Brexit – a financial non-event

If Britain does vote for Brexit, we would quickly agree new trade deals with the EU, says Merryn Somerset Webb. Europe has too much to lose not to.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

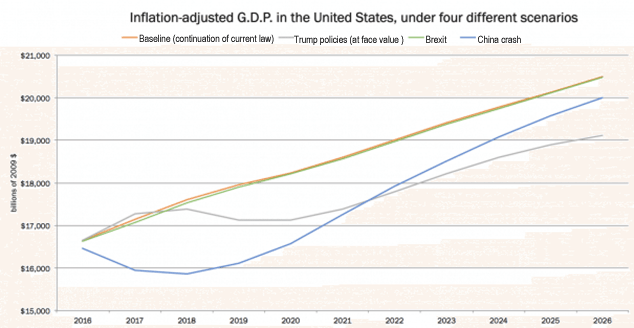

What would the global effect of Brexit be? Entirely uninteresting it seems. In her column in the Washington Post yesterday, Catherine Rampell asked Moody's Analytics to model the result on the US economy for her. As youcan see from the resulting chart below, nothing much happens in the US.

The lines for GDP with and without it separate slightly in the near term but move comfortably back together by 2020. No suggestion of much in the way of upheaval there (despite the fact that the headline refers to Brexit as a "terrible economic shock").

Things might be worse for countries inside the EU, however. Look at the papers earlier in the week and it looks like the worst affected could be Germany. We are Germany's third largest export partner with sales to the UK from Germany accounting for around 3% of the country's GDP. If there isn't a quick and generous trade deal that, say the Munich based Ifo Institute for Economic Research, could cut German long-term economic growth by 3%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The IMF is on the same page: it predicts terrible things for the UK on Brexit but also reckons that any countries with close trade and finance links with the UK would be hit. To that list they add Ireland, Malta, Cyprus, Luxembourg, the Netherlands and Belgium. #

Breakingviews.com also notes that Brexit might end up being a pain for Spain: some of its biggest companies have made big bets in the UK (think Santander, Iberdrola and Ferrovial). "It is unlikely that any EU economies would gain from the UK's exit."

Standard & Poor's agrees. It will, it says, be worst for Ireland which is the most susceptible "to any trade and migratory aftershocks" from a decision from the UK to leave. It's worth thinking about why Brexit makes no odds to the US we haven't a trade deal with them anyway so what difference? Then it's worth thinking about why it matters to likes of Germany because we do have a trade deal with them already.

This is simple stuff making a simple point: the single market matters to the rest of the EU just as much as it does to the UK (arguably rather more). So a post Brexit deal will, I think be fast and pretty straightforward. It isn't in anyone's interests for it not to be.

That might not be something that the scaremongers on all this can bring themselves to grasp (they want it to be way more complicated) but it is something that S&P point out in its report on the matter: Brexit misery for Ireland they say, only happens "in the unlikely event that an excited UK would not reach new terms on trade access to the EU after its departure."

Assuming everyone behaves sensibly we'll be in EFTA before we know it, and financially at least Brexit will turn out to be a total non-event.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn