How to find the path of least resistance for EUR/USD

A belief that "news makes the markets" would have lost you a lot of money betting against the euro, says John C Burford. Here's what to watch instead.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Later today, it is the turn of the US Federal Reserve to announce its intentions regarding the Fed funds interest rate (and possibly more quantitative easing later?). This should affect EUR/USD.

I have a question for you. If you were handed in advance the text of what Mario Draghi or Janet Yellen were about to say in their monthly reports, regarding their plans on changes in interest rates and money-printing (as many are, I believe), which way would you trade ahead of the reports?

Goodness knows, so many pundits obsess about these events before the event and then pore over the entrails afterwards. You would think that they contain the key to unlock riches beyond compare.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This has to be the supreme test of the near-universal theory that the news (and economic data) makes the markets. Surely, only a rabid contrarian could believe that increasing the supply of a currency could strengthen it. Or lowering interest rates into even deeper negative territory would also strengthen it.

And if it turns out that you have guessed incorrectly, would you abandon that theory?

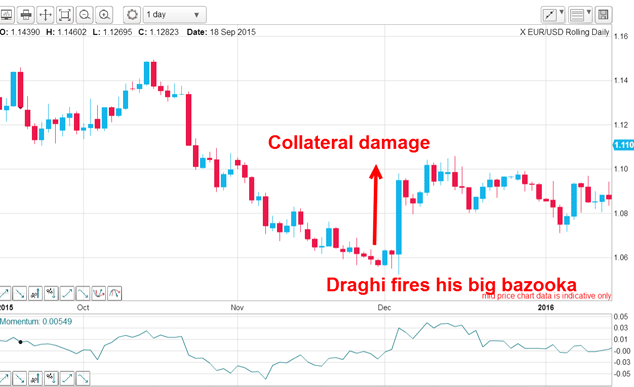

Well get ready to do just that. This is the EUR/USD performance after the December European Central Bank (ECB) announcement where Draghi shocked the markets by not only going negative on rates for the first time, but also kicking off a mammoth bond-buying spree. I call this his Big Bazooka Mark 1:

Ouch! It seems that he aimed his bazooka on his own army in a display of friendly fire! That was an eight cent appreciation on D-Day 1 in the "wrong" direction.

And here is last week's carbon copy performance when he ramped up the money printing and went even more negative on rates:

This time, the collateral damage was worth four cents to the enemy from that wrong-way Bazooka Mark 2. And the economic damage, under conventional thinking, is to future exports from the EU, which is the opposite of stated intentions. Another example of unintended consequences from one of the omnipotent central bank coterie!

Twice, the conventional and entirely rational conclusion must be that having prior knowledge of the ECB's intentions in December and this month caused a "sensible" trader to lose money.

Of course, this perverse behaviour can be rationalised by invoking the "sell the rumour, buy the news" principle (STRBTN), as I did. But that has nothing to do with the "news makes the markets" theory. It is only in hindsight that you can label the move as a STRBTN. Sometimes it works and sometimes it doesn't.

The rational conclusion must be that by correctly placing the horse before the cart, it is the news that makes the market. And that means that most of the material a typical investor reads is misleading (or worse), especially when it appears in the mainstream media.

But I still read it! It is in the understanding that in the interests of research, I am attempting to judge market sentiment. And sentiment was bearish the euro going into both D-Days, making the market vulnerable to short covering, no matter what Draghi had said.

These two events are examples of how, by taking a reading on sentiment, you can be in touch with the most likely path of least resistance. When you can do that, you can locate high probability/low risk trades, which are the only type of trade I consider. I must feel I have the odds very much on my side before I commit funds.

That means I rarely "chase" the market after a sharp move. Buying in a rapidly rising market is often hazardous because sharp snap-backs could occur at any time and stop you out.

A great example of this is provided by the above charts. If you were a little late in the day, you might be tempted into going long EUR/USD after the rallies had tipped its hand. But that was the most dangerous time to do that going long on December 3 around the 1.10 area was high risk because the market settled lower after your entry in a normal consolidation.

In general, I like to enter trades as the market is emerging from a congestion zone. Here is my trade entry on D-Day 1 in December:

In anticipation of a possible sharp rally, I had placed my entry buy-stop just above my blue trendline, which was hit as the market exploded upwards. This entry was still inside the congestion zone the market had formed since November.

The point is that in these zones, there are many "wrong" way short bets that must be unwound as the rally gets under way. This acts like a line of dominos falling over and at no time is a long trade at risk. That is the ideal swing trade entry.

Today, we shall learn what the Fed will (or won't) be intending. Is there a currency trade here?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

The challenge with currency hedging

The challenge with currency hedgingA weaker dollar will make currency hedges more appealing, but volatile rates may complicate the results

-

It's time to back the yen, says Dominic Frisby

It's time to back the yen, says Dominic FrisbyThe Japanese yen has been weak for a long time, says Dominic Frisby. That may soon change.

-

Investors dash into the US dollar

Investors dash into the US dollarNews The value of the US dollar has soared as investors pile in. The euro has hit parity, while the Japanese yen and the Swedish krona have fared even worse.

-

Why a strong dollar hurts – and what you can do about it

Why a strong dollar hurts – and what you can do about itAnalysis The US dollar is at its strongest level in 20 years. That’s bad news for most investment assets, says John Stepek – here’s why

-

Could a stronger euro bring relief to global markets?

Could a stronger euro bring relief to global markets?Analysis The European Central Bank is set to end its negative interest rate policy. That should bring some relief to markets, says John Stepek. Here’s why.

-

HubSpot: a tech stock set to tumble

HubSpot: a tech stock set to tumbleTips US tech stocks have had a fantastic couple of years. But this year is unlikely to be so bullish for high-fliers that can’t turn big profits.

-

What does the future hold for central bank digital currencies?

What does the future hold for central bank digital currencies?Briefings Many of the world's central banks – including the Bank of England – have expressed an interest in creating their own digital currencies. Shivani Khandekar looks at the state of play in central bank digital currencies.

-

A weakening US dollar is good news for markets – but will it continue?

A weakening US dollar is good news for markets – but will it continue?Opinion The US dollar – the most important currency in the world – is on the slide. And that's good news for the stockmarket rally. John Stepek looks at what could derail things.