Britain makes history: but what of the future?

The pound and stockmarkets have crashed in the wake of the EU referendum. But don’t panic – this isn’t the disaster it’s being made out to be, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain has cast its vote. And it has made a historic decision. The country has voted to leave the European Union (EU) by a narrow margin, with 51.8% voting leave' versus 48.1% voting for remain'. Prime minister David Cameron has resigned, and is aiming to have a new leader in charge of the country by the time the Conservative conference rolls around in October. On Friday morning, as the results were announced, the pound fell to a 30-year low, and stock markets both in the UK and across the rest of the world tanked.

Here at MoneyWeek, we've been arguing since the announcement of the referendum, that leave' won't be the disaster that it's been made out to be, and that Britain can go it alone and we still wholeheartedly believe that in the long term, voting to leave the EU was the best decision for Britain to make. But what happens now? We'll be looking at the whole subject in a lot more detail in next Friday's issue of MoneyWeek magazine, once the dust has settled. But in the meantime, we've pulled together this special issue to summarise what the issues are, what questions remain unanswered, what could happen next, and where the biggest threats and opportunities are for investors.

Brexit and your investments: what now?

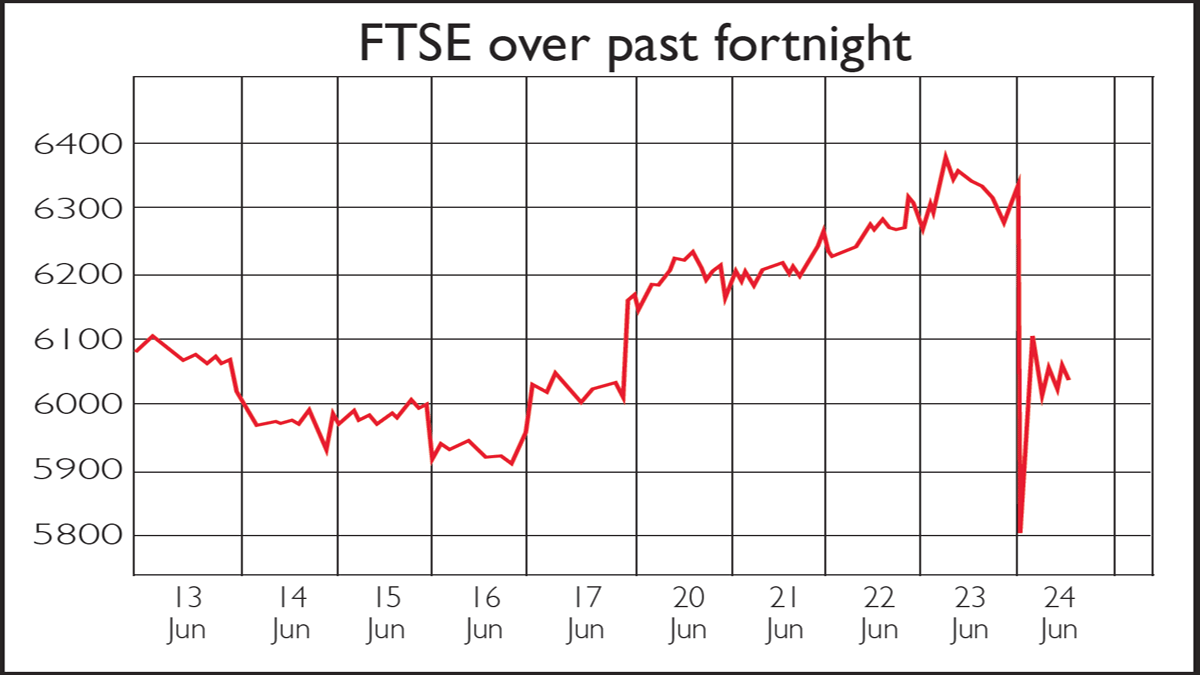

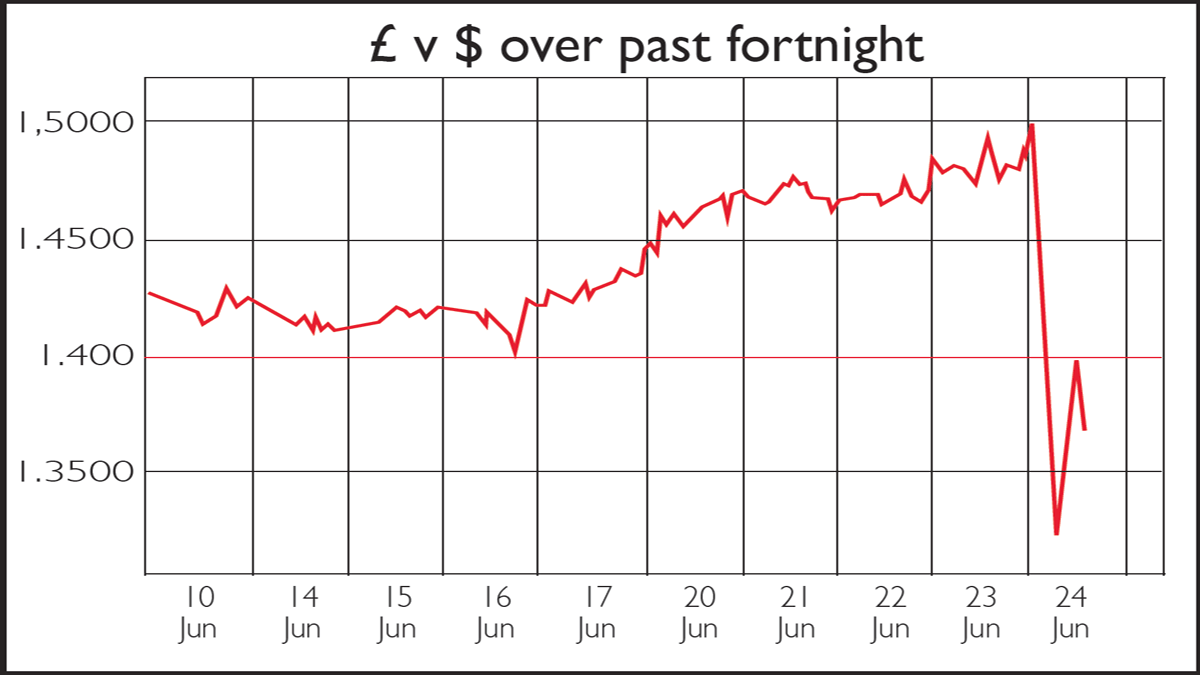

First things first, as an investor, don't panic. Don't make any sudden moves in reaction to this. That's easy to say, and if you woke up on Friday morning looking at a 10% drop in the pound and a similar-sized fall in the FTSE 100, then you probably didn't feel terribly calm. But amid talk of a massive plunge in sterling and in the stock market, it's worth getting a bit of perspective on this. The charts on this page show the movement of the pound against the dollar over the last week and a half or so, and the FTSE 100 over the same time period.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

You can see that, not much more than a week ago, both the FTSE 100 and the pound had virtually priced in' the market reaction to Brexit. In fact, the FTSE 100 was lower than it is at the time of writing. The reality is that markets got ahead of themselves, and convinced themselves that this vote was only going to go one way remain. That saw them rally hard until, come Friday morning, the risk was all on one side of the outcome even if remain' had won, there wasn't much further for sterling to bounce. Whereas, the reward was all on the opposite side of that trade it only took a narrow leave' vote to send both the pound and the stock market spiralling lower as a result of the initial shock. So the pre-vote exuberance goes some way to explaining the sheer size of the post-vote crash.

What happens now? John Higgins of Capital Economics one of the few analyst groups that swings more towards leave' than remain' suggests that this might actually be almost as bad as it gets, particularly now that "the rhetoric of pro-Remain policymakers has changed from Project Fear' to Project Reassure' and it has dawned on investors that a long period of negotiation, rather than sudden upheaval, now lies ahead." Higgins notes that Capital Economics had suggested that the pound could fall as far as $1.20. "A decline to this level now looks unlikely. That being said, we would be surprised if the exchange rate didn't fall back a little once the dust has settled."

There's another reason to be a little more optimistic on equities than perhaps the initial reaction suggests, says Higgins. And that boils down to monetary policy. Markets may not like uncertainty, as the old trope goes, but they do like loose money. And if Brexit suggests anything, it's that monetary policy will be looser than it otherwise would have been. For a start, the Bank of England has come out to reassure everyone that it stands ready to support liquidity and basically do what it takes to keep volatility under control. The Federal Reserve can use Brexit as an excuse to keep rates low too. Meanwhile, the European Central Bank will be under pressure to do something similar as we'll discuss in a moment, this is an existential threat for the EU and implicitly, the eurozone, which again suggests the possibility of more extreme action from the ECB. Finally, there's the Bank of Japan.

With the yen being viewed by markets as a safe haven' asset, the BoJ must be getting sick of the currency strengthening, especially after all its efforts to weaken it in recent years. Again, this safe haven rush just increases the chances that the BoJ will have to adopt more extreme monetary policy (something which Dan Denning, our publisher, discusses in detail in the cover story of the current issue of MoneyWeek magazine). In short, don't assume that this is a disaster for your investments. It could well be an opportunity. We look at some potential investments to keep an eye on in the box below.

Brexit and politics: what now?

In short, it could take quite some time before we actually leave the EU. Clearly, David Cameron has resigned and we will now have a different prime minister by the end of the year and probably before that. (See the box on page 6 for more details of the politics, including a potential leadership challenge for the Labour party). But what needs to be understood is that the EU referendum while Cameron clearly plans to honour it is not legally binding. To leave, Britain needs first to activate Article 50 of the Lisbon Treaty (there are other routes but they essentially involve tearing up other treaties and seem politically impractical).

Presumably Cameron does not plan to activate Article 50 before he leaves, which suggests there is next to no chance of Britain initiating the process of leaving the EU before the country has a new leader. And even after Article 50 is invoked, the UK has two years to secure a deal with the EU unless all parties involve agree to extend the negotiations.

As David Allen Green noted in the Financial Times before the vote, invoking Article 50 isn't necessarily a straightforward process either. British constitutional traditions suggest that "some form of parliamentary approval would be required perhaps a motion or resolution rather than a statute." Ruth Miller of Capital Economics notes that "the government could delay triggering article 50 until it decides on its ambitions, the political situation stabilises and until it has gained some understanding of what would be achievable in initial talks with EU member states."

So what's that likely to be? The initial reaction from the EU has been a tone of regretful but fairly hard-nosed disappointment. Jean-Claude Juncker, president of the European Commission, said that Brexit didn't spell the end of the European project. "The union of 27 member states will continue We now expect the United Kingdom government to give effect to this decision of the British people as soon as possible, however painful that process may be. Any delay would unnecessarily prolong uncertainty." He also said that "there will be no renegotiation. Any agreements will have to reflect the interests of both sides and be a balance of rights and obligations." This is to be expected. The EU doesn't want to be seen to be rolling over straight away to accommodate any recalcitrant members. According to pre-vote polls by Lord Ashcroft, around 60% of EU countries "said that if the UK does not like the terms of EU membership it should leave, rather than be given extra concessions." Perhaps more importantly, on Sunday, Spain is voting to try to form a government yet again the EU doesn't want to do anything to encourage more insurrection on that front.

That said, many EU leaders don't want to upset their own populations. Plenty of other countries are keen to get their own referendum and if granted, there's a good chance that more could vote to leave themselves. In April, a poll by Sifo showed that 36% of Swedes would want to leave the EU if Britain did, compared to 32% who would want to stay. And as the BBC points out, "leaders of eurosceptic parties in France, the Netherlands and Italy quickly demanded referendums in their own countries." So the EU has to strike a balance here, and many of the national leaders have acknowledged that. For example, Poland's EU minister Konrad Szymanski said that: "Without adaptation, without reform, we risk that we will lose another country, one or two, in the coming five or six years and we have to avoid this scenario because decomposition, a smaller union, is not the right answer today."

Meanwhile, French prime minister Manual Valls said: "It's an explosive shock. At stake is the break up pure and simple of the union. Now is the time to invent another Europe," while Italy's prime minister Matteo Renzi tweeted "We have to change [the EU] to make it more human and more just, but Europe is our home, it's our future". So it's certainly possible if not necessarily likely that the EU and the UK could still come to some sort of rearrangement that would involve Britain remaining within a reformed EU, probably after a second referendum vote.

No one wants to wreck existing trade deals

Moreover, other parties will campaign for the most important aspects of the EU such as free trade to be retained. Earlier this week, the German equivalent of the Confederation for British Industry argued that "imposing trade barriers, imposing protectionist measures between our two countries or between two political centres, the EU on the one hand and the UK on the other would be a very, very foolish thing in the 21st century. [We] would urge politicians on both sides to come up with a trade regime that enables us to uphold and maintain the levels of trade we have."

As Merryn pointed out on her blog recently: "We are Germany's third largest export partner, with sales to the UK from Germany accounting for around 3% of the country's GDP. If there isn't a quick and generous trade deal, that, say the Munich based Ifo Institute for Economic Research, could cut German long-term economic growth by 3%. The International Monetary Fund is on the same page: it predicts terrible things for the UK on Brexit but also reckons that any countries with close trade and finance links with the UK would be hit.

To that list they add Ireland, Malta, Cyprus, Luxembourg, the Netherlands and Belgium. Breakingviews.com also notes that Brexit might end up being a pain for Spain: some of its biggest companies have made big bets in the UK (think Santander, Iberdrola and Ferrovial)."

So there's going to be a lot of pressure from both the minority political parties and all of the business lobby groups to maintain business as usual' in as much as possible. In conclusion we'll know a lot more next week as the rounds of meetings get going over the weekend and throughout the week. But we'd certainly be wary of ruling out a pragmatic, rather than a spiteful outcome. On the next page, Merryn looks at some of the potential models Britain could follow.

The Brexit opportunities to keep an eye on right now

As Charlie Morris, investment director of The Fleet Street Letter newsletter points out, this is more of a "political crisis than an economic one. The reality is that the chief executive statements made so far suggest a long-term commitment to the UK. Any economic problems that we suffer are merely the old ones revisited" (for more on this, see Bernard Connolly on why leaving the EU makes perfect sense for the UK).

As for what to buy now? Charlie is taking advantage of the turmoil to pick up FTSE 250 stocks as Charles Gave of Gavekal pointed out before the vote, medium-sized UK companies "will see an immediate benefit from the cheaper pound." One way to invest in the FTSE 250 is through a simple exchange-traded fund such as the iShares FTSE 250 (LSE: MIDD).

If you don't already own Japan, this may be a good time to get back in. The main stock market index was hit hard by Brexit. The Baillie Gifford Shin Nippon investment trust (LSE: BGS)*, one way we've always liked to play Japan, is trading at an unusually low premium to its net assets following the vote. And as Jonathan Allum of SMBC Nikko points out in The Blah!, the drop in the Japanese index "is the biggest since 2011. If one looks back to 1985, there have only been seven worse days. The vast majority of these declines have, at least in the short term, proved to be buying opportunities." Moreover, pretty much regardless of what happens to the UK, this is "hardly Armageddon for the global economy."

It's also a good time to take a look at the MoneyWeek investment trust portfolio if you don't already own it.

- Merryn Somerset Webb is adirector of the Baillie Gifford Shin Nippon investment trust.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.