Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

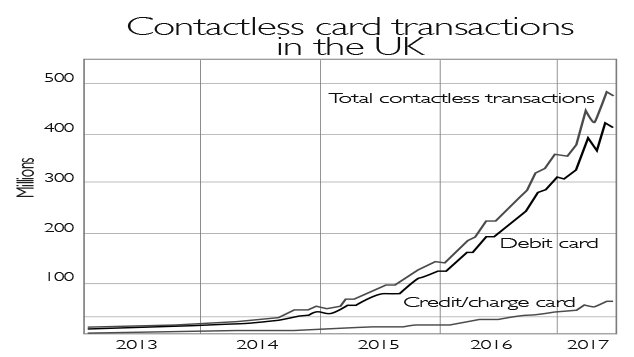

It's easy and convenient to tap and pay. No wonder, then, that contactless card transactions have rocketed in recent years 470 million transactions took place in June alone, notes Hugo Greenhalgh on FT.com.

In the first half of 2017 we spent £23bn in this way, almost as much as the £25bn for the whole of 2015. There are now 111 million contactless cards in issue, compared with 250,000 in 2007, when only 2% of them were used to tap and pay. Last year overall card payments (chip-and-pin and contactless) overtook cash for the first time. A third of card transactions were contactless.

Viewpoint

"Brexiteers are deeply sceptical ofstate action [yet] confronted with the most difficult administrative problem the British state has ever been lumbered with, [they] become optimistic to the point of cavalier about the capacity of the state... these newdirigistessuddenly regard the government as entirely capable of replacing four decades of European economic, social and environmental regulation without difficulty Such is their uncharacteristic faith in the benign hand of Whitehall that, through the Repeal Bill process, they are even prepared to put all power in the hands of ministers and bureaucrats to make regulations by edict."

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Philip Collins, Prospect

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

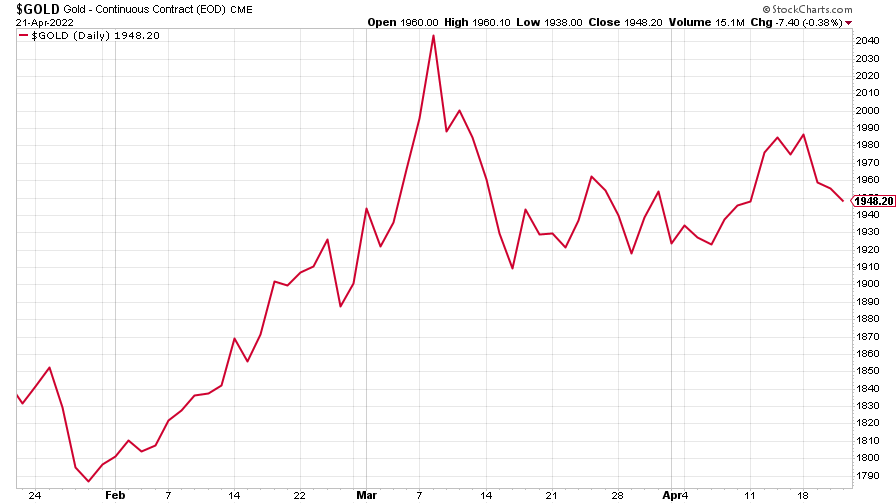

The charts that matter: bond yields and US dollar continue to climb

The charts that matter: bond yields and US dollar continue to climbCharts The US dollar and government bond yields around the world continued to climb. Here’s what happened to the charts that matter most to the global economy.

-

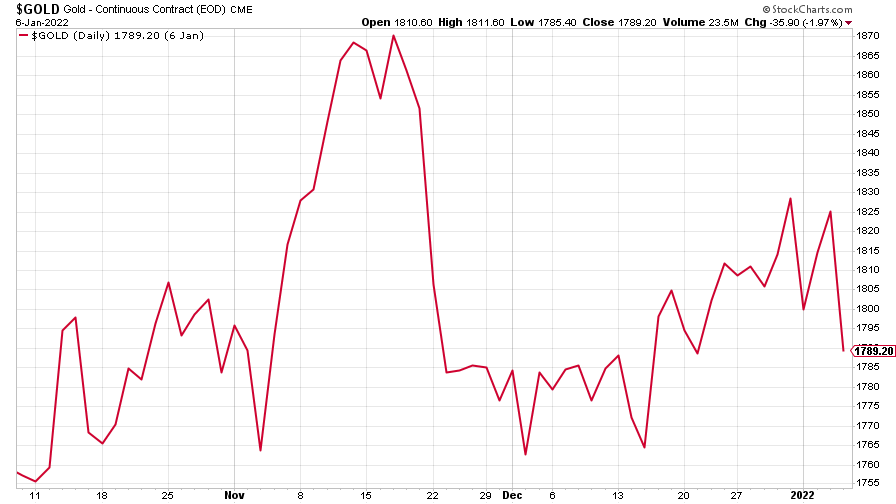

The charts that matter: markets start the year with a crash

The charts that matter: markets start the year with a crashCharts As markets start 2022 with a big selloff, here’s what happened to the charts that matter most to the global economy.

-

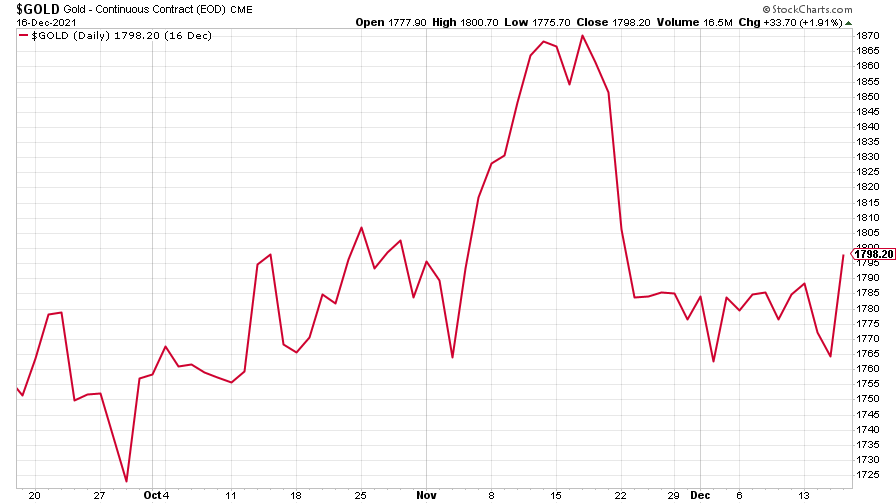

The charts that matter: Fed becomes more hawkish

The charts that matter: Fed becomes more hawkishCharts Gold rose meanwhile the US dollar fell after a key Fed meeting. Here’s what else happened to the charts that matter most to the global economy.

-

The charts that matter: a tough week for bitcoin

The charts that matter: a tough week for bitcoinCharts Cryptocurrency bitcoin slid by some 20% this week. Here’s what else happened to the charts that matter most to the global economy.

-

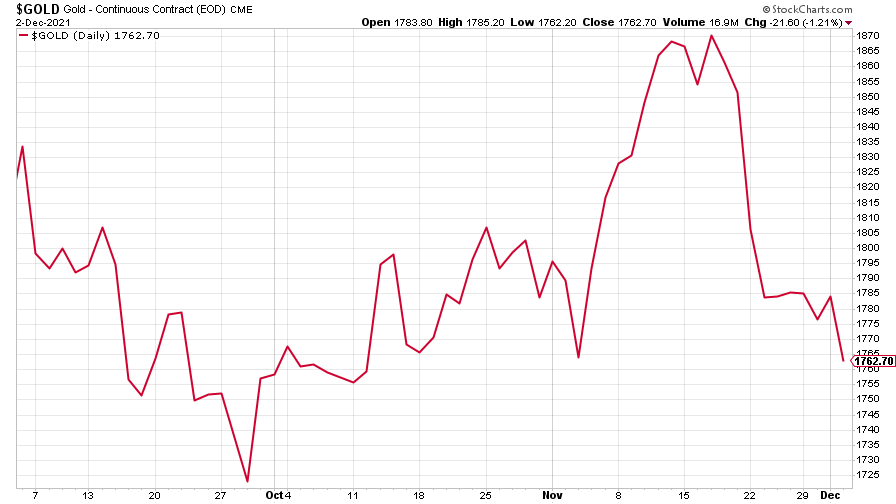

The charts that matter: omicron rattles markets

The charts that matter: omicron rattles marketsCharts Markets were rattled by the emergence of a new strain of Covid-19. Here’s how it has affected the charts that matter most to the global economy.

-

The charts that matter: the US dollar keeps on strengthening

The charts that matter: the US dollar keeps on strengtheningCharts The US dollar saw further rises this week as gold and cryptocurrencies sold off. Here’s how that has affected the charts that matter most to the global economy.

-

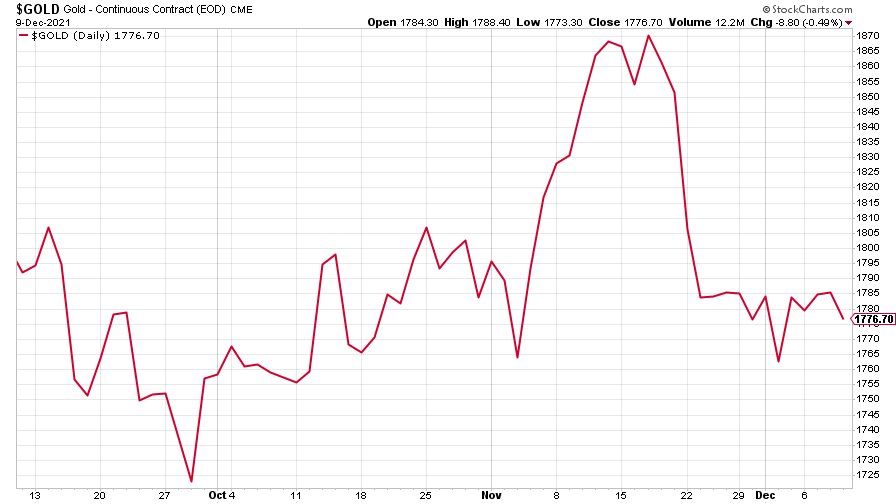

The charts that matter: gold hangs on to gains while the dollar continues higher

The charts that matter: gold hangs on to gains while the dollar continues higherCharts The gold price continued to hang on to last week’s gains, even as the US dollar powered higher this week. Here’s how that has affected the charts that matter most to the global economy.

-

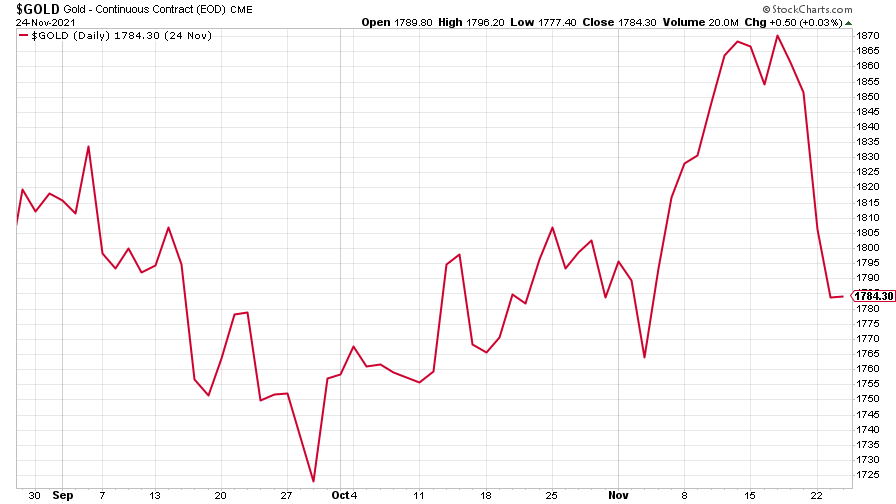

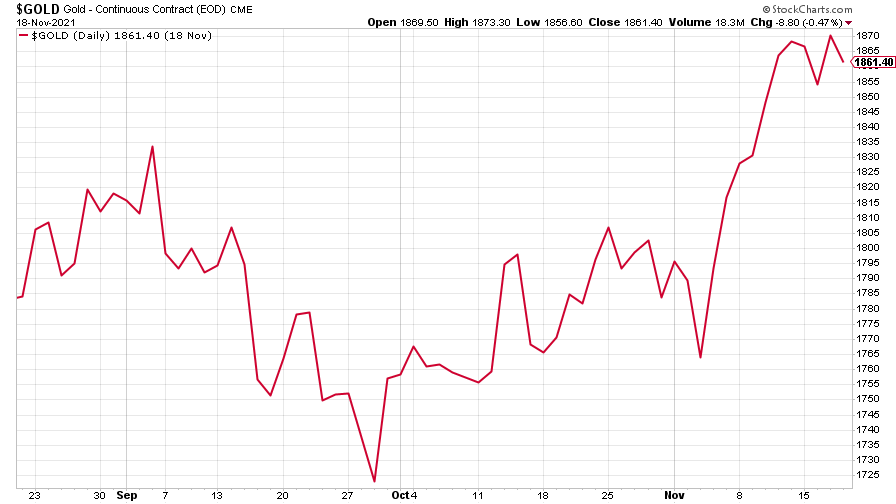

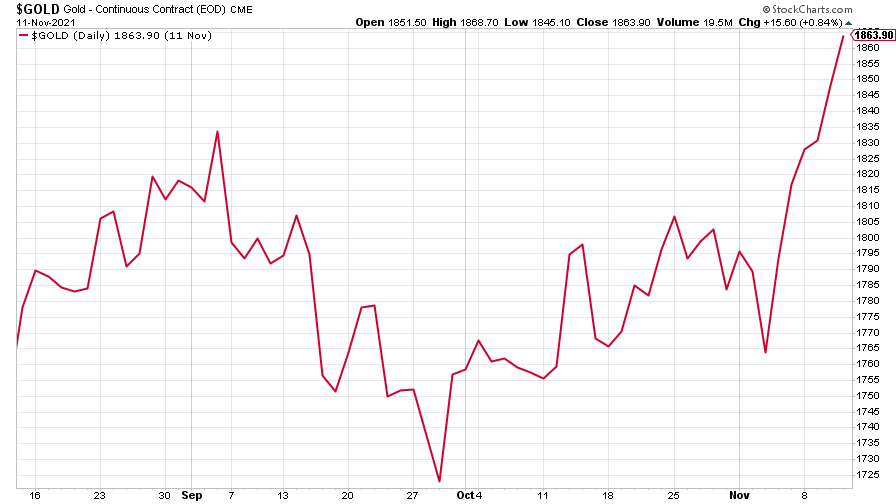

The charts that matter: inflation fears give gold a much needed boost

The charts that matter: inflation fears give gold a much needed boostCharts US inflation hit its highest in 30 years this week, driving gold and bitcoin to new highs. Here’s how that has affected the charts that matter most to the global economy.