Will our skies be filled with helicopters?

Inflation expectations are rising. John C Burford looks at how that will affect the stockmarkets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Have you noticed the latest buzz phrase flying about? It is "helicopter money". This is the plan for central banks to print money from nothing and distribute it to citizens directly. Up until now, they have tried to stimulate the economies through the back door by getting the new quantitative easing (QE) money into the hands of the banks who would theoretically make loans to companies and individuals.

That is the familiar QE scheme - and it has utterly failed in that mission. The banks are finally wising up to that fact after eight years, all it has done is pump up asset prices.

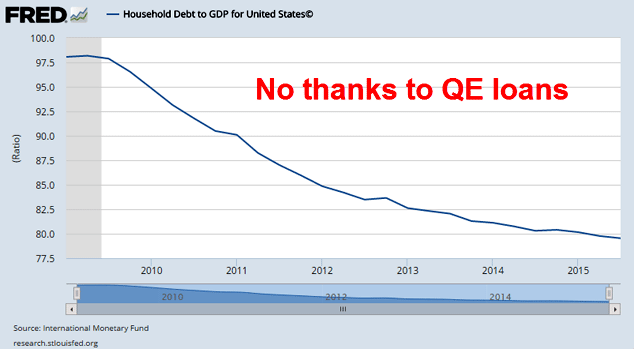

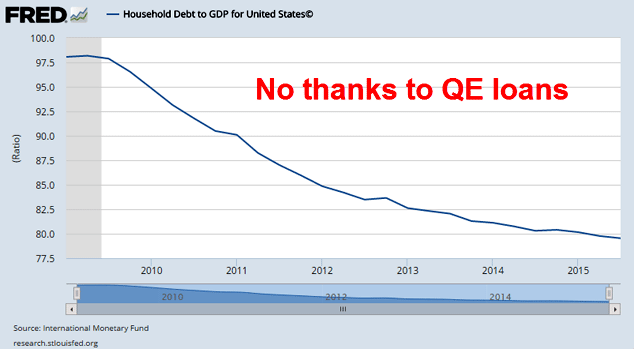

The big flaw in the QE scheme was simply this: consumers were at peak debt and unable and/or unwilling to take on any more.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Since the credit crunch ended in 2009, US consumers have been deleveraging enthusiastically as the experience convinced them that debt was bad. Here is a chart of US consumer debt since 2009:

Yes, the hedge funds, who were only too keen to take the hint, and, with virtually free money, bid up stocks safe in the belief that the Bernanke and now Yellen "puts" would protect them from any downside. But with QE having ended in 2014, who would take up the baton of buyer-in-chief?

None other than corporate chief financial officers, who started buying back their own company's shares! They floated bonds paying meagre interest and used the funds to boost their share prices. This had the advantage of super-charging bonuses for company officers, of course, which was unlikely to find disfavour among the board of management.

So now the Fed and other central banks are trying one penultimate desperate scheme to "stimulate" the economies negative interest rates. And when they see that it is not working either, they have the final last-stand plan in their drawer with helicopter money.

That is why we are hearing such a lot about it. The markets know that that step is getting closer because inflation expectations are rising. Imagine what helicopter money, when let loose, would do to the inflation rate! Zimbabwe, here we come.

One of the best indicators of inflation expectations is the very large Treasury inflation-protected securities (TIPS) market. When inflation expectations are rising, TIPS shares also rise. And in the past few days, TIPS shares have zoomed upwards.

Note that the rally started last December, just when commodity prices, including crude oil and even gold, started their major rallies.

The other major feature is the "golden cross" which is when the 50-day and 200-day moving averages cross over in an upward direction. This is taken by many traders as a very bullish signal. The opposite of this is the "death cross" which is a bear market signal.

With inflation expectations clearly rising, how will this affect the stockmarket?

In the past, rising inflation rates have had widely different effects on the markets. But today, with economies flirting with deflation, it is likely that with wages and salaries stable to negative, higher consumer inflation would reduce economic activity at first with a negative impact on consumer stocks.

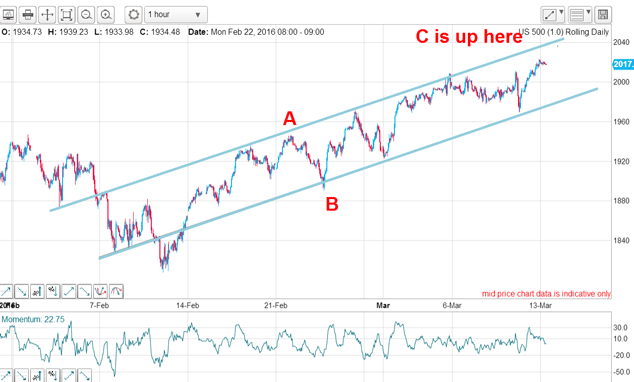

In my last article on the S&P, this was the hourly chart I showed:

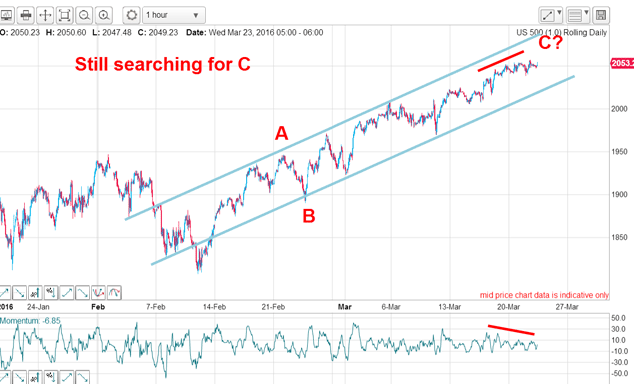

Here is the updated chart:

The market is certainly losing momentum on this scale, but remains in an uptrend.

I am not ready to call the top yet, but it must be getting very close.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

The challenge with currency hedging

The challenge with currency hedgingA weaker dollar will make currency hedges more appealing, but volatile rates may complicate the results

-

It's time to back the yen, says Dominic Frisby

It's time to back the yen, says Dominic FrisbyThe Japanese yen has been weak for a long time, says Dominic Frisby. That may soon change.

-

Why a strong dollar hurts – and what you can do about it

Why a strong dollar hurts – and what you can do about itAnalysis The US dollar is at its strongest level in 20 years. That’s bad news for most investment assets, says John Stepek – here’s why

-

Could a stronger euro bring relief to global markets?

Could a stronger euro bring relief to global markets?Analysis The European Central Bank is set to end its negative interest rate policy. That should bring some relief to markets, says John Stepek. Here’s why.

-

HubSpot: a tech stock set to tumble

HubSpot: a tech stock set to tumbleTips US tech stocks have had a fantastic couple of years. But this year is unlikely to be so bullish for high-fliers that can’t turn big profits.

-

What does the future hold for central bank digital currencies?

What does the future hold for central bank digital currencies?Briefings Many of the world's central banks – including the Bank of England – have expressed an interest in creating their own digital currencies. Shivani Khandekar looks at the state of play in central bank digital currencies.

-

Will the market crash again? Watch the US dollar for clues

Will the market crash again? Watch the US dollar for cluesOpinion One of the biggest driving factors behind the market’s recent big sell-off was the bounce in the US dollar. John Stepek explains why the price of the dollar matters so much, and why investors should keep a keen eye on it.

-

The US dollar’s days as the world's most important currency are numbered – it’s official

The US dollar’s days as the world's most important currency are numbered – it’s officialFeatures Central bankers reckon the dollar's days as the world’s reserve currency are numbered. But what could replace it? John Stepek takes a look at Bank of England governor Mark Carney's cunning plan.