Shares in focus: Just how sheltered is National Grid?

The utility giant has been one of the better safe havens to own. So, should you snap up the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Utilities are popular with nervous investors, but price still matters, says Phil Oakley.

Investing is about achieving a sensible trade off between risk and return.Many people don't like taking bigrisks with their savings, and this often draws them to the perceived safety of certain utility shares.

Electricitygenerators and suppliers, such asCentrica, are having a tough time justnow as energy prices stay low. But are the grid networks that move water, electricity and gas across the country and into our homes a better bet?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Although the amount of money they can ultimately make is capped by industry regulators, investing in these companies is often seen as a good way to protect your money from the ravages of inflation. That's because customer bills tend to be linked to changes in the retail price index (RPI).

Playing games with the regulator

Every five years or so these companies engage in a bout of gamesmanship with their respective regulators.

As their profits are largely determined by the size of their regulatory asset values (RAVs the value of their pipes, reservoirs, electricity pylons and so on), they tend to ask the regulator for permission to expand the size of their networks as much as they can.

They also want the biggest possible spending allowance for day-to-day running costs, such as wages and maintenance. Last of all, they want to earn as high a rate of interest on their RAVs as possible, so that they can pay both the interest on their borrowings and a rising dividend to their shareholders.

For years, the companies held the upper hand in these negotiations because they knew a lot more about their own businesses. But over time the regulators have made it much tougher for the companies to make excess profits.

For example, some water firms, such as Severn Trent and United Utilities, have had to cut their dividends in recent years, and some City experts fear they may have to do so again inthe future.

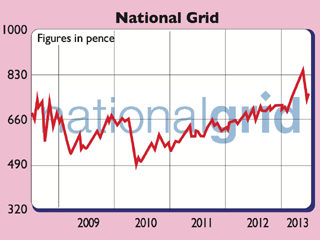

National Grid, on the other hand, has been a lot more dependable and has kept increasing its payouts. This makes it a standout investment for more risk-averse investors. So it's not really surprising that the shares have performed very well in recent times.

But it is possible to pay too much for any share even a relatively safe' one. Are National Grid shares too pricey and therefore too risky today, or are they still a buy?

The outlook

Under normal circumstances, it's difficult to think of a safer haven in the UK stockmarket than National Grid. The utility giant owns and looks after the essential wires and pipes that keep the lights on and allow us to heat our homes here in the UK and in northeast America.

National Grid has a lot of good things going for it right now. It's looked after its electricity and gas networks in the UK very well, and is making bumper profits from them. It also has the luxury unlike the water companies of not having to face up to a regulatory review of its customers' bills for another seven years.

Then there's the fact that it has been able to borrow money very cheaply more cheaply than the regulator had assumed and so boost returns to shareholders.

But above all else, the company is an essential part of what it takes to keepthe lights on and the gas flowing. On both sides of the Atlantic, a lot ofthe assets in place to do these jobs areold and worn out and need replacing.

There is also a need for more of them to meet the expected demand for electricity and gas. This is good news for National Grid, as it should mean that its asset values should grow by around 5% a year for the next few years.

This favourable backdrop has seen National Grid promise to increase its dividend by the rate of RPI inflation for the foreseeable future.

With a prospective dividend yield of 4.6% compared to a rate of inflation at around 2.3%, the shares look a much better bet than owning the inflation-protected bonds of the UK government, for example. So what's not to like?

The risks

Not too much, is the answer. But there are a few things you might want to consider before you plunge in. National Grid is going to have to borrow a lot of new money around £2bn a year for the next few years to finance its investment in its networks and to repay maturing loans. This should be no problem if interest rates stay low, but it could be more troublesome if they start rising, given the company's £25bn debt pile.

Another issue is that inflation is falling across most of the world. Given that a large chunk of National Grid's income is linked to inflation, a lower rate, or even falling prices (deflation), could see it having to break its promise of increasing dividends.

Last but not least is the rich valuation attached to the company's shares. The current market value of all its assets (its enterprise value) is just shy of £57bn. The RAVs of its UK and US electricity and gas businesses are around £36bn.

The £25bn or so attributable to the UK is probably worth quite a bit more than that, given how well it is doing, but the US business has been a consistent underperformer. Surplus property and other assets undoubtedly add more value but I'm not sure you could get to the current market value. So while National Grid is a good company, a lot of the good news looks to be in the price.

Verdict: hold, but don't buy at this price

National Grid (LSE: NG)

Share price: 930pMarket cap: £35.0bnNet assets (Sept 2014): £12.1bnNet debt (Sept 2014): £21.7bnP/e (prospective): 17.1 timesDividend yield (prospective): 4.6%EBIT/EV (latest): 6.5%Interest cover: 3.3 timesDividend cover: 1.3 times

What the analysts sayBuy: 10Hold: 12Sell: 6Target price: 880p

Directors' shareholdings

S Holliday (CEO): 2,374,872A Bonfield (CFO): 1,127,634P Gershon (Chair): 78,212

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

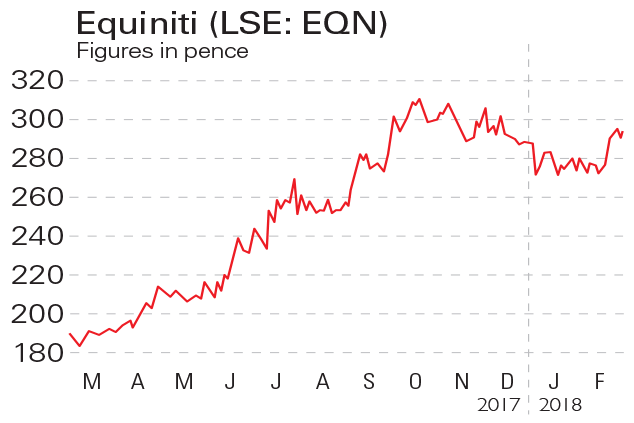

If you’d invested in: Equiniti and National Grid

If you’d invested in: Equiniti and National GridOpinion Financial services firm Equiniti has gone from strength to strength, while National Grid is facing uncertainty.

-

Shares in focus: A dependable dividend-payer

Shares in focus: A dependable dividend-payerFeatures This utility company pays out better than bonds for just a little more risk, says Phil Oakley.

-

Is it time to pull the plug on National Grid?

Features Investors' favourite National Grid is on a collision course with the energy regulator over what it charges its customers. That could spell trouble for the attractive dividend. So is time to sell National Grid? Phil Oakley investigates.

-

Should you buy National Grid bonds?

Features National Grid has launched a new bond for the retail market. Its key attraction for hard-pressed savers is that over the ten years the capital value of the bond rises in line with the RPI. So should you buy it?