Should you buy National Grid bonds?

National Grid has launched a new bond for the retail market. Its key attraction for hard-pressed savers is that over the ten years the capital value of the bond rises in line with the RPI. So should you buy it?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you are looking for an inflation hedge that is absolutely guaranteed to protect your capital, you're out of luck. Now that NS&I has withdrawn its index-linked bond from the market, there isn't one.

If you want to be sure you get your capital back when you want it, you need to put it into one of the banks covered by Britain's deposit guarantee. But not one of them will allow you to maintain the real value of your savings: use the British banks and you guarantee that your wealth will be slowly eroded from here. So what do you do? National Grid thinks it has the answer.

Last week, with a knowing sense of what the investing classes are hankering after, it launched a new bond for the retail market, the returns from which are to be linked to the Retail Price Index (RPI). The bonds will pay a starting interest rate of 1.25%. That's not much, but the rate is paid half yearly and adjusted in line with the annual change in RPI eight months before each payment date along the way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So, as the FT's Matthew Vincent notes, with the RPI at a (shocking) 5.2% today, the interest paid on the bonds first payment date in April next year will be half of 1.28%. But the key point and where the value in the bond lies is that over the ten years the capital value of the bond rises in line with the RPI.

See also

So, in ten years' time, the money you get back will have the same inflation-adjusted value as the money you put in. That's not a bad deal. But what it absolutely is not is a replacement for the NS&I index-linked bond. Why?

First, for the very simple reason that the former was fully backed by the government and this is not. It isn't even a very highly rated bond. The credit agencies have given it a triple-B investment grade, but only just. It is also worth noting that if you have to sell the bond before the end of its ten-year term, you will have to do so in the open market: that means you could make a capital loss.

Finally, while you can put it in an Isa, it isn't tax free the returns will be taxed as income at your marginal rate. Still, what it does do is effectively guarantee a real return if you buy it at launch, put it in an Isa and hold it for ten years subject, of course, to the National Grid not going bust (the prospectus points to the "substantial risks" involved in this assumption).

In a lousy environment for inflation-shy investors, there aren't many other options that offer all this. So I don't expect National Grid to have too much trouble getting the issue away.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

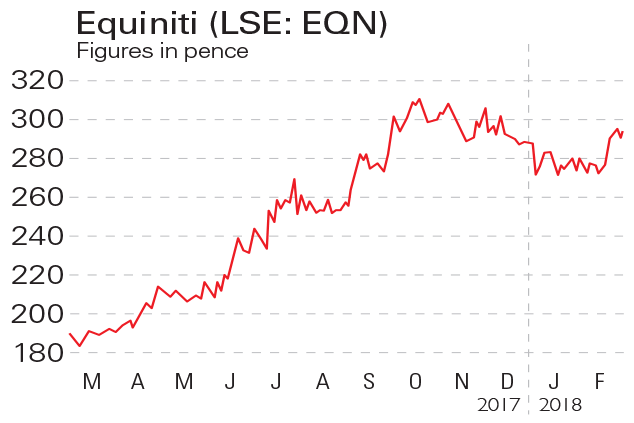

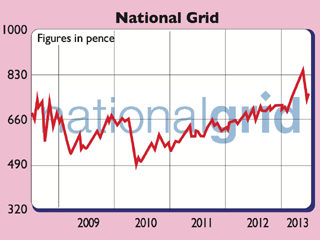

If you’d invested in: Equiniti and National Grid

If you’d invested in: Equiniti and National GridOpinion Financial services firm Equiniti has gone from strength to strength, while National Grid is facing uncertainty.

-

Shares in focus: Just how sheltered is National Grid?

Shares in focus: Just how sheltered is National Grid?Features The utility giant has been one of the better safe havens to own. So, should you snap up the shares? Phil Oakley investigates.

-

Shares in focus: A dependable dividend-payer

Shares in focus: A dependable dividend-payerFeatures This utility company pays out better than bonds for just a little more risk, says Phil Oakley.

-

Is it time to pull the plug on National Grid?

Features Investors' favourite National Grid is on a collision course with the energy regulator over what it charges its customers. That could spell trouble for the attractive dividend. So is time to sell National Grid? Phil Oakley investigates.