Three stocks to profit from the boom in pharma M&A

Ailsa Craig picks three stocks that should capitalise on the M&A trend in the pharmaceutical sector, either as potential targets or as well-established acquirers of other rivals.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Each week, a professional investor tells us where she'd put her money. This week: Ailsa Craig of the International Biotechnology Trust.

We expect that mergers and acquisitions (M&A) activity will remain at high levels in the biotechnology sector over the next few months. Larger pharmaceutical and biotechnology companies will continue to snap up smaller rivals because these small companies are better at developing innovative drugs. Despite Donald Trump's recent comments about the high price of US drugs, it will be difficult to implement policies that force healthcare companies to reduce the cost of medicines. However, increased scrutiny may persuade firms not to increase prices as much as they would have done. That would provide an additional incentive for large companies to acquire smaller firms in a bid to increase earnings, as price curbs will otherwise have a negative impact on sales and profit growth. We have chosen three companies that capitalise on this M&A trend, either as potential targets or as well-established acquirers of other rivals.

Genmab (Copenhagen: GEN) is a Danish firm that specialises in producing drugs to treat cancer. It developed Darzalex, which is used to treat multiple myeloma a form of bone-marrow cancer. The drug does not cure the disease, but it significantly improves the chances of survival. Genmab formed a partnership with Johnson & Johnson to help develop, manufacture and market the drug worldwide. Since the launch of Darzalex in the US at the end of 2015, its sales have beaten expectations, and the outlook is extremely positive as it will not face a competing product over the near to medium term. The drug may also prove efficacious at earlier stages of the disease as well as being used in other forms of cancer. The strength of Darzalex's position may make it compelling for Johnson & Johnson to acquire Genmab.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Shire (LSE: SHP) owes its success to Adderall, a treatment for attention-deficit-hyperactivity disorder. This franchise has been very lucrative, but the company's reliance on Adderall meant that the expiry of its patents had the potential to be disastrous. So Shire has embarked on a series of acquisitions, including Dyax, ViroPharma and Baxalta, which specialise in rare diseases and haematology. It has developed and launched Xiidra, an ophthalmology drug, which is expected to do well. Shire is attractively valued, has strong earnings growth and is likely to continue to be interested in acquiring smaller firms.

Incyte (Nasdaq: INCY) has seen strong sales for Jakafi, a treatment for myelofibrosis, which launched in partnership with Novartis. The firm is set to launch baricitinib, in partnership with Eli Lilly, to treat rheumatoid arthritis. It also has a late-stage oncology drug called IDO, which is being tested in combination with a number of oncology drugs in non-exclusive deals with major pharmaceutical firms. Incyte's product pipeline makes it a desirable acquisition target and Gilead Sciences is rumoured to be interested in buying the company.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ailsa Craig has been the lead portfolio manager of International Biotechnology Trust (IBT) since 2021.

Ailsa has managed IBT since 2006. She began her career at Insight Investment / Rothschild Asset Management before joining Baring Asset Management as a research analyst. She holds a BSc (Hons) in Biology from the University of Manchester, the IMC and the Securities Institute Diploma.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Shire: a tempting buy-out bet

Shire: a tempting buy-out betFeatures Pharmaceuticals firm Shire is set to be taken over – but it’s cheap even if the deal fails.

-

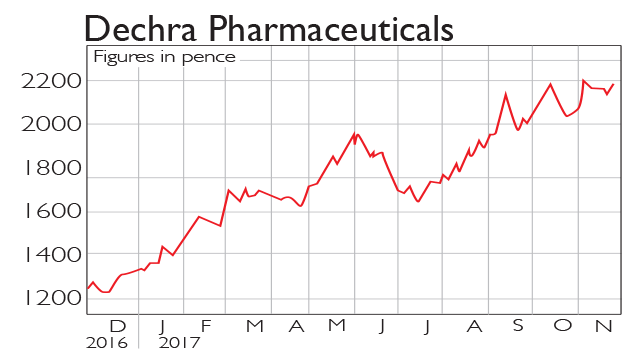

If you’d invested in: Dechra Pharmaceuticals and Shire

If you’d invested in: Dechra Pharmaceuticals and ShireFeatures Dechra Pharmaceuticals is a drugs company that specialises in the development of medical treatments for pets. Over the next three years, the firm’s earnings per share is expected to more than double.

-

Pocket some grey pounds – three healthcare stocks to buy now

Opinion The ageing population is an opportunity for the health and medical sector. Here, professional investor Garry White picks three healthcare stocks to buy now.

-

UK stocks ahead as investor shrug off fresh oil price drop

UK stocks ahead as investor shrug off fresh oil price dropMarket Reports Investors have shrugged off concerns over the falling price of oil this morning ahead of the release of US earnings data.