The pound could hit parity with the euro – but if it does, buy it

Anyone visiting the continent this summer will have been in for a rude shock at the cash till, says Dominic Frisby. But the pound won't stay down forever.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Anyone travelling to the continent from the UK this summer will have, no doubt, winced every time they've had to pay for anything.

The euro has been strong surprisingly so while the pound (and the US dollar) have been weak.

Today, I want to consider the euro against the pound. We could be close to an inflection point.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The euro's relentless rise

But he has been extremely successful in achieving one of his stated goals: a weaker US dollar.

Whether he can actually take the credit for that or not is another matter. But the US dollar is down by some 15% this year against the euro, which has done very little else this year but surge.

People always seem to like to know why a market has done what it's done. An easy explanation for euro strength is the perception that the European Central Bank (ECB) is set to rein in its quantitative easing (QE) programme at some point soon.

That may or may not be the case. In fact, the euro was not particularly strong against sterling in the first five months of the year. So it seems that this surge was, at first, more a matter of US dollar weakness than anything else. By late April, sterling was actually up against the euro on the year.

What did for sterling was the disastrous (if you're Theresa May) general election. One euro could be exchanged for 83p in late April. It doesn't seem that unreasonable a price now, although bear in mind that once upon a time in 2000, a euro would fetch you a mere 57p.

Today one euro is almost 92p. Parity, it seems, beckons.

Let's take a look at a long-term chart so we can see where we are in the grand scheme of things. Here is the euro against the pound since its inception in 1991.

On an intraday basis, the euro went to 98p at the height of the financial crisis in November 2008. So 98p is as far as this forex pair is concerned the final frontier.

The next big line in the sand, I would say, is 94p. We got there in spring 2009, and we also touched that level on an intraday basis during the peak post-Brexit pound panic in autumn last year, when we got the so-called Flash Crash.

After that I would say 90p is the next pivotal figure it's been a point of resistance and support in the past although this month the euro breezed through that level like it wasn't there on its way to its current price just shy of 92p.

So the euro is now a penny or two off the extremities of the Flash Crash of 7 October 2016. It's just 6p from the extremities of the 2008 financial crisis. That is how far things have come. Those levels were panic extremes. This time around it's been more gradual.

Here's the euro against the pound over the last three years, for some more recent perspective.

My view is pretty basic: the euro is overvalued. The pound is cheap.

Such is the strength of the two currencies Britain's economy is now smaller than France's. Can you imagine the shame? Together with these latest ideas being touted about to tear down their statues, our ancestors must be turning in their graves.

How low can the pound go?

the euro is over-valued against the pound by 9%. In an email he tells me: "The strong euro is only 9% expensive against GBP which is still modest compared to its 23% overvaluation in late 2008 when EUR/GBP reached 1.02 (98p)."

Charles estimates that purchasing power parity (PPP) ie, fair value would be around 82-83p (although in late 2008, that figure would have been around 74p).

My instinct is that, despite these high valuations, we are not quite yet at the high and that this rally is not quite done. Trends often defy "sensible" thought if you can call mine that and right now the euro is in a strong uptrend.

The ECB next meets, I understand, in early September, so perhaps something will be attempted then to stem the tide if not before, when ECB boss Mario Draghi appears at the central banker jamboree in Jackson Hole later this week. I'm not sure a strong euro will be deemed that desirable a thing across Europe in this age of competitive devaluation.

Despite what you might read on Twitter, Britain is not falling apart. Our government may be insecure. We have too much debt, for sure. But the stock market is strong. Unemployment is low. Business is pretty good. And the argument could easily be made that, despite the political insecurity, Britain is actually in better shape than many countries in Europe.

So, my view is also that an opportunity is brewing. Perhaps 94p will be the turning point. Or perhaps we need to go back to 98p.

That said, on a PPP basis, if things were to get as over-valued as they were in late 2008, and Charles Ekins is correct that PPP then was 74p, then perhaps we have a final target beyond parity at somewhere like £1.10 to €1.

I find that most unlikely, but you never know.

My view is that somewhere in the not-too-distant future, long-sterling, short-euro is going to be the trade.

Indeed, I've already taken a small position, and I'm underwater. I'll be considering adding if we get to 94p or 98p, or even at parity if we get there. But I'm willing to wait.

Since late 2016, long-sterling, short-euro has been what they call a "widow-maker".

I don't quite know what the reverse of that is, but I'm hoping this turns out to be my "school-fees-payer" in the next academic year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Investors dash into the US dollar

Investors dash into the US dollarNews The value of the US dollar has soared as investors pile in. The euro has hit parity, while the Japanese yen and the Swedish krona have fared even worse.

-

Could a stronger euro bring relief to global markets?

Could a stronger euro bring relief to global markets?Analysis The European Central Bank is set to end its negative interest rate policy. That should bring some relief to markets, says John Stepek. Here’s why.

-

A weakening US dollar is good news for markets – but will it continue?

A weakening US dollar is good news for markets – but will it continue?Opinion The US dollar – the most important currency in the world – is on the slide. And that's good news for the stockmarket rally. John Stepek looks at what could derail things.

-

How the US dollar standard is now suffocating the global economy

How the US dollar standard is now suffocating the global economyNews In times of crisis, everyone wants cash. But not just any cash – they want the US dollar. John Stepek explains why the rush for dollars is putting a big dent in an already fragile global economy.

-

Gold’s rally should continue

Features Matthew Partridge looks at where the gold price is heading next, and what that means for your online trading.

-

Prudent trades in Prudential

Prudent trades in PrudentialFeatures John C Burford shows how his trading methods can be used for more than just indices and currencies. They work for large-cap shares too.

-

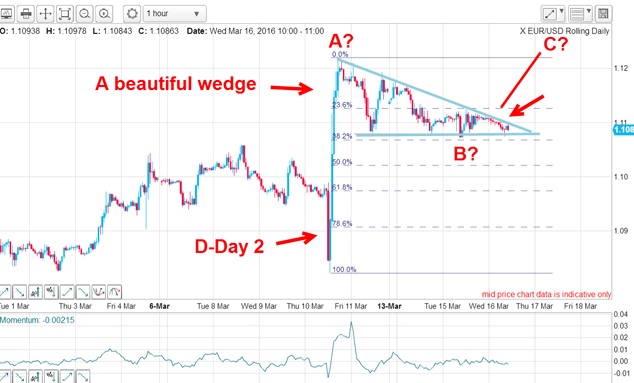

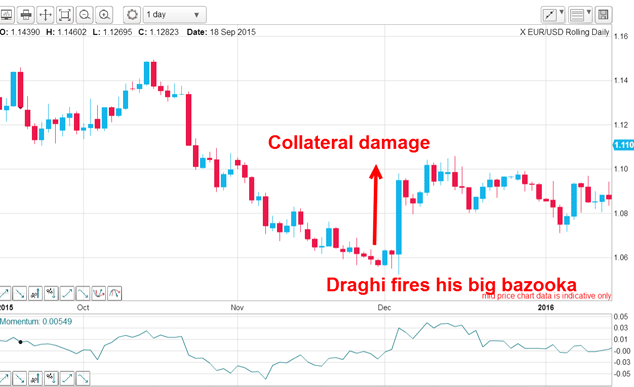

Did you find the path of least resistance in EUR/USD?

Did you find the path of least resistance in EUR/USD?Features John C Burford outlines a trade in the euro vs the dollar in the wake of the US Federal Reserve’s most recent announcement.

-

How to find the path of least resistance for EUR/USD

How to find the path of least resistance for EUR/USDFeatures A belief that "news makes the markets" would have lost you a lot of money betting against the euro, says John C Burford. Here's what to watch instead.