What will Saudi Arabia’s pipe dreams mean for oil?

Saudi Arabia is hoping to break free from its dependence on oil. Can it do it? And what will that mean for the rest of us – and for the oil price? Matthew Partridge reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Saudi Arabia is hoping to break free from its dependence on oil. Can it do it? And what willthat mean for the rest of us and for the oil price? Matthew Partridge reports.

Over the past two years the oil market has beenturned upside down. By summer 2014 oil priceshad spent the best part of three and a half yearsabove $100 a barrel. Almost everyone analysts,economists, pundits, oil companies expected it tostay that way. Yet within just six months, prices hadhalved.

After a brief respite and recovery in early2015, a second slide saw both key oil benchmarks Brent and West Texas Intermediate (WTI) crashbelow $30 a barrel, levels not seen since 2004. Sincethe start of this year, prices have made anothercomeback. But can this rally last?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There are plenty offactors behind oil's slide from the glut of US shaleoil, to concerns over Chinese growth, to worriesabout rate hikes in America. But the biggest factoris arguably the actions of Saudi Arabia. The wealthyoil state says it is planning for a future beyond oil. Isthat possible? And what will that mean for oil?

This'll hurt you more than it hurts meSaudi Arabia has huge influence on the oil market.It accounts for around a fifth of the world's reserves,and its de-facto leadership of oil producers' cartelthe Organisation of Petroleum Exporting Countries(Opec) only increases its power. Between them, thecartel's 13 members account for around 40% of oilproduction and 80% of proven reserves.

However,as advances in "fracking" technology have unlockedUS shale oil, enabling America to become a topproducer too, Opec's grip on the market has slipped.After prices started to slide in 2014, most analystsassumed that Opec would slash production.

Instead,the Saudis raised output, against the wishes of manyfellow Opec members. It seemed odd, but it wasa simple recognition of reality the last thing theSaudis wanted to do was to cut down on their ownsupply and encourage America to boost productionfurther.

The decision has taken its toll on US shaleproducers, whose production costs are higher thanthe Saudis'. The number of crude oil rigs deployed inAmerica is down by more than two-thirds from itspeak, expansion plans have been mothballed, andseveral shale producers have gone bust (although theindustry endures as my colleague David Stevensonpoints out below).

But it's not just about staving off Western rivals.Saudi Arabia sees itself as the centre of both theMiddle East and the Muslim world. Iran stronglydisagrees. This conflict has its roots in the centuries-olddispute between two different branches of Islam(Saudi Arabia is mostly Sunni, Iran mostly Shia), buthas acquired a new urgency in the past five years, asa result of the "Arab spring".

Neither Iran nor SaudiArabia both highly authoritarian welcomed thepro-democracy protests that gripped the MiddleEast following the revolution in Tunisia in late 2010.But that didn't stop them from exploiting the chaosin order to advance their own interests, resulting in aproxy war between the two across the region.

In Syria, Saudi Arabia has supported Islamist rebelsagainst both Syrian dictator Bashar al-Assad, andthe moderate Syrian opposition. In response, Iranhas given Assad weapons and troops. In Yemen,Iran has backed the Houthi insurgency, which hasdriven the internationally recognised governmentfrom the former Yemeni capital, Sana'a.

In response,Saudi Arabia has bombed Houthi positions. So forSaudi Arabia, cheap oil is as much an economic weapon asa liability. Low prices might hurt Riyadh, but theSaudis hope that they will be more painful for Iran which has recently re-entered the oil market after theUS lifted sanctions against the country and alsoRussia, which is friendly to both Iran and Assad.

Saudi Arabia's game of thrones

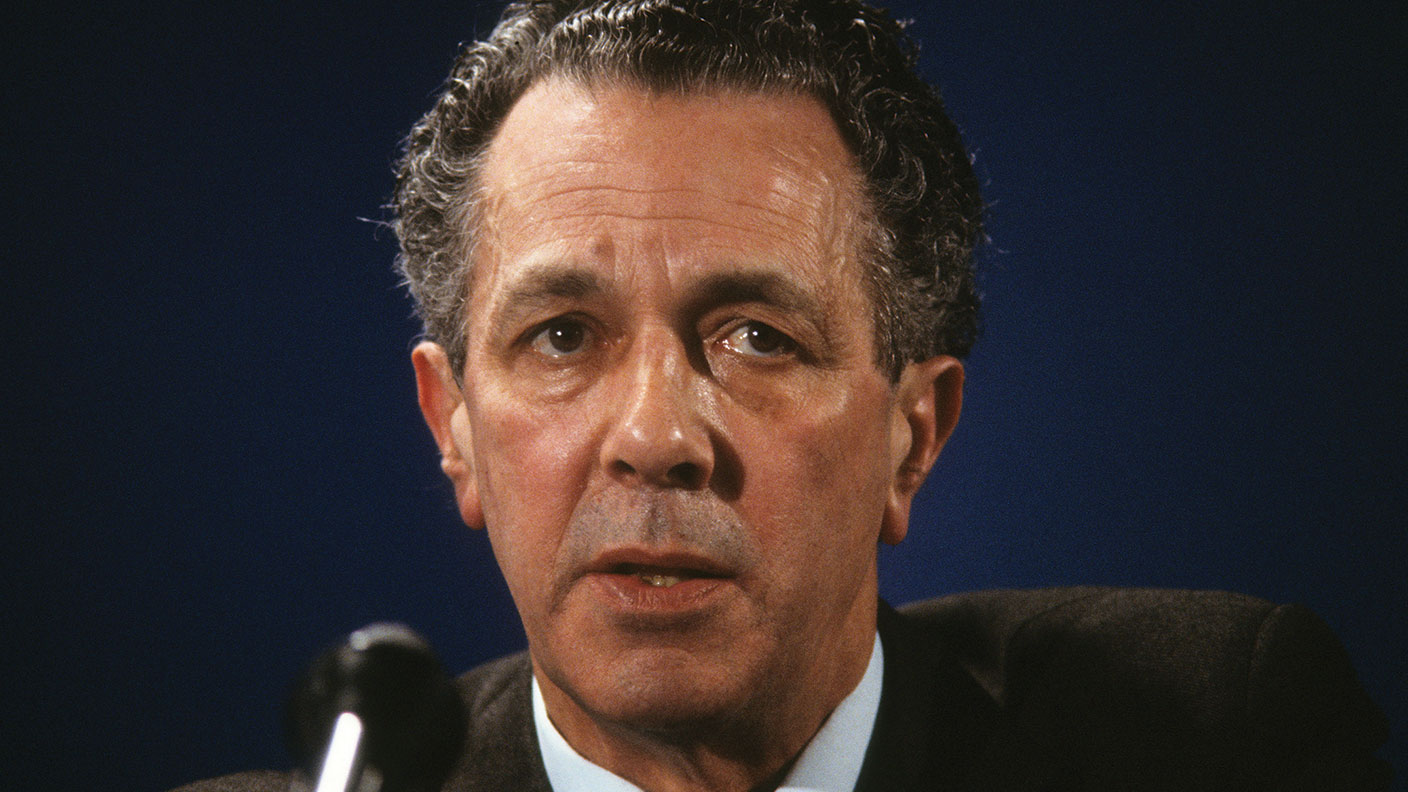

A succession struggle has merely complicatedthings further. Last year, 80-year-old Salmanbin Abdulaziz Al Saud became king, giving himabsolute power. However, reports suggest hesuffers from dementia and struggles to carry outeven basic duties.

The official heir is the crownprince and interior security minister, Muhammadbin Nayef. However, analysts think he wants topass the crown to his son, the 30-year-old deputycrown prince, Mohammad bin Salman Al Saud(normally the crown passes from brother to brother).

Prince Mohammad, currently the Saudi defenceminister, is known for his aggressive anti-Iranian stance. Not only has he played a key role in SaudiArabia's Yemen campaign, but last month heoverruled the Saudi oil minister to veto a deal thatwould have seen Opec producers join Russia tofreeze production at January's levels. Why the veto?Because the deal didn't include Iran.

Meanwhile, afortnight ago, the prince outlined a dramatic neweconomic policy that would see Saudi Arabia slashwelfare spending, and end its "addiction to oil" bydiversifying the economy. Mohammed has evenpromised to float a small stake in state-owned oilgiant Aramco, and create a huge sovereign wealthfund. Most ominously for other oil producers, thereport pledges that the reforms will go ahead, evenif the oil price falls below $30, suggesting the Saudisare planning for prices to remain low.

Keep pumping oil to hang on to market share,while quickly diversifying away from a dependenceon the stuff. It sounds like a good plan on paper.But it's unlikely to work in reality, says geopoliticalanalyst John McCreary of KGS NightWatch. TheSaudis have been talking about diversification fornearly two decades now, but have made little orno progress. In 2005 the creation of a $100bn city,which was meant to turn the kingdom into a centreof finance and manufacturing, was announced.

Last year, the Saudigovernment admitted thatthe project would take afurther two decades tocomplete, if it ever gets offthe ground at all. One keyissue is Saudi Arabia's harshreligious laws. To becomean attractive destination forfinance and non-religioustourism industries thecountry is keen to encourage these would have to betoned down substantially. Butthat would mean confrontingthe powerful religiousestablishment, and that'sunlikely to happen.

For thelast four decades or so theregime has operated underan implicit agreement, wherebyit adheres to a harsh interpretation of Islamic lawsin exchange for the religious authorities supportingthe absolute monarchy and opposing anything thatwould diminish its power.

Easier said than done

So diversification is easier said than done. Andthe fact is that for all the bravado, cheap oil isplaying havoc with the Saudi economy. Oil revenuesaccount for 90% of government revenue, so fallingprices have caused the deficit (the gap betweenannual income and spending) to explode to $98bn,equivalent to 15% of GDP.

The war in Yemen isalso proving expensive. As for cutting spending as many other, more stable nations have learned,budget cuts look good in theory, but getting thempast a hostile population is a different matter. SaudiArabiafaces potential unrest from both its Shia minorityand its youthful population, meaning that anyattempts at austerity are likely to spark popularprotest.

Tentative efforts towards modest tax risesand subsidy cuts have already proved extremelyunpopular. The financial situation is so unhealthythat credit-ratings agenciesrecently downgraded Saudibonds, while the internationalMonetary Fund warns thatSaudi Arabia could conceivably runout of financial assets withinfive years. One sign of justhow hard cheap oil is hittingSaudi Arabia comes fromthe construction business.

The Saudi Binladin Group,the largest builder in the country,fired around a quarter of itsworkforce 50,000 workers.The staff were mostlyexpatriates from Asia,and the Binladin Groupclaims they were paid offin full, but there have beenprotests nevertheless, someof them violent.

Finally, Saudi Arabia's policy ofpushing down prices is alienating its Arab allies,including those in the Gulf. So despite the failureof the most recent Opec talks, there are plentyof reasons to think that Saudi Arabia couldcompromise in the near future.

Indeed, as ThomasPugh of Capital Economics points out, the Saudiswere among the first to raise the possibility offreezing output in the first place, so a completeIranian freeze may not be the stumbling block mostassume instead, a smaller increase from Tehranmay be a possible compromise.

So how high could prices rise if Saudi Arabia does agree tocuts? Most economists agree that the governmentneeds prices to rise to around $100 a barrel toenable it to balance the budget. US shale oil meansthat seems highly unlikely to happen.

However, it'splausible that we could see prices rise to around $60-$65, the level at which the majority of the US shaleindustry becomes viable again. Capital Economicsexpects a medium term price of $60 a barrel. Welook at the best ways to play the oil market rebound below.

The best bets in the sector

If you're looking for a direct "long" bet on oil, then an exchange-traded commodity fund such as ETFS Commodity Securities Crude Oil (LSE: CRUD) is one option. It is linked to the Bloomberg WTI index (so should rise or fall with the oil price) and has a total expense ratio of 0.49%.

However, direct bets on commodity prices are little more than speculation. A better strategy is to invest in beaten-down oil stocks. Royal Dutch Shell (LSE: RDSA) looks the most attractive of the UK oil majors. Shell refused to hedge its production when prices tumbled, but that means it stands to benefit all the more if prices continue to recover.

Meanwhile, the company has slashed both capital spending and operating expenses. It trades at 13.7 times 2017 earnings, and should be able to maintain its dividend at the current 7% yield. Rising prices should also help those explorers who can survive long enough to take advantage of the rebound.

James McKeigue notes that there has been a lot of interest in the gas and oil deposits in the Vaca Muerta deposit in Argentina, helped by government subsidies and heavy investment from international oil companies. One way to play this is via Andes Energia (LSE: AEN), though be aware that the company is not making any profits yet, so it's a high-risk trade.

Finally, there's state-owned Brazilian producer Petroleo Brasileiro (NYSE: PBR), aka Petrobras. Petrobras is a really risky play, due to the various corruption scandals surrounding the company and Brazil.

However, we expect theimpeachment of Brazilian presidentDilma Rousseff to act as a catalyst for ahost of business-friendly reforms, amongwhich is likely to be reform of Petrobras.This should enable the company to cutcosts and debt. At the moment it tradesat 6.7 times 2017 earnings and nearly a50% discount to book value.

We're on the bottom now's the time to buy

Oil prices could fall again maybe towards $30 a barrel but I think we've seen the bottom, writes David Stevenson. Managers are now launching funds to take advantage. Guinness Asset Management is in the early stages of launching a new oil and gas closed-end fund, for example.

Guinness has experience in the sector with its Global Energy Fund, but now it has recruited two exploration and production (E&P) experts from investment house M&G Sachin Oza and Stephen Williams. The pair's new fund will focus on smaller, listed E&P stocks.

The fund is built on an assessment of the top ten basins for oil and gas globally, and will have a strong African and Latin American flavour. The portfolio will contain around 30 stocks, and the managers will then try constructively to engage with the businesses, to encourage consolidation. You'll need at least $100,000 to invest in it in the first instance, though it might become more widely available later.

If you like the idea but don't quite have the capital to hand, there's Riverstone Energy (LSE: RSE), which I own myself. Riverstone takes a private-equity approach to North America-based E&P businesses, as well as midstream sectors, and aims to back management teams with proven records.

Everything seems to be going to plan, judging by the most recent results, and the shares haven't been hit as hard as those of most E&P firms. Numis reckons it's currently trading at a discount of around 26% to net asset value (on a share price of 815p).

Riverstone focuses on big North American shale deposits. If Riverstone is right, then Saudi Arabia's plan of sabotaging the unconventional oil and gas boom hasn't worked. There's been plenty of pain, but these huge reserves remain in business.

That would be terrible news for mostOpec members, who've endured terriblefinancial stress backing a plan that hasn'teven achieved its key objective. The goodnews potentially is that Riverstoneis still sitting on a fair amount of cash,which it can use to cherry-pick distressedassets just 77% of its total funding of$1.3bn has been invested to date.

The bad news is that some of thosedistressed assets might actually besitting on its balance sheet it takes awhile for bad private-equity decisions towork their way into the share price,so it's almost impossible to work outwhether Riverstone has a collection ofprized assets, or overpriced stinkers.

Given the expertise of management andits past success, I suspect the former.So if you're playing a big rebound in oilrelatedequities, what better way than toinvest via a fund with a chunky discountto net asset value, core North Americanassets and a pot of money to buy dirt-cheapassets?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek news quiz: Can you get smart meter compensation?

MoneyWeek news quiz: Can you get smart meter compensation?Smart meter compensation rules, Premium Bonds winners, and the Bank of England’s latest base rate decision all made the news this week. How closely were you following it?

-

Adventures in Saudi Arabia

Adventures in Saudi ArabiaTravel The kingdom of Saudi Arabia in the Middle East is rich in undiscovered natural beauty. Get there before everybody else does, says Merryn Somerset Webb

-

The cost of petrol in the UK compared with the rest of the world

The cost of petrol in the UK compared with the rest of the worldNews The price of petrol in the UK went through the roof last year, but has since settled. We look at how UK petrol price compares with the rest of the world.

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why we need to get a grip on our government

Why we need to get a grip on our governmentEditor's letter Our government is trying to do too much, enacting policies that are destructive to the private sector. It needs to drop the the feel-good nonsense and create policies that lead to long-term wealth, says Merryn Somerset Webb.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?