, his portfolio also includes stakes in Uber, Airbnb, financial news website Business Insider, cloud human resources company Workday, and software company Nextdoor.

Bezos has pledged to give away a majority of his wealth to charity during his lifetime. He committed $10 billion towards fighting climate change through his Bezos Earth Fund, and gave out $117 million in grants to support homeless families across the US and Puerto Rico.

How much did Jeff Bezos and Lauren Sánchez's wedding cost?

The Bezos-Sánchez wedding in Venice cost at least $20 – 25 million, according to Forbes’s estimates. Meanwhile, Reuters places the figures between $47 – $56 million.

There was no compromise on its 200-attendee star-studded guest list, with appearances made by Bill Gates, Leonardo DiCaprio, Kim Kardashian and several high-profile celebrities, who were staying at five-star luxury hotels across Venice.

Forbes also reported that the couple’s wedding planners commissioned around 30 private water taxis to escort the guests (Venice has 280 in total), which cost them roughly $270,000 for three days. The catering was by a three-Michelin-star chef, likely to have cost $360,000 for food and beverages for a night, or $1.1 million for the three days.

Bezos donated nearly $3.6 million in total to Corila, UNESCO’s Venice office, and the Venice International University.

While extravagant, the amount pales in comparison to Anant Ambani and Radhika Merchant’s wedding last year, which cost between $400 – $500 million, and included performances from Rihanna and Justin Bieber.

However, Business Insider reports that the Bezos-Sánchez wedding boosted Venice’s economy by a staggering $1.1 billion. This is based on analysis from Italy’s tourism minister and consultancy firm JFC. A lion’s share of the figure (over 90%) came from publicity and media exposure.

What will Amazon do with the James Bond franchise?

Amazon revealed on 20 February 2025 that it had taken creative control of the iconic James Bond franchise. This comes after the e-commerce giant bought MGM — which shares the rights to the series with Eon — in an $8.5 billion deal. This gave Amazon access to a catalogue of more than 4,000 movies and 17,000 shows.

It also means that Amazon MGM Studios and Eon Productions now co-own the intellectual property related to the James Bond franchise.

In more recent news, Amazon announced that legendary Oscar-nominated filmmaker Denis Villeneuve of Dune and Blade Runner 2049 fame will direct the next James Bond film.

Variety reported that the studio is interested in casting Harris Dickinson, Tom Holland, or Jacob Elordi for the role of James Bond.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Oojal has a background in consumer journalism and is interested in helping people make the most of their money.

Oojal has an MA in international journalism from Cardiff University, and before joining MoneyWeek, she worked for Look After My Bills, a personal finance website, where she covered guides on household bills and money-saving deals.

Her bylines can be found on Newsquest, Voice.Cymru, DIVA and Sony Music, and she has explored subjects ranging from politics and LGBTQIA+ issues to food and entertainment.

Outside of work, Oojal enjoys travelling, going to the movies and learning Spanish with a little green owl.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Amazon stock falls as AWS results underwhelm

Amazon stock falls as AWS results underwhelmApple stock rose after earnings on a return to growth in China; Amazon's share price fell despite an earnings beat

-

Is the technology rout over?

Is the technology rout over?Analysis Big tech has reported a bump in revenues leading some to question if the pandemic slump is over

-

Tech stocks have plunged this year, but is now the time to buy?

Tech stocks have plunged this year, but is now the time to buy?Tips Tech stocks have faced heavy selling pressure this year, although all of these firms have bright futures.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

Why Big Tech’s move into medicine is a mistake

Why Big Tech’s move into medicine is a mistakeOpinion The big tech companies have long wanted a slice of the medical action, and now they are moving in. They are making a big mistake and will fae a huge backlash, says Matthew Lynn.

-

Defensive income plus growth potential? This stock ticks all the boxes

Defensive income plus growth potential? This stock ticks all the boxesTips Telecom Plus has survived the energy crisis that has driven so many of its competitors under, and has emerged bigger and stronger than ever. One to consider for your portfolio, says Rupert Hargreaves.

-

What to buy as the tech-stock bull market crashes

What to buy as the tech-stock bull market crashesCover Story The decade-long bull market in tech stocks has come to a rapid halt. Investors need to distinguish solid stocks from speculative ones rather than just buying the dip, says Matthew Partridge

-

Amazon’s shares have fallen hard – value investors should take note

Amazon’s shares have fallen hard – value investors should take noteTips Investors have dumped Amazon shares as post-pandemic life returns to normal. But it still has plenty of competitive advantages, says Russell Hargreaves, and value is now beginning to emerge.