How to invest in the next big medical breakthrough

There is currently no cure for MS, Alzheimer’s and Parkinson’s diseases but research gallops on. There will be big rewards for the first drug company to break through, says Dr Mike Tubbs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Patients and the families of patients suffering with serious neurological diseases such as Alzheimer's, Parkinson's and multiple sclerosis (MS) are all hoping for research breakthroughs which could lead to a cure. At present there are drugs that can alleviate the symptoms, and in some cases slow down the progression of these three diseases but there is still no cure. The situation for Alzheimer's is particularly bleak there are no drugs available that treat the underlying causes, and even those treatments that do exist can only alleviate symptoms temporarily. There has been little progress for patients in the last decade or more not a single new Alzheimer's drug has been approved by the US regulator, the Food and Drug Administration (FDA), for 14 years.

Of course, an ageing and increasingly long-lived global population means that ever more of us will end up being affected by these diseases, whether directly or through the impact on a loved one. So drug companies have every incentive to try to develop new, more effective treatments for all three. However, investors need to appreciate that research and development spending in this area falls squarely into the "high risk/high reward" category. The high rewards reflect the urgent medical need for better treatments and as we've already alluded to the very large number of sufferers. For example, in the UK alone, the Alzheimer's Society says that 850,000 people currently suffer from dementia, with 62% of those having Alzheimer's. On top of that, roughly 225,000 new cases are being diagnosed each year. As a result, in the absence of an effective new treatment to arrest the progress of the disease or cure it altogether, the total number of sufferers is expected to rise to two million by 2051. In the US, meanwhile, the Alzheimer's Association reckons that 5.5 million suffer from Alzheimer's. That is expected to rise to 13.8 million by 2050. Worldwide the number of current sufferers is roughly 50 million, but this could easily be an underestimate because of under-diagnosis, particularly in developing countries. Parkinson's disease is slightly less common, but still afflicts about ten million people worldwide; MS sufferers number around 2.5 million.

Hunting a cure for Alzheimer's

The huge rewards likely to go to the first company to gain approval to market an effective Alzheimer's drug are based on estimates that such a drug could reach peak sales of $20bn a year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Given that Alzheimer's is currently the fifth-biggest killer of over-65s in the US, this does not seem unreasonable, and that sort of figure would represent a massive revenue boost for any drug company be it a large biotech such as Biogen, which had 2016 sales of $11.4bn, or even one of the pharmaceutical giants, such as Eli Lilly, whose 2016 revenue came in at $21.2bn.

The high risks for Alzheimer's drug developers reflect both the difficulty of developing effective new treatments and some high-profile late-stage clinical trial failures that have been experienced in the last few years. For example, Merck, Eli Lilly and Lundbeck have all seen treatments fail clinical trials in the last year or so. Merck's verubecestat and Eli Lilly's solanezumab were both seen as promising candidates, but both failed in late-stage trials. To be successful, a new drug not only has to reduce the amyloid plaques in the brain that are characteristic of Alzheimer's, but must also improve the patient's cognitive ability. Meanwhile, in September 2017, there was disappointment from US-based Axovant Sciences as it announced that its late-stage clinical trial had found no difference between the effects of its Alzheimer's drug (intepirdine) and a placebo. Axovant's share price fell by 70% on the news (having almost doubled in the previous nine months or so), which demonstrates the risks that are there for investors.

But recently there have been some more-promising results from Biogen's aducanumab for early-stage Alzheimer's. In an extended Phase Ib trial of 143 patients over three years, there were two encouraging observations. Firstly, the drug reduced both the levels of amyloid plaques in the brain and reduced the loss of problem-solving and memory skills in test subjects. Secondly, the effects were dose dependent. In other words, higher doses proved more effective, which is an important positive feature in any clinical trial. For example, after three years, those who had been on the highest dose of aducanumab had declined four points on a scale measuring memory and problem-solving skills, whereas those who took a placebo and were then switched to a low dose, declined by eight points twice as much deterioration.

These promising results have encouraged Biogen to start two final-stage Phase III clinical trials with much larger numbers of patients. Let us hope for the sake of the many Alzheimer's patients (present and future) that these Phase III trials fare better than the earlier ones by Merck, Eli Lilly and others. Biogen does have the advantage that it specialises in treatments for neurological diseases and is probably the world's leading current supplier of drugs for MS. The company also has four other Alzheimer's candidates E2609 in Phase III, BAN2401 in Phase II and two more drugs in Phase I. Two of these are in collaboration with Eisai and one is licensed from Bristol-Myers Squibb. Another positive is that, between them, these pipeline candidates span three different approaches to the treatment of Alzheimer's.

Turning to other late-stage clinical trials of Alzheimer's drugs, there are three Phase III trials being carried out by Swiss healthcare giant Roche on gantenerumab, an antibody which has been developed in partnership with German biotech MorphoSys. MorphoSys currently has a large pipeline of antibody drugs for a range of diseases being developed in partnerships with most of the major pharmaceutical companies. Novartis has two Phase II trials of new Alzheimer's drugs in progress, while AstraZeneca (along with Eli Lilly) has lanabecestat in Phase III trials. There are a number of other late-stage trials in progress or recruiting volunteers right now, so there could be interesting developments from companies other than the ones mentioned above.

Progress on Parkinson's

The charity Parkinson's UK summarises the state of play for drug treatments for Parkinson's disease pretty succinctly. "Current medications can help to manage Parkinson's symptoms, but we don't yet have any treatments that can cure, slow, stop or reverse the progression." In short, there is an urgent medical need for more effective drugs. My father had Parkinson's, so I know how debilitating it is and that experience makes me particularly keen to see the development of an effective treatment. Some of the companies mentioned above in connection with Alzheimer's also have clinical trials of new Parkinson's treatments in progress, as do some other large pharmaceutical companies.

For example, Prothena, a US biotech, has partnered with Roche on PRX002 for Parkinson's which is in Phase II trials, while drugs giant Pfizer also has a Phase II trial in progress for Parkinson's. At earlier stages of development, we have biotech group Biogen, whose BIIB054 is in Phase I clinical trials, and AstraZeneca's MEDI1341, which is about to enter Phase I clinical trials on Parkinson's patients and has just been partnered with Japanese drugmaker Takeda to co-develop it.

An example of a risky-but-promising biotech approach to Parkinson's comes from Voyager Therapeutics. The motor symptoms associated with Parkinson's disease, such as shaking and slow movement, are caused by falling levels of the neurotransmitter dopamine in the putamen, an area of the brain that helps to regulate motion. This in turn is caused by the death of dopamine neurons in a part of the brain called the substantia nigra, which is where a substance called levodopa is converted into dopamine, which is then released into the putamen. This reaction is catalysed by an enzyme called AADC for short.

Giving Parkinson's patients doses of levodopa can help to offset this, but as the disease becomes more advanced, levodopa becomes less effective and adverse effects increase. And around 15% of Parkinson's patients, says Voyager, have motor fluctuations that are not well controlled by levodopa. In both cases, Voyager's VY-AADC01 gene therapy (see page 24) is designed to help. This therapy delivers the AADC gene directly into neurons of the putamen (which are not damaged by Parkinson's). This enables those neurons to express the AADC enzyme, which in turn means that levodopa can be converted into dopamine directly in the putamen, effectively cutting out the substantia nigra altogether. Voyager still has almost no revenue, but it has announced positive results for a Phase Ib trial of the treatment, which "demonstrated durable dose-dependent and time-dependent improvements across multiple measures of patients' motor function after administration of the gene therapy".

The outlook for multiple sclerosis

Like the other two neurological diseases discussed here, MS has no cure. But there are many drugs which alleviate symptoms or slow progression of the disease. Biogen is the world leader in MS its Tecfidera is the most widely-prescribed MS medicine and it has five other MS treatments on the market. It also has a new MS drug in Phase II testing just now. But there is a lot of research into new treatments and several new drugs have been approved in the last two years, including Roche's Ocrevus, with many more in Phase III and Phase II trials.

In summary, the growing amount of research and the number of new drugs in clinical trials should give us hope that improved treatments and perhaps one day even full-blown cures are in prospect for the big three neurological diseases. Meanwhile, the company or companies that can finally achieve these breakthroughs can expect to reap rich rewards we look at some of the most promising stocks below.

What is gene therapy?

Many diseases are caused or exacerbated by flaws in our genes. Gene therapy involves treating such diseases by repairing or modifying our DNA (the chemicals our genes are made of), or by inserting extra genes into a patient's cells (using a virus as the "delivery vehicle"). The idea is to correct or supplant the gene or genes that are not doing their jobs properly, and hence cure disease. The technique was developed in the 1970s, but it was 1989 before the first gene was successfully implanted in a human genome. Since then, more than 2,300 clinical trials have been carried out (as of February last year).

Gene therapy was first conceived as an approach to treating inherited diseases such as Huntington's disease or cystic fibrosis. However, the development of CRISPR technology which allows the editing of existing genes already inside the cells has greatly extended the range of potential conditions that could be treated, from HIV infection to high blood cholesterol, notes New Scientist.

Gene therapy tends to be expensive for several reasons: the diseases involved are usually rare, so there is a small population of potential patients; the treatment usually needs to be tailored to the individual; and the treatment is often a one-off rather than recurring.

Three stocks to buy now

Of the stocks in the story above, the least risky option is to buy Roche (Zurich: ROG), which has drugs in development for Alzheimer's, Parkinson's and MS. The company also pays a reliable dividend, which has grown for more than 25 years, and in 2016 its sales came to CHF50.6bn. However, Roche specialises in oncology and neuroscience is a modest overall part of its business. Greater exposure to neurological diseases comes through a company such as Biogen (Nasdaq: BIIB), which has aducanumab for Alzheimer's and developmental drugs for all three diseases discussed above, as well as a strong existing MS franchise.

A higher risk option is Prothena (Nasdaq: PRTA), which has little revenue but is sitting on a cash pile of $476m that it can use to advance its Phase II Parkinson's treatment (partnered with Roche) and its lead drug for AL amyloidosis, a disease that can lead to dementia, vision and cardiac problems.

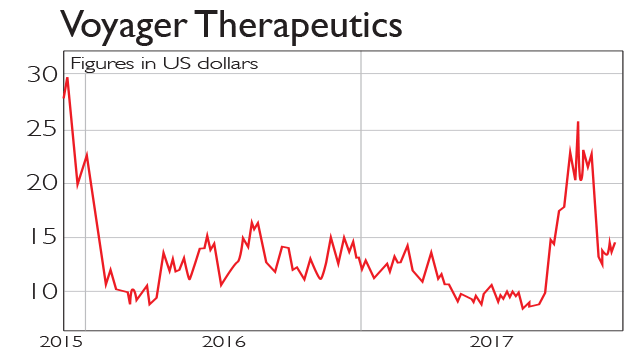

The riskiest bet is Voyager Therapeutics (Nasdaq: VYGR), a biotech which specialises in severe neurological diseases and has a new gene therapy for advanced Parkinson's alongside other pre-clinical gene therapies for Alzheimer's, Huntingdon's and other diseases. Voyager says it expects to have cash of $90m-$100m by the end of this year, enough to last it into 2019.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Highly qualified (BSc PhD CPhys FInstP MIoD) expert in R&D management, business improvement and investment analysis, Dr Mike Tubbs worked for decades on the 'inside' of corporate giants such as Xerox, Battelle and Lucas. Working in the research and development departments, he learnt what became the key to his investing; knowledge which gave him a unique perspective on the stock markets.

Dr Tubbs went on to create the R&D Scorecard which was presented annually to the Department of Trade & Industry and the European Commission. It was a guide for European businesses on how to improve prospects using correctly applied research and development.

He has been a contributor to MoneyWeek for many years, with a particular focus on R&D-driven growth companies.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.