What is Elon Musk's net worth?

Elon Musk is the richest person in the world and close to becoming the first-ever trillionaire. How did the Tesla and SpaceX founder make his fortune?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When Elon Musk’s fortunes don’t make the headlines, his shenanigans tend to keep him in the public eye – whether it’s rebranding Twitter as X, or Tesla struggling to overtake Chinese electric car companies.

Musk has been the richest person in the world since 2021 – except for the moment when Oracle’s Larry Ellison briefly surpassed him in September 2025.

We look at how Elon Musk made his billions.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Elon Musk’s net worth over the years

Elon Musk’s net worth is $849.2 billion, according to Forbes.

In comparison, Larry Page, the second-richest person and co-founder of Google, has a fortune of $265.5 billion on the Forbes Real Time Billionaires List.

Musk’s net worth has grown substantially over the past few years thanks to his various investments in the world of tech, space and manufacturing.

In 2016, he was worth $10.7 billion. Just a decade later, he has surpassed the $700 billion mark – a feat no one has achieved before – making Musk nearly three times richer than his rivals and close to becoming the world’s first trillionaire.

But where did it all begin? Musk was born in South Africa on 28 June 1971. He exhibited a keen interest in technology and innovation from an early age and moved to the US at 17 to attend college.

His first major success came with Zip2, a company that provided online business directories and maps to newsletters. In 1999, Compaq acquired Zip2 for nearly $300 million, paving the way for Musk into the tech industry.

Musk used his proceeds from the sale to launch X.com, an online payment platform that eventually evolved into PayPal. In 2002, eBay acquired PayPal for $1.5 billion.

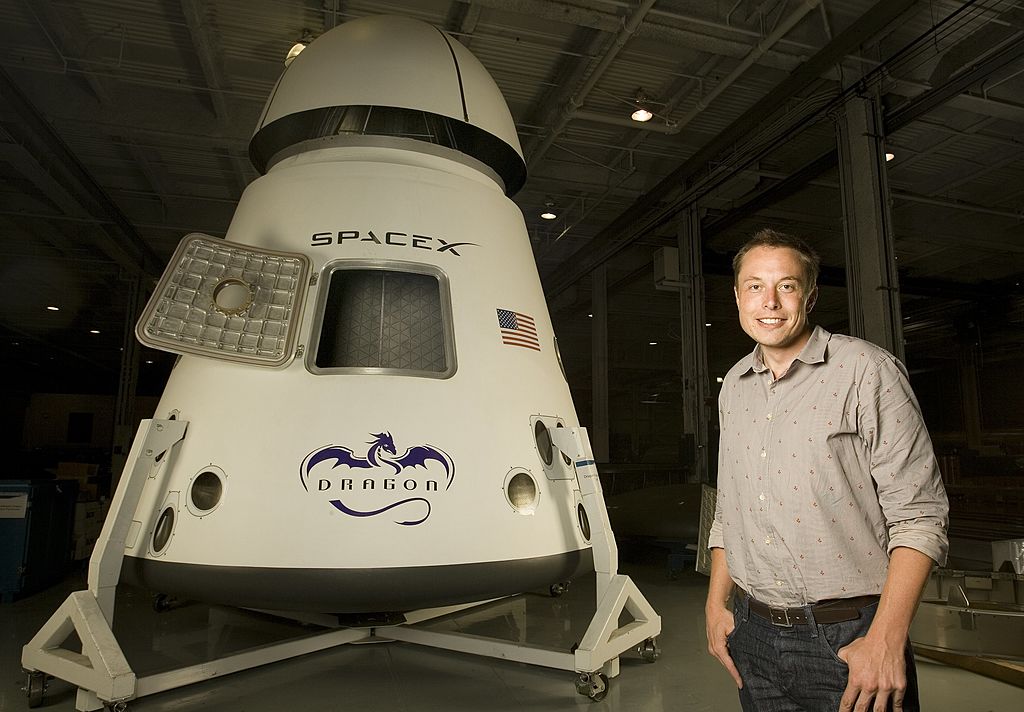

That same year, Musk used $100 million of his own fortune to start SpaceX, aiming to make space exploration more accessible and colonise Mars.

In 2004, Musk joined Tesla Motors and became the company’s CEO four years later. Under his leadership, Tesla transformed into a trailblazer in the electric vehicle market. Tesla’s revenue jumped from $12 billion in 2017 to $54 billion in 2021. At the time of writing, Tesla has a market capitalisation of £1.15 trillion.

Beyond SpaceX and Tesla, Musk has diversified his ventures into other industries. He co-founded SolarCity, a solar panel installation firm that Tesla acquired in 2016.

In February 2026, SpaceX acquired xAI in a $1.25 trillion merger, ahead of an initial public offering (IPO) later this year. The two companies announced the deal, saying that it would form “the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet, direct-to-mobile device communications and the world’s foremost real-time information and free speech platform.”

Ahead of the merger, Forbes reported that Musk added another $62 billion to his wealth after xAI Holdings raised $20 billion from private investors with a $250 billion valuation. At this rate, it looks like it won’t be long before his net worth tops $1 trillion.

Elon Musk’s other investments

While the majority of Musk’s wealth comes from his business ventures, his influence stretches far beyond the tech world.

He was a prominent Donald Trump supporter during the 2024 US elections, which resulted in Musk being appointed as the leader of the Department of Government Efficiency (DOGE), though he has since departed DOGE to focus on Tesla.

Musk has built up a vast property empire over the years. In 2020, he stated on X (formerly Twitter) that he would sell all his “physical possessions” and “own no house”. At that time, the asking prices for his seven homes were more than $100 million, according to Architectural Digest. It included a 16,000 square-foot home in Los Angeles that was built in 1990, which sold for $29 million.

I am selling almost all physical possessions. Will own no house.May 1, 2020

After shedding his property portfolio, Musk moved into a tiny home in Boca Chica, Texas, close to the SpaceX headquarters. He wrote on Twitter/X in 2021: “My primary home is literally a ~$50K house in Boca Chica/Starbase that I rent from SpaceX.”

Musk moved into a 6,900-square-foot mansion in West Lake Hills, Texas, in 2022, worth $6 million.

The billionaire has also built his own company town called Starbase, named after his rocket launch site, on the southern tip of Texas. The city covers around 1.6 square miles and is home to some 500 people, according to the Guardian.

Musk may not spend big on property, but the same can’t be said about vehicles. The CEO of Tesla has a large collection of cars, ranging from a Ford Model T, a 1997 McLaren F1, a Tesla Roadster and the 1976 Lotus Espirit that James Bond drove in the 1977 film The Spy Who Loved Me. Musk bought it at an auction in 2013 for nearly $1 million, according to the BBC. He also owns private jets, each worth millions of dollars.

While Musk doesn’t donate his wealth as generously as other billionaires like Bill Gates, Jeff Bezos and Mark Zuckerberg, he still gives away billions in shares to charities. He has an organisation called the Musk Foundation, with more than $14 billion in assets. However, The New York Times reported that the charity failed to give away the minimum amount required by law for the fourth year in a row.

How does Elon Musk manage his wealth?

With so many billions to his name, it’s not surprising that Elon Musk has a wealth manager. His fortunes are handled by Excession LLC, a single-family office formed in 2016. It’s run by James Birchall, Musk’s trusted advisor and CEO of Neuralink.

We explore whether you should get a financial adviser, and how much you should be paying them in separate pieces.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Oojal has a background in consumer journalism and is interested in helping people make the most of their money.

Oojal has an MA in international journalism from Cardiff University, and before joining MoneyWeek, she worked for Look After My Bills, a personal finance website, where she covered guides on household bills and money-saving deals.

Her bylines can be found on Newsquest, Voice.Cymru, DIVA and Sony Music, and she has explored subjects ranging from politics and LGBTQIA+ issues to food and entertainment.

Outside of work, Oojal enjoys travelling, going to the movies and learning Spanish with a little green owl.

-

What the government’s baby boomer retirement data says about the future of pensions

What the government’s baby boomer retirement data says about the future of pensionsA study of the retirement routes of people born in 1958 paints a worrying picture for people’s pension savings

-

An experienced investor’s end of tax year checklist

An experienced investor’s end of tax year checklistThe clock is ticking down before the end of the 2025/26 tax year, when any tax-free savings and investment allowances are lost. For experienced investors, though, the deadline for some tax-saving schemes is even earlier.

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictator

The rise and fall of Nicolás Maduro, Venezuela's ruthless dictatorNicolás Maduro is known for getting what he wants out of any situation. That might be a challenge now

-

The most influential people of 2025

The most influential people of 2025Here are the most influential people of 2025, from New York's mayor-elect Zohran Mamdani to Japan’s Iron Lady Sanae Takaichi

-

The steady rise of stablecoins

The steady rise of stablecoinsInnovations in cryptocurrency have created stablecoins, a new form of money. Trump is an enthusiastic supporter, but its benefits are not yet clear

-

The return of Erik Prince, America's notorious mercenary

The return of Erik Prince, America's notorious mercenaryErik Prince, founder of the controversial private military group Blackwater, was shunned for pushing the boundaries of legality. He has re-established himself

-

No peace dividend in Trump's Ukraine plan

No peace dividend in Trump's Ukraine planOpinion An end to fighting in Ukraine will hurt defence shares in the short term, but the boom is likely to continue given US isolationism, says Matthew Lynn

-

Canada will be a winner in this new era of deglobalisation and populism

Canada will be a winner in this new era of deglobalisation and populismGreg Eckel, portfolio manager at Canadian General Investments, selects three Canadian stocks