Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

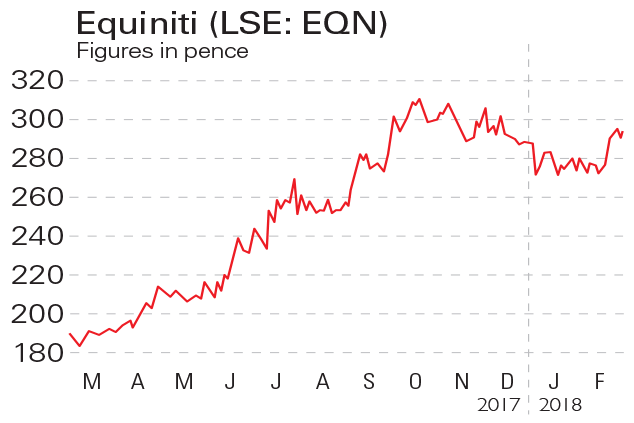

Equiniti (LSE: EQN) is an outsourcing business focused on financial and administrative services such as share registration, pension administration and risk-management software. The company floated two years ago and is now a constituent of the FTSE 250 with a market value of around £1.1bn. Last month Equiniti completed a $227m acquisition of Wells Fargo's share registration and services business. The deal, partially funded by a £122m rights issue, givesthe company the chance to break into the US, where the volume of shares issues is greater.

Be glad you didn't buy

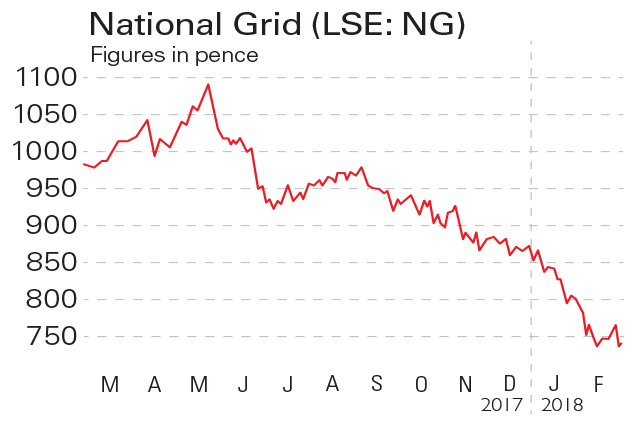

National Grid (LSE: NG) is a multinational electricity and gas utility business headquartered in Warwick. The firm's shares spiked in May last year as it reported adjusted pre-tax profits of £4.7bn in the year to 31 March, a 14% increase from the year before and ahead of analysts' expectations. National Grid also announced that it had invested a record £4.5bn in the UK's gas and electricity networks. Despite this, the firm's share price has collapsed by 23% over the past six months due to rising political risk and uncertainty over the regulatory regime.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

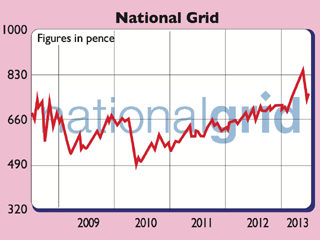

Shares in focus: Just how sheltered is National Grid?

Shares in focus: Just how sheltered is National Grid?Features The utility giant has been one of the better safe havens to own. So, should you snap up the shares? Phil Oakley investigates.

-

Shares in focus: A dependable dividend-payer

Shares in focus: A dependable dividend-payerFeatures This utility company pays out better than bonds for just a little more risk, says Phil Oakley.

-

Is it time to pull the plug on National Grid?

Features Investors' favourite National Grid is on a collision course with the energy regulator over what it charges its customers. That could spell trouble for the attractive dividend. So is time to sell National Grid? Phil Oakley investigates.

-

Should you buy National Grid bonds?

Features National Grid has launched a new bond for the retail market. Its key attraction for hard-pressed savers is that over the ten years the capital value of the bond rises in line with the RPI. So should you buy it?