Pocket some grey pounds – three healthcare stocks to buy now

The ageing population is an opportunity for the health and medical sector. Here, professional investor Garry White picks three healthcare stocks to buy now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Each week, aprofessional investor tells MoneyWeek where he'd put his money now. This week:Garry White, chief investment commentator, Charles Stanley.

Asset allocation matters more than individual stockpicking. So you must pay attention to trends across sectors and markets, to ensure you are well positioned for future moves. One of the biggest trends in the FTSE 100 this century was the rise and now fall of commodities. The weighting of commodity-related stocks in the index is now falling as Chinese growth stutters and supply moves into surplus, sending miners' share prices to multi-year lows. Oil companies are also being hit while oil-service companies such as Petrofac and Wood Group have already been demoted from the index. Another sector with a declining blue-chip weighting is engineers, with companies such as Melrose Industries demoted to the FTSE 250 and Weir Group a strong candidate to exit at next month's reshuffle.

But one sector healthcare looks very different. The global population is rising, ageing and gentrifying. As people get richer they tend to spend more on health and wellbeing. This is an opportunity for drugs groups, healthcare providers and medical device makers. Over the next few years, the healthcare component of the FTSE 100 is likely to grow. AstraZeneca and GlaxoSmithKline have endured significant pain over the last few years: blockbuster treatments have come off patent and new discoveries have been few and far between. However, they now seem to be over the worst. Shire has ambitious, acquisitive plans and Hikma Pharmaceuticals, which entered the FTSE 100 in March, is also likely to grow by acquisition. In the FTSE 250, NMC Health, the largest healthcare provider in the United Arab Emirates, and Abu Dhabi-based Al-Noor Hospitals are also growing fast.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

One way to play the rise of healthcare provision in emerging markets is via an exchange-traded fund (ETF). The db x-trackers MSCI EM Healthcare fund (LSE: XMEH) tracks the emerging-markets healthcare sector. A company's weighting in the index depends on its relative size based on the combined value of its readily available shares, compared to other companies. The index holds 30 equities across ten countries and has a dividend yield of 0.88%. The top ten holdings account for 60% of the ETF and the sector breakdown within this is 68% pharmaceuticals, 20% healthcare facilities, 6.7% healthcare distributors, 2.3% managed healthcare, 1% healthcare supplies and 1.3% life science tools and services.

Hikma (LSE: HIK) does not develop its own drugs, but makes generic copies of older medicines whose patent protection has expired. Its recent purchase of US specialist generics company Roxane from Germany's Boehringer Ingelheim for $2.65bn has transformed its position in the US market. Revenues in 2014 were up 9% and the company expects to meet the City's growth expectation this year.

In the past, Shire (LSE: SHP) has been accused of being too reliant on its best-selling treatment for attention deficit hyperactivity disorder (ADHD), Adderall XR. But Shire's current strategy involves expanding into high-profit margin niche treatments. These include treatments for conditions such as binge-eating disorder. Last year, Shire's revenues came in at around $6bn, but the company has recently made an unsolicited bid for recently listed US business Baxalta. Baxalta's board is yet to open its books and the offer is likely to be raised. Shire sees the deal as an opportunity to create a global leader in rare diseases, with product sales of about $20bn by 2020.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Garry White is chief investment commentator at Charles Stanley.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Shire: a tempting buy-out bet

Shire: a tempting buy-out betFeatures Pharmaceuticals firm Shire is set to be taken over – but it’s cheap even if the deal fails.

-

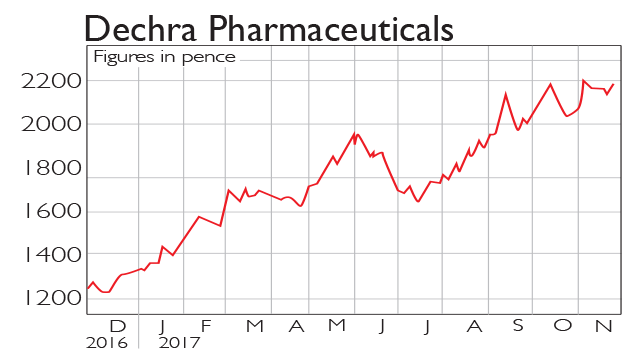

If you’d invested in: Dechra Pharmaceuticals and Shire

If you’d invested in: Dechra Pharmaceuticals and ShireFeatures Dechra Pharmaceuticals is a drugs company that specialises in the development of medical treatments for pets. Over the next three years, the firm’s earnings per share is expected to more than double.

-

Three stocks to profit from the boom in pharma M&A

Opinion Ailsa Craig picks three stocks that should capitalise on the M&A trend in the pharmaceutical sector, either as potential targets or as well-established acquirers of other rivals.

-

UK stocks ahead as investor shrug off fresh oil price drop

UK stocks ahead as investor shrug off fresh oil price dropMarket Reports Investors have shrugged off concerns over the falling price of oil this morning ahead of the release of US earnings data.