Everyone is wrong about the euro

Spread betting expert John C Burford looks at how all this talk about ECB money printing is affecting the euro/US dollar – one of his main trading markets.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Tomorrow is the day.

It's the day when Mario Draghi, the president of the European Central Bank (ECB), will finally stand in front of the world's media and tell them that he's about to fire the ECB's printing presses (you might know this better as QE, or quantitative easing).

This is a big deal. Europe has been stuck in a deep recession for more than six years now. Money printing has been tried in the USA, UK and Japan. And it seemed to help lift those economies out of recession. Of the big rich economies, the eurozone has been the only holdout.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There's a lot of debate about whether money printing really does improve the economy. But one thing everyone can agree on is that it really shocks the markets.

Money printing drives markets crazy

That's why money printing is popular with hedge funds and other investors.

It pushes the value of their assets up, and makes them look like investing geniuses (which will have to be reflected in the value of their annual bonus, of course).

And the process has already begun. Since the rumours about money printing in the eurozone started, investors have been piling into certain assets, in expectation of a big payoff when the money printing gets going.

The best example of this is the euro itself.

I smell a rat

But as a trader, I'm always wary of basing my trades on the decisions of central bankers. As we learned last week with the Swiss central bank debacle, central bankers are not necessarily as reliable as has been assumed. As I wrote on Monday, the Swiss central bank taught currency traders a sharp lesson last week you can't always trust a central bank!

So how is all this talk about money printing affecting the euro/US dollar which is one of my main trading markets?

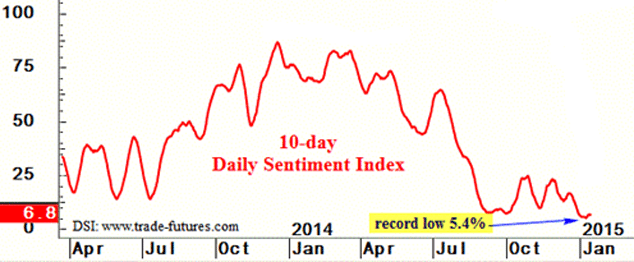

Take a look at the 'daily sentiment index', which tracks trader sentiment about the markets. As you can see, sentiment is at a record low of 5.4%.

The daily sentiment index is at a record low

So everyone's sure the euro will fall. That's interesting to me.

If you've been following my emails, you'll know that this is exactly the situation I look for as a trader. I think conditions are ripe for a surprise.

Virtually nobody expects the euro to rally in the next few weeks and months. In the same way that few people expected the euro to fall a year ago, when everyone thought the euro would go up and the daily sentiment index was reading over 80%).

So I've a strong suspicion that the euro is about to go up. In order to confirm this and pinpoint when the turn might happen I turn to my tried and trusted technical trading methods.

What the charts are telling me

This could be a head and shoulders' pattern

The "head and shoulders" is a well-known trading pattern. Head and shoulders patterns are particularly common when a long term trend is about to go into reverse. And when you spot one, it can offer great low-risk trades if you know how to trade it.

The head and shoulders pattern gets its name from its distinctive shape. It appears as small rally from the "neckline", followed by a large rally, then another small rally.

We could be seeing a variant of this pattern taking shape in the euro/US dollar as we speak a reverse head and shoulders (in a reverse head and shoulders, the head and shoulders pattern projects downwards rather than upwards).

If this is a true head and shoulders there will be a rally to the pink zone. Keep an eye on that neckline!

The lesson?

First watch the crowd. When you see big numbers on one side of a trade, be very careful about joining them.

Second to pinpoint the timing of your trade, watch for the patterns in the charts.

By the time of my next email on Friday, everything should be a lot clearer. Over to you, Mario!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how