Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

UK stocks notched up gains in early action as investors looked to shrug off a further retreat in oil prices and concerns about the outlook for the upcoming US fourth quarter earnings season.

AT 10.13am, the FTSE 100 was ahead 29.36 points or 0.45% to 6,530.5.

Pharmaceuticals group Shire (LSE: SHP) was in focus on news that it is buying US group NPS Pharma(Nasdaq: NPSP)for $5.2bn in cash. Shire plans to accelerate the growth of NPS Pharma's innovative portfolio, focused on gastrointestinal disorders and rare disease patient management.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The deal comes just a couple of months after a £32bn takeover of Shire by US group AbbVie folded.

Oil majors were a drag this morning, with BP (LSE: BP), Shell (LSE: RDSA) and BG Group (LSE: BG) all down just under 1%, as Brent crude fell over 2.5% in early action to $48.81 a barrel.

Concerns about the near-term outlook for oil prices were heightened by Goldman Sachs cutting its average forecast for Brent in 2015 to $50.40 a barrel from $83.75 a barrel. The broker reckons that in three months time, the price will be as low as $42 a barrel.

Overnight news that a big US oil refinery has been hit by explosions and fire, disrupting production, further undermined sentiment over the outlook for oil prices over the short-term.

Amongst the housebuilders, Taylor Wimpey (LSE: TW)assured investors in a trading update that its order book stands at record levels and that it has kicked off its new year in an "excellent position". The firm says it is benefiting from a "more sustainable housing market".

Investors are nervously eyeing the start of the US fourth quarter earnings season today with aluminium group Alcoa (NYSE: AA) slated to enlighten after close on Wall Street. Corporates on the fourth quarter runway for later this week include Goldman Sachs (NYSE: GS), JPMorgan Chase & Co (NYSE: JPM) and Wells Fargo (NYSE: WFC).

The Wall Street Journal reckons the reporting season will test investor nerves as it is likely to reveal the softest US profit growth in years, thanks to the collapse in oil prices and a strong dollar.

That "double whammy", together with the highest valuations for US stocks since the financial crisis, will test the market's ability to prolong its extended bull run, ensuring more bumpy trading in the weeks ahead.

Elsewhere, The Daily Telegraph reports that North Sea oil and gas firms are to be offered tax breaks by Chancellor George Osborne to avoid a drastic reduction in their investment programmes due to the dramatic fall in oil prices.

The Guardian, meanwhile, cites Jeremy Leggett, an award-winning scientist and former oil and gas industry adviser, as saying that the oil price crash coupled with growing concerns about global warming will encourage at least one of the major oil companies to turn its back on fossil fuels in the near future.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kam is a former deputy editor at Hemscott Invest and online editor, City A.M and he was also previously the Digital Editor at IFA Magazine. Kam is currently a senior journalist at The Global Treasurer and contributes to MoneyWeek. Kam shares expertise on the FTSE 100, investing and global stocks.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Shire: a tempting buy-out bet

Shire: a tempting buy-out betFeatures Pharmaceuticals firm Shire is set to be taken over – but it’s cheap even if the deal fails.

-

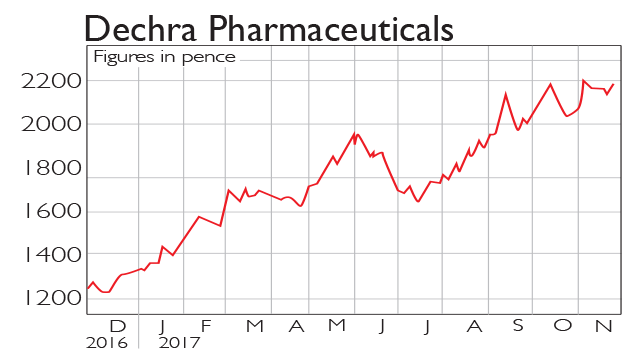

If you’d invested in: Dechra Pharmaceuticals and Shire

If you’d invested in: Dechra Pharmaceuticals and ShireFeatures Dechra Pharmaceuticals is a drugs company that specialises in the development of medical treatments for pets. Over the next three years, the firm’s earnings per share is expected to more than double.

-

Three stocks to profit from the boom in pharma M&A

Opinion Ailsa Craig picks three stocks that should capitalise on the M&A trend in the pharmaceutical sector, either as potential targets or as well-established acquirers of other rivals.

-

Pocket some grey pounds – three healthcare stocks to buy now

Opinion The ageing population is an opportunity for the health and medical sector. Here, professional investor Garry White picks three healthcare stocks to buy now.