If you’d invested in: Dechra Pharmaceuticals and Shire

Dechra Pharmaceuticals is a drugs company that specialises in the development of medical treatments for pets. Over the next three years, the firm’s earnings per share is expected to more than double.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

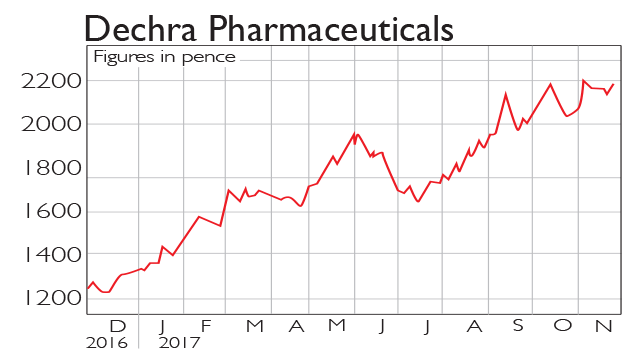

Dechra Pharmaceuticals (LSE: DPH) is a drugs company that specialises in the development of medical treatments for pets. Pet ownership is on the rise around the globe, as is spending on those pets, so Dechra is operating in a booming market.

Over the next three years, the firm's earnings per share is expected to more than double. Over the same time period, revenue is predicted to grow from £359m to £465m; profit, from £26m to £57m.

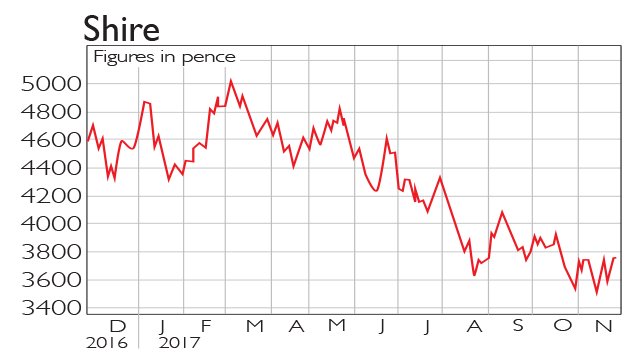

Be glad you didn't

Shire (LSE: SHP) is a biotechnology group with treatments for attention-deficit hyperactivity disorder and inflammatory bowel disease, among others. It has suffered from problems in the production of one of its best-selling drugs, Cinryze. Despite this, the firm has posted a 7% rise in sales to £3.7bn in the quarter to the end of September. Management is considering splitting the firm in two so it can focus more on developing medicines for rare diseases.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Shire: a tempting buy-out bet

Shire: a tempting buy-out betFeatures Pharmaceuticals firm Shire is set to be taken over – but it’s cheap even if the deal fails.

-

Three stocks to profit from the boom in pharma M&A

Opinion Ailsa Craig picks three stocks that should capitalise on the M&A trend in the pharmaceutical sector, either as potential targets or as well-established acquirers of other rivals.

-

Pocket some grey pounds – three healthcare stocks to buy now

Opinion The ageing population is an opportunity for the health and medical sector. Here, professional investor Garry White picks three healthcare stocks to buy now.

-

UK stocks ahead as investor shrug off fresh oil price drop

UK stocks ahead as investor shrug off fresh oil price dropMarket Reports Investors have shrugged off concerns over the falling price of oil this morning ahead of the release of US earnings data.