How to fatten your profits as the world slims

Modern living has turned us into overweight, inactive couch potatoes. There’s an app for that, says Alice Gråhns – and an opportunity to profit for smart investors.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Modern living has turned us into overweight, inactive couch potatoes. There's an app for that, says Alice Grhns and an opportunity to profit for smart investors.

Once upon a time, hard, regular physical exercise was part and parcel of our daily existence, rather than an optional extra we fitted in in our spare time. From ancient times until really fairly recently, our ancestors didn't need expensive gym facilities to stay in shape. From hunter-gathers to farm labourers to industrial workers, a combination of physically demanding manual work, walking rather than driving, and a daily calorie intake restricted by necessity rather than choice, kept us active (if not always healthy). It's little surprise that many of us struggle to keep fit in the modern era of sedentary jobs, widespread car ownership, and virtually limitless opportunities to snack.

This has created a burgeoning boom in businesses dedicated to keeping us healthy. In 2006, 13% of adults in England took part in regular fitness activities. By last year, this had risen to 16%. Today, one in every seven people in the UK is a member of a gym, and ever more are signing up. In the year to the end of March 2017, overall UK gym membership numbers grew by 5.1% (6.3% in terms of value), according to the 2017 State of the UK Fitness Industry Report by health and fitness consultancy LeisureDB. Meanwhile, the sector has grown globally from being worth $67bn in 2009 to $83bn last year. And it's not just about going to the gym. Every aspect of the fitness industry from sports centres to healthy foods to tracking technology and even "activewear" is expanding rapidly. People don't just care about what they do with their bodies, but also about what they put in them and on them.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Indeed, says David Minton, founder of LeisureDB, the industry is entering a golden age. Individuals are increasingly aware of the need to look after themselves, helped both by public health campaigns and (in the UK) the ongoing post-2012 Olympics "halo" effect. Meanwhile, fitness facilities are ever more widespread and of higher quality, customer service is improving, and gym membership is becoming more affordable, says Steven Ward, chief executive at UK Active. While the 16- to 34-year-old demographic is the key target market (young consumers generally are), the older generation is also increasingly interested in getting into shape.

Then there's the expanding role the government sees for the industry. We wrote about the obesity epidemic a few months ago in MoneyWeek, but increasingly there's a new public health enemy number one inactivity. Physical inactivity is the largest cause of premature mortality globally, according to the World Health Organisation. Nearly 13 million people in the UK are classed as physically inactive, meaning they fail to rack up at least 30 minutes of physical activity per week. The fitness industry can only benefit from government efforts to tackle that. Indeed, all of those inactive adults represent a significant growth opportunity.

Big health is big business

As demand has grown, the range of options for keeping fit has widened considerably. These days, in most British cities, you'll see a fitness centre on every other street corner be it a low-cost gym, a boutique gym or an expensive health club with fancier facilities. Much of the industry's growth is arising at the budget end of the market. There are now more than 500 low-cost clubs (defined as those charging less than £20 a month), accounting for 15% of the market value and more than a third of total membership. Beyond offering keen pricing, budget chains attract customers by offering 24-hour access (so you can work out around your working day) and freedom from annual contracts.

These budget gyms often appeal to first-timers who, as they become fitter, may work their way up the market, says Minton. Boutique gyms are smaller and more exclusive than low-cost gyms, and tend to focus on one specific area of fitness. Alternatively, health clubs are larger and more anonymous, but usually have the most extensive facilities, with spas and swimming pools. But whatever the entry level, the two key staples of the fitness industry are gym sessions (people working out individually) and fitness classes (exercising as a group), says Lisa O'Keefe, director of insight at Sport England. Almost 4.5 million people do gym sessions regularly and 1.6 million people take fitness classes. Men generally tend to stick to weightlifting, while women typically favour group workouts, says O'Keefe. This is a trend that has become more apparent fairly recently, helped partly by the high profile of female athletes at the London Olympics in 2012.

The industry itself not unlike the fashion business is very good at creating and responding to demand, generating an ongoing stream of new classes to capture fickle consumers' imaginations. A couple of years ago, Zumba was the "in" exercise. Today, CrossFit, yoga and innovative spinning (cycling on the spot) classes have taken over. Even nightclubs have joined in they provide exercise classes during the day and put the gym equipment away for the night.

It's about what you eat too

Interest in healthy eating is booming too. And you don't have to be an ardent gym bunny to care about watching what you eat. For example, the UK market for organic food is now worth nearly £2.1bn, and is growing strongly total sales of organic food grew by 7.1% last year, according to the Soil Association, while non-organic sales fell. A growing number of companies now provide healthy meal and nutrition plans delivered direct to your door.

However, above and beyond those who desire a more healthy diet, there's a growing appetite for supplements and specialist foods aimed specifically at gym fanatics, bodybuilders, professional athletes and enthusiastic amateurs: everything from so-called "superfoods" packed with vitamins and antioxidants to protein shakes. It's fair to say that the scientific benefits of many of these supplements are the subject of debate and others are simply soft drinks repackaged as "lifestyle" brands. Yet demand for these products is growing just as, if not more, rapidly than the market for organic food. The global sports nutrition market is already worth nearly $30bn and it's expected to grow at an annual rate of around 8.1% for the next five years, to reach a value of $45.27bn by 2022.

The rise of "athleisure"

The growing cult of the body with everyone from celebrities to fitness bloggers to "ordinary" people given to posting snapshots of their "rock-hard abs" on social media has also fuelled a desire to look good in workout gear. Scruffy tracksuit bottoms won't cut it in your high-end boutique gym, leading to a rapidly growing market for athletic products and apparel. Increasingly that trend is spilling out into the high street. Sportswear is not just for exercise. Indeed, many people who wouldn't go to the gym if you paid them will nevertheless snap up expensive "athleisure" gear. According to GlobalData, growth in the sportswear sector is set to outpace the total UK clothing market this year, which itself is expected to grow by 2.1%.

Indeed, the fashion trend is so popular that many wonder how long its vertiginous rise can be sustained. However, investors can relax even if UK consumers start to find new fashions, the global trend remains robust, driven partly by growth in China. In fact, global athletic wear sales are expected to increase by nearly 20% by 2021, to $355bn from $290bn currently, according to analysts at Morgan Stanley. This can be attributed to the increasing number of luxury fashion designers turning their eye to sportswear. Stella McCartney designed the Team GB kit for the 2012 Olympics, and since then both Chanel and Dior have released couture trainers, while Alexander Wang launched an athletics range for H&M. The activewear trend has, of course, also boosted sports brands such as Nike and Adidas.

A robotic nag

Another growing obsession both in terms of physical health and the wider self-help movement is the drive for relentless self-improvement via the formation of healthy habits. This usually involves keeping some sort of record of your activities, which in turn has increased demand for devices that can track what you do and nag you gently (or not so gently) when you fail to achieve your daily targets.

The chances are that you already have such a device or at the very least, your smartphone has the capability to act as a fitness tracker if you download the right app. Technology is disrupting most businesses on the planet and the fitness industry is no exception. Wearable devices from phones to smartwatches to simple wristbands mean that you can now easily track how far you've run, what speed you've been going at, and how many calories you've burned. And a few days after your run, you'll get an electronic reminder that you found 7.30pm on Tuesday evening to be a convenient time for a workout don't you think that now is the ideal time for another one?

This ability to track our progress and to adjust our exercise patterns accordingly has in turn fuelled even more demand for yet more data and analysis. As a result, the global wearables sector is expected to rocket in value from $23bn last year to $173bn in 2020, according to global analyst MarketsandMarkets.

The disruption caused by technology in the fitness industry isn't all about wearable technology. The software at the back-end of a fitness centre is just as important whether it be a booking system, a management tool for members' access to the facility, or an automated sales system. In the future, these customer-relationship management (CRM) systems will undergo major changes as artificial intelligence becomes increasingly popular, reckons Minton.

The goal of any fitness services provider is ultimately to make the process more seamless the fewer hurdles there are between a customer joining the gym and following through on their good intentions to use it, the more profitable the gym is likely to be. Artificial intelligence will help to personalise membership for each customer your gym's software will learn what type of activity you like, and send personalised "push notifications", informing you of upcoming classes you might enjoy and offering to book you in for a session. Just as wearables already know your preferences, so your local gym will too.

The five best stocks to buy now

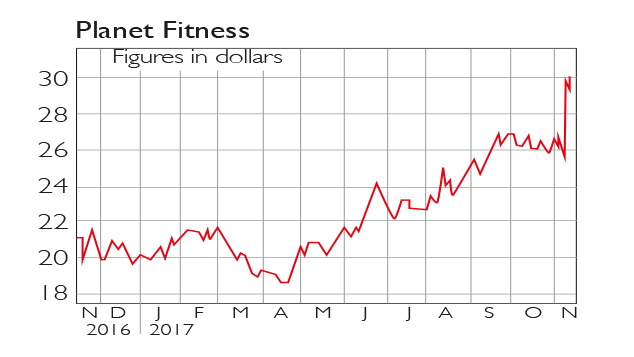

If you want to invest in the growth of the fitness market, US-based Planet Fitness (NYSE: PLNT) is one of the largest and fastest-growing gym chains in the world, with around seven million members. The company's quarterly revenue has climbed 12.1% year over year to $97.5m, but unfortunately, that rapid growth appears to be thoroughly priced in after the share price surged following the strong results it now trades on a steep price/earnings (p/e) ratio of 45. An alternative UK-based option is the low-cost fitness chain The Gym Group (LSE: GYM). The company has 95 gyms in the UK and plans to open another 20. It's growing fast too it saw revenue rise by 18.8% to £42.8m in the six months to June 30 but trades on a slightly less eye-watering forward p/e of below 30, which is just about reasonable (though still not cheap) given the growth rate.

On the dieting side, there are several big US firms that produce diet plans and low-calorie foods, including Weight Watchers and Medifast. Ever so slightly cheaper than either of those on a forward p/e of around 25 is Nutrisystem (Nasdaq: NTRI). Brokers are targeting an average price of around $70 a share for the stock, compared with its current level of just below $50. Another option you may be considering is supplements provider Herbalife, given its p/e of 14. However, we'd be wary of this one Herbalife is a consistent short-selling target, and while it has thwarted the shorts so far (notably hedge-fund manager Bill Ackman), we wouldn't risk investing without doing detailed due diligence first.

A key brand to keep an eye on in the activewear sector is Adidas (Frankfurt: ADS). In North America, sales jumped 31% in the last quarter, topping $1bn in the region at a time when Adidas's two biggest rivals, Nike and Under Armour, have struggled to keep sales up on their home turf. On a p/e of 28, it's not cheap, but of the big brands it currently looks the best option. A less obvious bet is Lululemon Athletica (Nasdaq: LULU). The upmarket yoga and fitness gear company has struggled amid concerns over potential competition from Amazon and Nike, but continues to expand both internationally and in other areas, such as men's clothing.

On the tech side, one option is Mindbody (Nasdaq: MB). This $1.5bn firm provides cloud-based business-management software and payment systems for "the wellness services industry", and offers an app designed to help users find and book exercise classes. It doesn't yet make a profit, so it's risky, but revenues are growing fast.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.