I correctly predicted the euro would turn up at $1.11

Elliott wave theory has once again proved why it's an invaluable tool when it comes to trading the euro, says John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It has been two weeks since Mario Draghi announced the European Central Bank (ECB) would start printing oodles of euros.

Conventional wisdom says this announcement should make the euro fall in value (the more euros Draghi prints, the less each individual euro is worth).

The conventional story is wrong, though. The euro hasn't crashed the way many said it would. The market was expecting money printing (AKA quantitative easing (QE)) in the eurozone, so when the announcement came, it was already factored into the price of the euro.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I am always on the lookout for weird events like this. When a market fails to react in the expected way, it can reveal important trading opportunities.

The euro is only the most recent example.

We saw the same thing happen last year when the Fed announced its most recent money-printing programme. After the Fed announced the programme, the dollar started a rally that is still ongoing.

When a market makes such a contrary move, there is obviously something else going on besides the QE effect.

A new trend is coming

But as the trader Joe Granville loved to say, "When it appears obvious to the majority, it is obviously wrong".

So when a trend changes direction, that means a different theme has become dominant but it may not become apparent to traders for some time. In the meantime, the market churns as traders try to figure out what they should believe! This period can be a nightmare to trade.

So the question is this: now that the market has digested the news about the eurozone money-printing blitz, is there a new theme emerging? Will we see a euro recovery? That would certainly be against majority opinion.

In my postof 21 January, I noted a 'head and shoulders' pattern, which is a well-known reversal pattern. A reversal pattern indicates the main trend is about to change.

This was the chart I had then:

All it would have taken to verify the head and shoulders pattern would have been a move above the 'neckline' into the pink zone.

So did the market move into the pink zone after 21 January? Let's update the chart to this morning:

The market broke above the neckline on Monday, 26January. That gave me confirmation of the head and shoulders pattern, and so of the trend reversal.

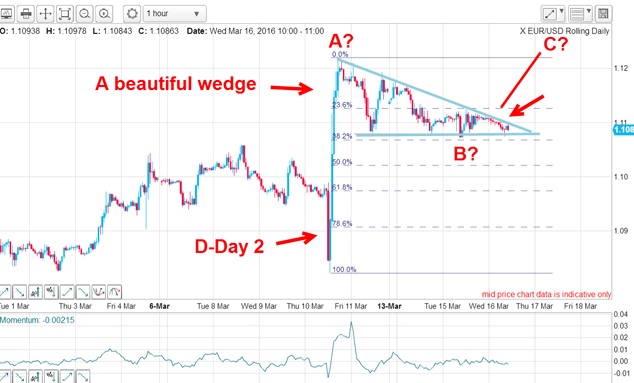

After it broke the neckline of the head and shoulders pattern, a beautiful wedge pattern started to emerge.

When a market changes direction, it often enters into a churning phase with no clear direction up or down. The wedge pattern describes this perfectly. But eventually, a decision is made and the market moves out of this wedge usually violently.

Yesterday, the market broke strongly upwards out of its wedge pattern.

The euro is going up

I can see an Elliott-wave pattern forming. There are five waves down to the 1.11 low. And according to Elliott wave theory, that forecasts a change in trend.

And in addition to that, yesterday, the market broke through my upper tramlineadded confirmation the trend has changed direction.

Conclusion? Shorting the euro is not a one-way bet any more.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Investors dash into the US dollar

Investors dash into the US dollarNews The value of the US dollar has soared as investors pile in. The euro has hit parity, while the Japanese yen and the Swedish krona have fared even worse.

-

Could a stronger euro bring relief to global markets?

Could a stronger euro bring relief to global markets?Analysis The European Central Bank is set to end its negative interest rate policy. That should bring some relief to markets, says John Stepek. Here’s why.

-

A weakening US dollar is good news for markets – but will it continue?

A weakening US dollar is good news for markets – but will it continue?Opinion The US dollar – the most important currency in the world – is on the slide. And that's good news for the stockmarket rally. John Stepek looks at what could derail things.

-

How the US dollar standard is now suffocating the global economy

How the US dollar standard is now suffocating the global economyNews In times of crisis, everyone wants cash. But not just any cash – they want the US dollar. John Stepek explains why the rush for dollars is putting a big dent in an already fragile global economy.

-

The pound could hit parity with the euro – but if it does, buy it

The pound could hit parity with the euro – but if it does, buy itFeatures Anyone visiting the continent this summer will have been in for a rude shock at the cash till, says Dominic Frisby. But the pound won't stay down forever.

-

Gold’s rally should continue

Features Matthew Partridge looks at where the gold price is heading next, and what that means for your online trading.

-

Prudent trades in Prudential

Prudent trades in PrudentialFeatures John C Burford shows how his trading methods can be used for more than just indices and currencies. They work for large-cap shares too.

-

Did you find the path of least resistance in EUR/USD?

Did you find the path of least resistance in EUR/USD?Features John C Burford outlines a trade in the euro vs the dollar in the wake of the US Federal Reserve’s most recent announcement.