Protect yourself from mobile-banking app scams

Security flaws in some mobile-banking apps are being exploited by crooks.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

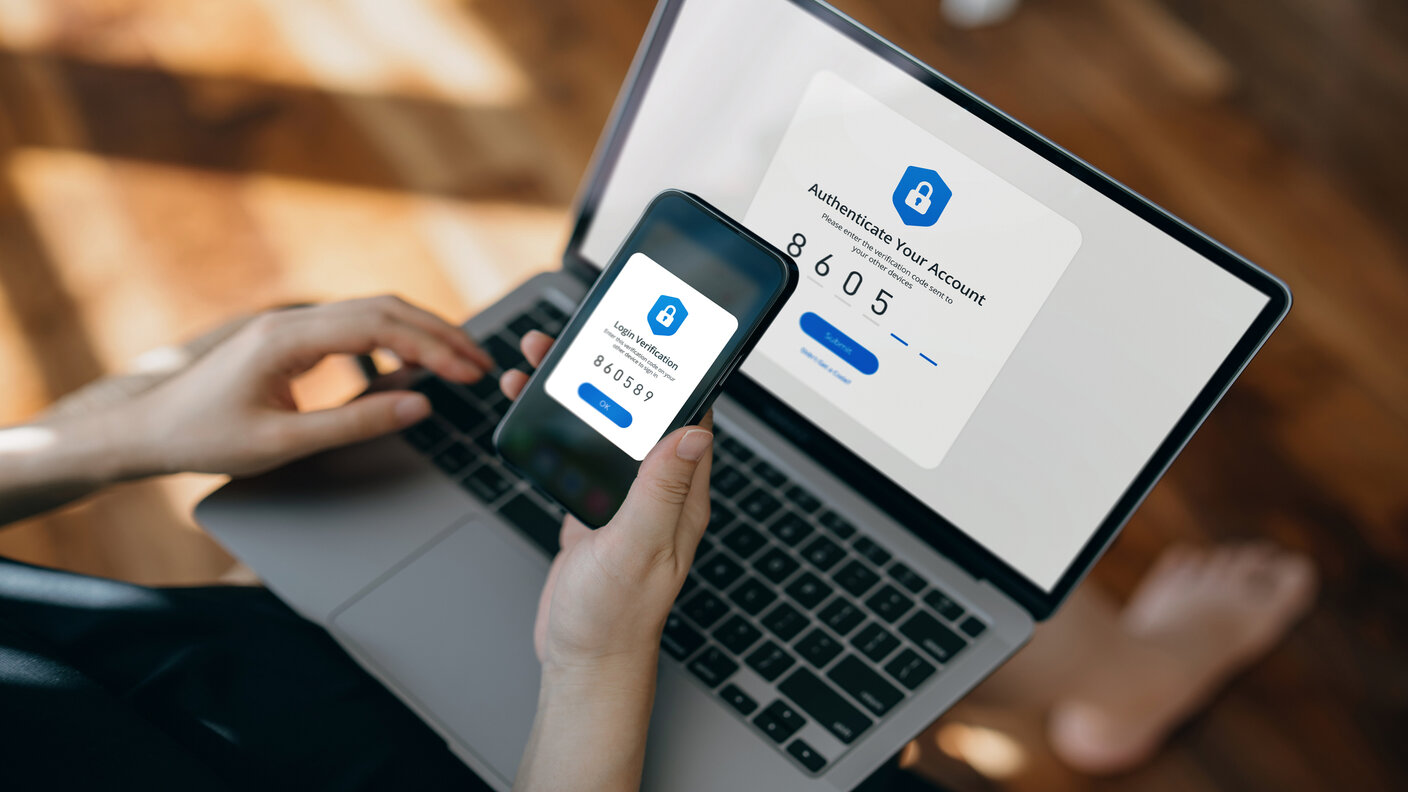

Mobile-banking security is becoming a growing issue as more and more people use banking apps.

Last year the issue gained the public’s attention when a group of thieves started breaking into lockers at gyms across London to steal bank cards and mobile phones while their owners were exercising.

They were then able to use the cards to go on shopping sprees at stores such as Apple and Harrods. Some of the victims reported that their banks were initially unwilling to refund them, saying that the criminals had used their PIN code, so they must have been at fault (eg, by keeping a note of the code with their cards).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Later the banks gave in as it became clear that the problem was not their customers’ carelessness, but weak points in mobile-banking security.

Common bank app scams

There’s no shortage of ways that thieves can try to get into somebody’s account, but many of these involve having some personal information to wriggle around security protocols.

However, what appears to be happening in these cases is simpler. The thief has the cards and the phone. Of course, if they have been able to get a PIN – for example, by watching over the victim’s shoulder as they unlock their phone or use their card – their task is much easier, especially as many people tend to use the same PIN for multiple purposes.

But even if they don’t, they may still be able to get into some bank accounts. The thief installs the mobile banking app for the bank that issues the cards on a new phone and uses the card details to register for it.

Some banks require you to pass detailed identity checks to do this, but a one-time passcode sent to your phone by text message will be enough with others. While the thief can’t get into the original phone, they may be able to read the message in the lock screen if – like many people – the victim has message previews enabled.

Alternatively, they can put the SIM from the stolen phone into another phone. At this point, they can get into the victim’s account via the app, which may allow them to check the PIN for the card or transfer funds to another account, with minimal other security checks.

The apps not vulnerable to scams

Not all apps are so vulnerable: consumer group Which reckons that Lloyds/Halifax, Virgin Money and Barclays are weaker than Chase or Monzo, for example.

But rather than relying on your bank, there are a few steps that can help stop this kind of fraud, beyond obvious ones such as having a hard-to-guess PIN. First, disable message previews so they can’t be seen when your phone is locked.

Second, set a SIM PIN, which stops your SIM being used in a new phone by somebody who doesn’t know the code.

Third, make sure you have Find My iPhone (Apple) or Google’s Find My Device (Android) enabled, so that you can lock and wipe your device remotely if it’s stolen – but note this alone won’t stop a SIM-swap, for example.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings account

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings accountUlster Bank is offering savers the chance to earn 5.2% on their cash savings, but you need to act fast as easy access rates are falling. We have all the details

-

Moneybox raises market-leading cash ISA to 5%

Moneybox raises market-leading cash ISA to 5%Savings and investing app MoneyBox has boosted the rate on its cash ISA again, hiking it from 4.75% to 5% making it one of top rates. We have all the details.

-

October NS&I Premium Bonds winners - check now to see what you won

October NS&I Premium Bonds winners - check now to see what you wonNS&I Premium Bonds holders can check now to see if they have won a prize this month. We explain how to check your premium bonds

-

The best packaged bank accounts

The best packaged bank accountsAdvice Packaged bank accounts can offer great value with useful additional perks – but get it wrong and you could be out of pocket

-

Bank of Baroda closes doors to UK retail banking

Bank of Baroda closes doors to UK retail bankingAfter almost 70 years of operating in the UK, one of India’s largest bank is shutting up shop in the UK retail banking market. We explain everything you need to know if you have savings or a current account with Bank of Baroda

-

How to earn cashback on spending

How to earn cashback on spendingFrom credit cards and current accounts to cashback websites, there are plenty of ways to earn cashback on the money you spend

-

John Lewis mulls buy now, pay later scheme

John Lewis mulls buy now, pay later schemeThe CEO of John Lewis has said the retailer will consider introducing buy now, pay later initiatives for lower-priced items.

-

State pension triple lock at risk as cost balloons

State pension triple lock at risk as cost balloonsThe cost of the state pension triple lock could be far higher than expected due to record wage growth. Will the government keep the policy in place in 2024?