The four Asian markets to put your money on now

Taken together, Asia’s four fastest-growing economies are set to overtake Japan. If you’re after growth, forget the West and head East, says Rupert Foster.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Across the developed world, investors are holding their breath, wondering which extreme monetary-policy tool central bankers will wield next to try to generate sustainable growth. But if it's growth you're after, forget the major Western economies. The four fastest-growing economies in the world (I am sceptical about China's official GDP data) are all in developing Asia. Each is run by pro-business leaders, and should see accelerating growth over the next two years. They are achieving this without monetary gimmicks, and as the table below shows with relatively "normal" interest rates. Taken together, Indonesia, Vietnam, India and the Philippines comprise the world's fourth-largest economy, and are set to overtake Japan next year to become the third largest. Their success increasingly matters for the rest of us the US will need to grow by more than 1.7% this year to match the contribution of these four to overall global GDP growth.

Bond investors are taking note government bonds offering positive yields are increasingly rare today, and as a result, emerging-market bond-fund inflows have been strong all year, driving yields lower as prices rise. Stockmarkets have been firm too. Indonesia's is up 14.6% year to date, Vietnam's 14.0%, India's 9.3% and even the Philippines' despite growing political concerns, which we'll come to later gained 8.6%. The currencies of all four have been stable to strong against the US dollar, so returns for overseas investors have been impressive.

So what are the risks of investing in these high-growth marvels, and which are most appealing? Generally speaking, emerging markets are more volatile than developed markets (the ups and downs are greater and more frequent). But as long as you don't get shaken out at the bottom, or suckered in at the top, volatility is just noise. Fund managers care about volatility because of their monthly, quarterly or annual benchmarking, but genuine long-term investors should be less concerned. Since the Asian crisis in 1997, investing in emerging Asia has been no worse than investing in developed markets over the long run, and mostly it's been much better.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Also, the path of progress for developing economies is well trodden by now their leaders and foreign investors know what policies should be implemented and when. All emerging Asian countries have large, young, well-educated populations, which helps the investment case. But they need to tick three of the four following boxes to become a great medium-term investment story: low wage levels, both relative to the Western world and now, more importantly, to Asian rivals, particularly China; pro-business leaders who encourage high levels of foreign investment; controlled levels of corruption corruption is only tolerated if it's pro-growth; and a solvent banking sector, supported by the government, that can allow for strong infrastructure investment.

| Country | New leader | Est. 2016 GDP growth | Est. 2017 GDP growth | Interest rate |

| India | Narendra Modi | +7.6% | +8.0% | 6.75% |

| Indonesia | Joko Widodo | +5.1% | +5.6% | 5.0% |

| Philippines | Rodrigo Duterte | +6.8% | +7.0% | 5.7% |

| Vietnam | Nguyen Xuan Phuc | +6.1% | +6.3% | 6.5% |

India

Moving on to individual countries of the four, India is the largest and most significant. Prime Minister Narendra Modi arrived in May 2014 on a wave of optimism. The challenges facing him were to improve both the government's fiscal position and the solvency of the state banks in order to drive forward a much-needed infrastructure boom. A few posh airports and roads do not a modern economy make India needs a lot more to encourage foreign investment and unlock the potential in its 1.3-billion-strong population. The oil-price collapse has improved the government's fiscal position, but dealing with the state banks has been tougher.

This is where India's development comes up against its entrenched, almost feudal, power bases. Corruption and cronyism have shaped state bank lending policies. Sorting out bad debts will mean the beneficiaries of this corruption will have to take some pain. These people have used all of their political power to delay or dilute the restructuring of these banks, so much so that the eminently sensible governor of the Indian central bank, Raghuram Rajan, resigned in June. Luckily, Rajan has been replaced by his deputy, which should allow for continuity in both the progress and the rigour of the restructuring, and I remain optimistic that Modi wants to use his political capital to push through this reform. Meanwhile, he has also passed laws to allow easier bankruptcies and to encourage foreign investment. Last year, India saw foreign investment of around 1.5% of GDP better than Indonesia and the Philippines, but well below Vietnam's 5%.

Even with the infrastructure delays, India is growing at 7% a year or more. A solid infrastructure story could drive growth to 10%-plus for several years, if the development experience of Japan, South Korea and China is any guide. For now, growth is mainly consumer-driven, with credit growth rising rapidly. The private banks are steadily taking market share from the bad, debt-mired state banks, and quality consumer stories such as Maruti Suzuki (which has 40% of the rapidly growing, SUV-obsessed domestic car market) provide great exposure to India's growing middle class.

Indonesia

Of our four economies, Indonesia is the least exciting, as its GDP per head is already above the key $10,000 level (the others are all below $7,000). In many ways Indonesia is a laggard from an earlier phase of Asian development, along with Malaysia and Thailand. These countries were aided by strong commodity stories, but have been held back by fraught politics. Indonesia has so far been bailed out by its large population 257 million and strong wage growth, which is fuelling a consumer boom. But the wage-growth story will run out of steam soon, unless the government can encourage an infrastructure-spending boom. If not, then wage growth will stall, as the country's relative competitiveness declines. President Joko Wikodo has done a good job so far, but needs to deliver policy change in the next year or so.

The Philippines

In June, the Philippines elected Rodrigo Duterte. "Duterte Harry", as he is sometimes known, takes an uncompromising stance on crime around 3,000 drug dealers have already been executed since he came to power. Yet he is viewed as pro-business he admits that he knows nothing about economics or business and so will leave it to the experts, and his appointments within government so far support that claim. Sabre-rattling with the US Duterte's comments about President Barack Obama being a "son of a bitch", and threats to end military co-operation with the US, do not bode well but actions speak louder than words, and Western leaders are always slow to realise that Asia's voters like to see their leaders stand up to the West.

His early friendliness with China may prove a masterstroke as he plays off the two powers in the region. Elsewhere, the economy is in a golden condition. Wages are lower and labour cheaper than China, and its large, English-speaking workforce is currently growing at an amazing 2% a year. Once again, the Philippines would benefit from more infrastructure spending and the foreign investment that goes with it. Duterte may have to be more friendly probably in private to foreign business leaders. The risk is he strays too far down the populist path and veers into Hugo Chvez territory.

Vietnam

Of the four, Vietnam is the most obvious classic development story. As I wrote here last year, Vietnam is following a carbon copy of the North Asian command-economy development model, and is right now at the stage of easiest gains. Vietnamese wages are a quarter of East Coast Chinese wages, despite its large, very well-educated workforce. The country is still run by the Communist Party and so can follow a command-economy model.

The last two prime ministers have worked hard to encourage foreign investment, with South Korea and the Samsung group doing a lot of the heavy lifting. This has allowed an electronics industry to emerge in Vietnam. Until wages get near Chinese levels, Vietnam will continue to take a significant share of global production in the last five years alone, starting from almost zero, it now accounts for a world-beating 1.6% of production of low-end goods and 3% of electrical goods (only behind China, with a 5.5% share). Despite the bad press globalisation has been getting, there are still a few clear beneficiaries and Vietnam is the largest.

On that point, it's concerning that both Donald Trump and Hillary Clinton have threatened not to sign off on the TPP trade deal we shall have to see if that threat becomes a reality. Yet either way, I don't expect it to affect Vietnam much, as it is one of the few remaining countries to combine very low wages with a helpful form of government. Vietnam is also benefiting as large electronics and textile groups diversify their risk, by moving 10%-20% of their production out of China. This is a classic investment tale, told many times before, and so is nicely predictable, as long as the leadership do not forget their lines. In short, if you want to profit from Asia's growth, there is no need to re-invent the wheel aim for economies with low wealth and wages, but great demographics and pro-growth leaderships.I look at some of the best ways to invest below.

Rupert Foster was an Asian equities fund manager for 20 years. He is now an investment strategist.

The best ways to invest in emerging growth

The easiest way to get exposure to the long-term growth prospects of these countries is to buy an exchange-traded fund (ETF) or other country-focusedfund for each market. If you want to keep it really simple, exclude Indonesia (the least exciting of the four in terms of the development stage they're at), and stick with Vietnam, India and the Philippines. For general exposure to the region, high-net-worth investors might want to investigate the Waverton South East Asian fund (Waverton.co.uk), but it comes with a high minimum investment level.

Overall, until the infrastructure boom comes along, investors in India should focus on consumption (via car manufacturers such as Maruti, for example), internet retail, and financial stocks (such as private banks Indusind and Yes Bank). A decent Indian ETF, such as the Amundi ETF MSCI India (LSE: CI2G), will provide cheap access to the overall trade and India's booming GDP growth, or you can opt for an active fund such as India Capital Growth.

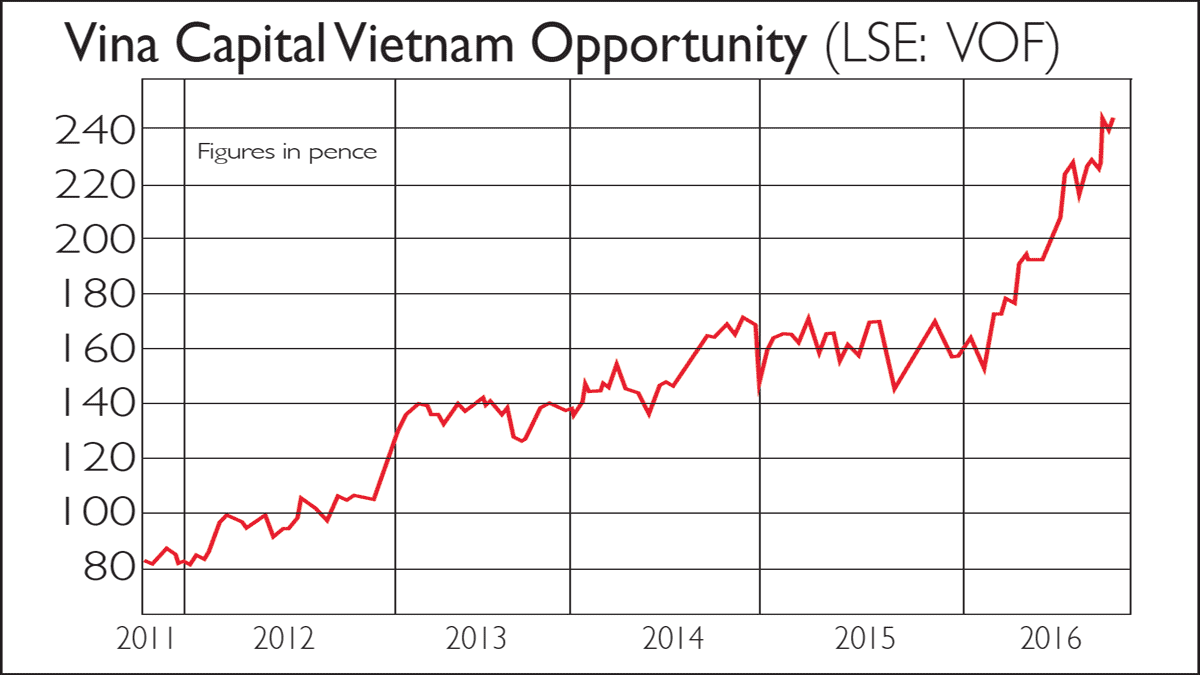

As for individual stocks it's tricky for UK investors to invest directly in Indian or Vietnamese shares. Several solid Indian businesses are listed in the US, but most are not highly geared to the main development trends. One exception worth looking at is MakeMyTrip (Nasdaq: MMYT), India's leading online travel agent. Ctrip the leading player in China bought a significant stake last year, which will aid MakeMyTrip's growth. A typical emerging-market fund will get you a bit of exposure to Vietnam, but I suggest going for a pure country fund. Dragon Capital's Vietnam Equity Fund is a good option, as is Vina Capital's Vietnam Opportunity Fund (LSE: VOF).

If you feel intrepid, direct investment is possible in both the Philippines and Indonesia. In the Philippines, I would focus on two southeast Asian blue chips food and beverage giant Universal Robina (Manila: URC) and the Jollibee (Manila: JFC) fast food chain. Also, if infrastructure spending rises, Metro Pacific (Manila: MPI) with its diversified exposure to water, roads and power is well placed to benefit. However, a good ETF, such as db x-trackers MSCI Philippines (LSE: XPHG), will give you as much exposure as most private investors might want to the Philippines story.

The Indonesian story is mainly about consumption growth, with "new economy" (internet) companies set to take significant market share across the board. Sadly, investment opportunities in this sector are few and far between, or have already been bought by the likes of China's Alibaba (which owns half of Lazada, the dominant player in e-commerce in southeast Asia).

An alternative way to play the consumer story is via Astra International its exposure to the car sector puts it in a strong position. Jardine Cycle & Carriage (Singapore: JCNC) is one way to buy in (the Jardine family own a controlling stake in Astra) without having to buy Indonesian stocks directly. If you prefer the ETF option, you can go for the HSBC MSCI Indonesia (LSE: HIDR).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is an investment strategist and adviser at J & C Foster, providing Asian, Consumer and Global Equities Strategy advice to a number of family offices and portfolio management organisations. He writes on Asia and Global Macroeconomics for a number of investment publications including MoneyWeek and HL Investment Times.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.